Table of Contents

- GTN Automation

- Top Challenges and Most Liked GTN Automation Tasks

- Process Insights

- Things to Think About

- About Revenue Analytics Collaborative

In the pharmaceutical and biotech industry, the term gross-to-net (GTN) has developed into more than just the financial management and forecasting of manufacturer’s discounts. The GTN umbrella encompasses all aspects of revenue management, reporting, and analytics. To add value to the industry, the Revenue Analytics Collaborative (RAC) began surveying its members in 2014 to document successful GTN automation practices and trends. The RAC exists to share expertise between top industry professionals in addition to tracking data and benchmarks related to industry trends.

GTN Automation

Gross-to-net automation processes are fast becoming necessary to keep up with the ever-changing landscape in pharmaceutical commercialization.

As the GTN bubble grows to over $204 billion1 with net revenue declining each year, GTN automation is essential to achieve transparency and accuracy. In order to see our industry progress in GTN automation, let’s dig deeper into the 2023 survey responses from RAC members.

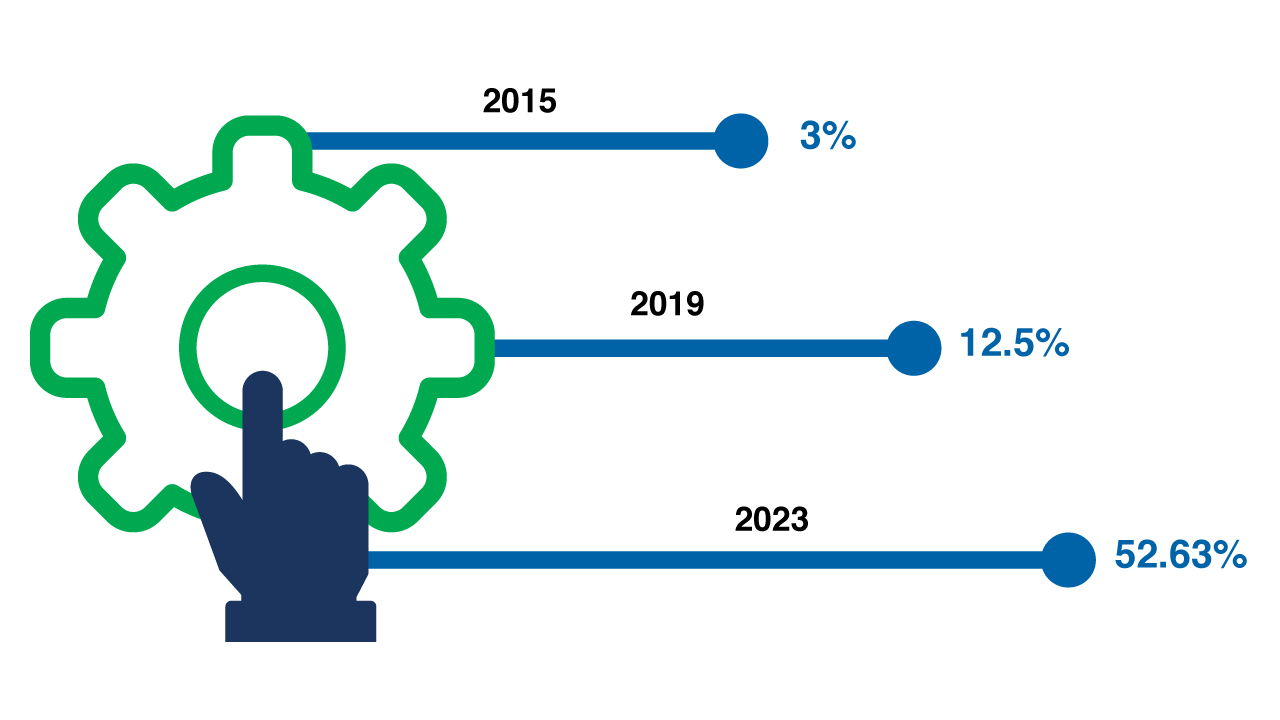

In 2015, only 3% of those polled had a digital initiative in place. In this year’s poll, 53% were exploring the option. A third of those polled already have an automated system in place.

Revenue Analytics Collaborative (RAC) GTN Automation Practices and Trends Survey

Figure 1 – RAC Members Survey of GTN Automation Initiatives

Despite the complexities, many manufacturers still choose to use manual, Excel-based processes to manage their gross-to-net processes. A majority of those polled still use Excel/Access for their accrual and forecasting process. However, this number is steadily decreasing. In 2019, manufacturers with no manual processes were over 90%, and today it’s only 67%.

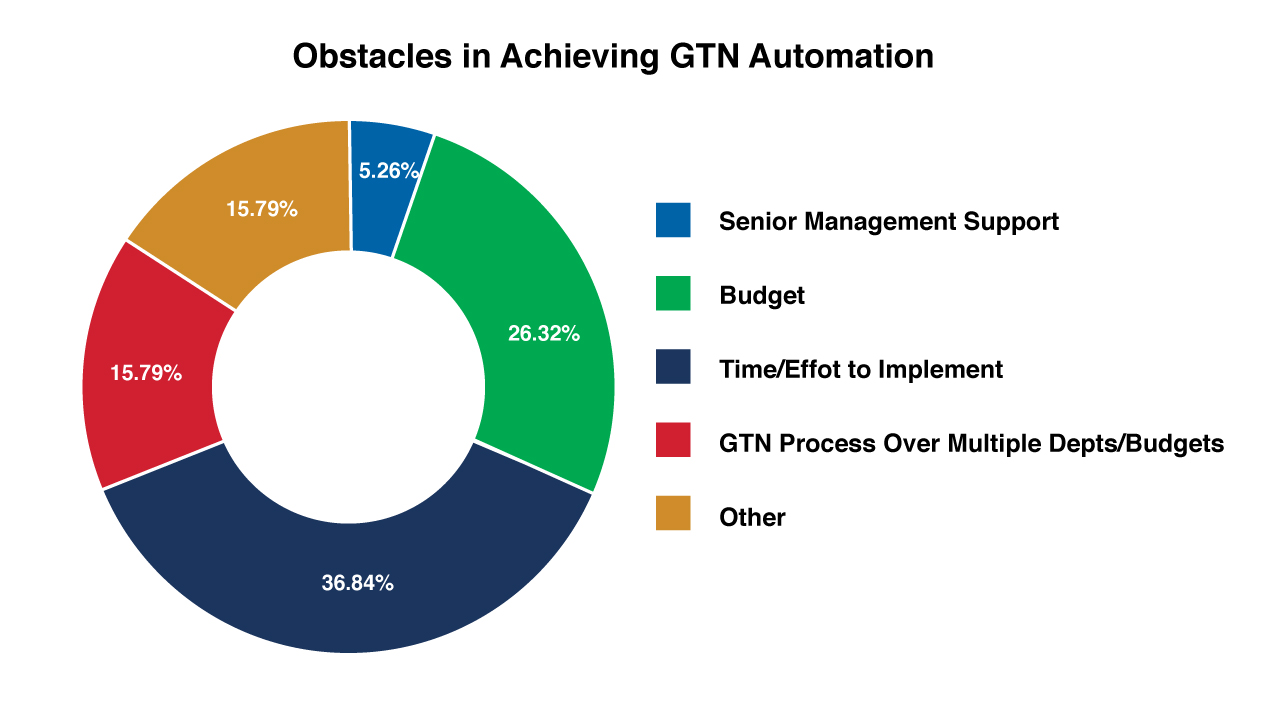

Why aren’t more organizations using GTN automation? The industry’s GTN community has significant barriers to digitalizing their GTN. GTN automation is often a decision that needs to be made company-wide, as it affects the entire organization’s bottom line and brings about financial challenges that affect gross-to-net optimization. 37% reported that the time and effort to implement GTN automation was their number one obstacle. Budget was the second reported obstacle with 26% feeling it was an obstacle.

The hot topic in 2024 will be optimizing GTN automation without digitizing it. It’s not easy, or ideal, but many of you out there are getting it done.

Organization Obstacles in Achieving GTN Automation

Figure 2 – Obstacles in Achieving GTN Automation

Top Challenges and Most Liked GTN Automation Tasks

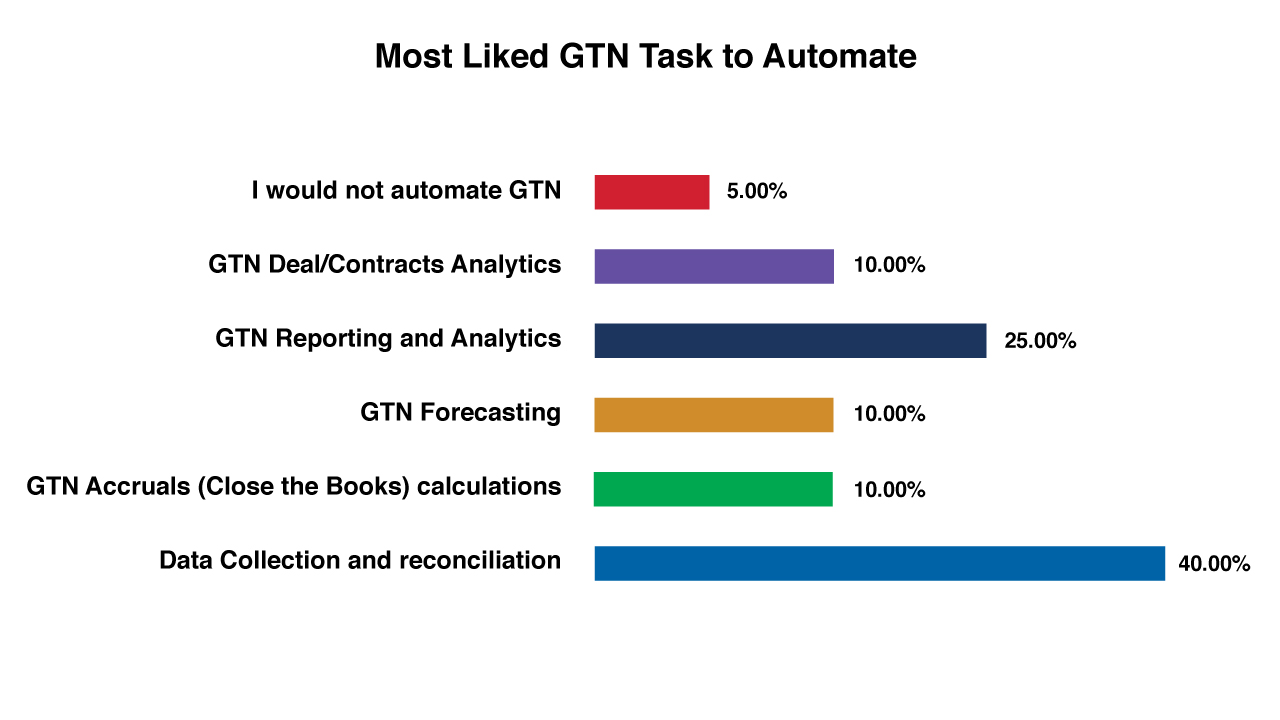

Data collection and reconciliation is the top challenge seen by our poll participants. This is likely due to a large number of those in revenue analytics who are leaving large pharma organizations and moving to smaller companies; they are having a more difficult time wrangling data from various inputs. We used to see a lot of need around forecasting, deal analytics, and closing the books, but in the past few years, these processes have become automated or semi-automated. 55% struggle with GTN forecasting, while 45% struggle with GTN reporting and analytics.

Which GTN process or task would you most like to automate?

Figure 3 – Most Liked GTN Task to Automate

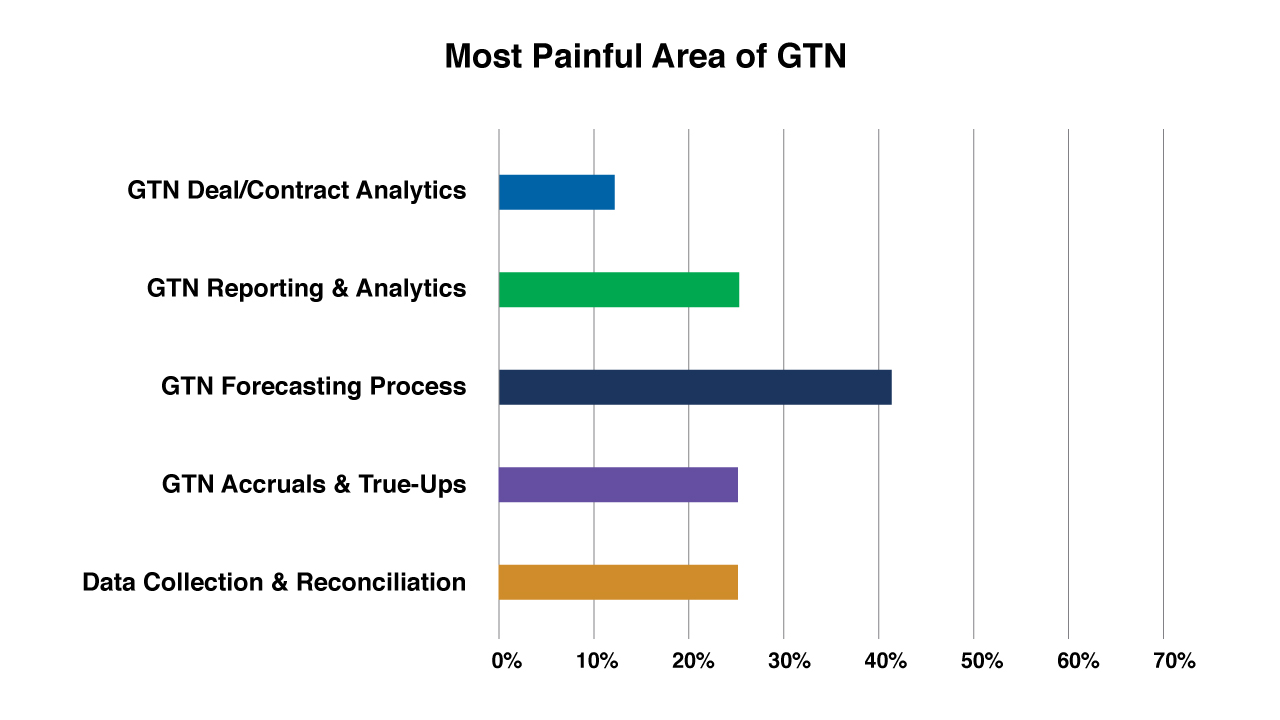

Managed care rebates are difficult for manufacturers as those contracts typically have three distinct pieces to manage and predict: base rebate, administrative fee, and price protection impact.

Medicaid fell in terms of difficulty and tied with Managed care at 25% finding it the most painful. 70% of respondents in 2019 listed it as their most painful line item, and while certainly not as painful as it used to be, it is certainly difficult to predict due to lag times and many manufacturers are able to reconcile this using claim level detail.

Which GTN line is most painful to you?

Figure 4 – Most Painful Area of GTN

Process Insights

It is still an industry favorite to benchmark where Contracts & Pricing operations lie within your organization. Even though government pricing and rebate adjudication are very compliance and operational tasks, we see the industry still holding tight with responsibility in the Finance Accounting area of 50% and 40%, respectively.

Government pricing experts are often experts in not only government pricing but a multitude of areas including government programs and FSS. As a result, we see a surge in business process outsourcing for both government pricing and rebate adjudication as well. Having the right ecosystem partner is not only important for audit readiness but is also necessary as GTN expertise is often hard to find, and many companies, especially smaller pharmaceutical companies, often have trouble managing it in-house. GTN automation processes can help solve and streamline these challenges for pharmaceutical companies that may not have dedicated GTN expertise within them.

Personally, in my career I’ve seen outsourcing become wildly popular in the pre-commercial/biotech/small manufacturer landscape in the Contracts & Pricing operations arena. My virtual travels via the Revenue Analytics Collaborative network yield or reflect an industry rate of 9 out of 10 manufacturers outsourcing in the pre-revenue and small manufacturer space compared with roughly 50% of the industry a decade ago.

What’s your biggest struggle to achieve net revenue optimization?

Channel forecasting to include Medicaid expansion, coverage gap, price protection, and other factors are the top struggle for RAC members. Data collection, integrity, and analytics were a concern for 29% of those polled. Overall manual data input and process troubled 24% of the respondents.

Things to Think About

GTN, in the past 20 years, has taken on a whole new meaning. Gone are the days of ‘green shade accountants’ managing GTN like an operating expense. GTN has been a rollercoaster ride for the past two decades, and I passionately believe that staying connected as an industry is one of the best ways to manage, and optimize your GTN automation. In closing, my personal recommendations for anyone managing GTN would be:

- Benchmark your organizational design and close/forecast processes with the industry

- Assess the risk related to your current GTN methodologies

- Analyze all of your GTN contracts to see if they are even profitable

- Show and tell your key stakeholders your GTN and average selling price by channel.

Armed with this information, industry professionals gain the ability to find the optimal point between the net price and patient access and adherence.

Join us at the Pharma BioTech GTN Summit where we’ll chat about topics such as Month-end close and calculation of GTN, Reconciling Pipeline against Sales and Demand, Managed Care payments for 340b contracted pharmacies, and more.

The RAC exists to share knowledge between leading industry professionals in addition to tracking data and benchmarks related to industry trends, including GTN automation. Our research shows that digitalization is in the process of hitting its stride. Our goal is to help industry professionals get to the next step of finding the optimal equilibrium that continues to maintain high standards for patient care while driving company growth.

About Revenue Analytics Collaborative

The mission of the Revenue Analytics Collaborative is to facilitate timely and anonymous knowledge sharing amongst Pharma industry colleagues working in Commercial Contracting, Government Pricing, Gross-to-Net, and Trade/Channel business and financial roles. Join us today at RACollab.org.

Sources:

- Drug Channels Institute, 2023

- Revenue Analytics Collaborative Benchmark Survey 2023

- Revenue Analytics Collaborative Industry Benchmark Survey, 2015

- Revenue Analytics Collaborative Industry Benchmark Survey, 2019