Three Categories for the Ten Common Market Access Issues

For years, pharmaceutical companies aggressively invested in all facets of market access to maximize patient initiation and therapy adherence. Today, in light of ongoing financial squeeze/pressures, patient access needs to be more tightly balanced against the need for sufficient net-price realization.

Walking the fine line between these two critical but opposing forces requires a market access strategy that is truly optimized and efficient. To that end, we’ve identified from conversations with hundreds of our customers the ten most common warning signs that your market access operations need some immediate attention. We’ve broken them down into three critical categories.

Too Much Legacy Thinking Around Market Access in Pharma

Underestimating the Impact of Evolving Drug Archetypes

A 2020 study by Deloitte revealed that 50% of drug launch failures are attributed to limited drug market access issues, more evidence that legacy access strategies aren’t working. One of the primary causes of overreliance on these traditional commercialization playbooks is not fully grasping the implications of the growing and changing drug archetypes. For example, many manufacturers still:

- Treat a biosimilar like a generic drug, rather than a specialty medicine

- Launch a specialty lite drug into retail

- Fail to comprehend the changing dynamics of vaccinations into the retail pharmacy and retail clinic setting

Not Fully Understanding Commercialization Economics

The shift towards increasingly specialized medicines is heightening the pressure on traditional retail distribution and reimbursement models and turns up the heat on the so-called “fight for the dollar” in pharma market access issues. Payers are transferring an increasing percentage of costs to patients through both higher premiums and out-of-pocket expenses. This has caused copays to rise by 14%-18% annually, and this trend is likely to continue. Further, the trend towards cost-shifting and sharing, high-deductible plans, and the growing number of formulary restrictions is creating a resurgence in cash payment for medications. Traditional access models never had to deal with these issues to this degree. And lastly, extensive rebates have been the foundation of the payer-manufacturer relationship and a key tactic to drive volume and preference. If list price and wholesale acquisition cost (WAC) continue to slow, the average rebate amount will be forced to shrink as well. As a result, the gap between list price and rebate will present a very real and increasing challenge for pharmaceutical companies.

Market Access Strategies Constrained by Legacy Infrastructure

Our customers routinely tell us how much their business, drug portfolios, and market access strategies have changed over the past 5-10 years. However, when asked how their core commercialization technology, data, and processes have changed, the answer is usually “not much.” As a result, commercial teams are increasingly constrained by legacy processes, outdated revenue management systems, datasets that are aggregated and managed in isolation from other data, and an overload of data with a shortage of actionable insights.

Growing Turnover of Legacy Talent

The inherent issues seen in drug development and commercialization combined with an ever-changing regulatory environment and intense competition – even in niche, specialty categories – create a highly dynamic, risk-filled environment. Couple this with a shortage in critical government pricing, gross-to-net, and analytical skill sets and you have the making for operational challenges for any market access strategy.

Inadequate Data to Run the Business

Gaps in Coverage by Traditional Data Sources Causes Pharma Market Access Issues

Historically, access and trade management teams relied on widely-available commercial data sets to monitor inventory levels and demand. However, the evolution towards increasingly specialized therapies is driving significant changes in medical benefits as well as in specialty and digital pharmacy dispensing. As a result, coverage of these drugs by traditional data sources has greatly eroded. The bottom line is that the analogs needed to substantiate both conservative and upside forecasts may not be available.

Patient Initiation and Adherence Remains a Mystery

In the ideal world, you would know when each patient starts therapy and their level of adherence with accurate pharma patient analytics. Unfortunately, this is seldom the case, and the culprit is often poor patient status data. This can happen when there is a gap between a referral to a specialty pharmacy (SP) and when the SP begins to report status for the referred patient. Another example is when an SP delays updating the status for pending new patients who have not yet filled their scripts or have been canceled. Without accurate data, your entire market access team is forced into a reactive mode and proactive patient intervention is impossible.

In addition, many manufacturers continue to report that their engagement with SPs isn’t particularly efficient or effective. For example, they report that in most cases, the QBR included discussions of high level business trends without getting into enough detail to identify actionable, operational issues. Digging deeper, the root-cause of this was the fact that each party was calculating their metrics differently and some weren’t even using the same definition of what constituted a new patient. Similarly, few pharma teams have access to benchmark analytics that could show what good patient initiation looked like for a given payer mix.

Not Laying a Foundation for Value-Based Contracting

Today, modeling, executing, and measuring even traditional channel and payers contracts are challenges for most pharmaceutical companies. Looking ahead, the slow-but-steady evolution towards value-based contracting and payment models is inevitable. While new frameworks (ICER, ASCO, etc.) continue to emerge, there isn’t a dominant one on the horizon. Nevertheless, pharma organizations must develop the capability to bring together combinations of payer-reported utilization data with patient-level data from the channel, labs, and health systems to have any chance of implementing value-based agreements.

Stuck in Operational Silos

Drowning in Spreadsheets and Data

Most commercial teams are drowning in spreadsheets to manage inventory, track patient initiation and adherence, monitoring specialty pharmacy performance, and more. While this is certainly an easy approach it has numerous, well-documented pitfalls. Spreadsheets are not SOC-certified, are cumbersome to share and work on collaboratively, are error-prone, lack strong version control capabilities, as well as enterprise scalability. Layer on top of this the armies of analysts who are cutting-and-pasting and importing-and-exporting data from one system to another and you have a recipe for market access issues with errors, weak transparency, and poor audit-readiness.

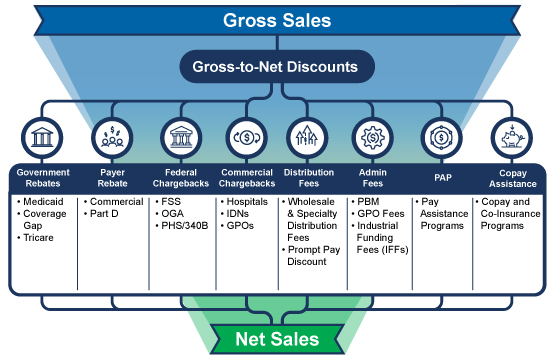

Gross-to-Net (GTN) is Out of Control

Consider these two facts: the GTN bubble is approximately $300 billion annually, and the three-to-five year forecasted growth in net-revenue is expected to be negative. The spend-at-all-cost days are over. Today, your finance and access teams need to understand the true net-price of all of your therapies. Do you have a proven, consistent, and transparent way to calculate net-price? Are you certain that you’ve accounted for all of the discounts, rebates, fees, chargebacks, incentives, and other adjustments that are common in most pharmaceutical business models? Can you show auditors a clean GTN waterfall model and how you arrive at your net-price? If these questions make you tremble, you’re not alone, and it’s time for a change.

Modeling the Business Remains a Pipe Dream

“What-if”. This is one of the most common and feared phrases in pharmaceutical finance and operational organizations. Questions such as “how does a 2% increase in WAC price impact our government pricing, rebate burden, and net-price?” or “what percent of our contracts are performing at-or-better than the agreed-upon terms?” represent significant challenges for most teams. Most organizations simply lack the data, methodology, and manpower to perform such analyses in an efficient timeframe. As a result, they’re only able to model a handful of changes per year. Best-in-class companies can model even complex contract and pricing changes in a matter of hours or days.

IntegriChain’s unique focus on data, technology, consulting, and outsourcing helps manufacturers overcome these challenges and balance the operational, commercial, and financial dimensions of both patient access and net-price realization. For more information, contact us at ic@integrichain.com.