Editor’s Note: This month, we offer updates on three topics: Notice of The New Medicare Part D Agreement, AMP Removals Impact on WAC Drug Pricing, and 2023 SPTR Recap. As always, if you have questions on any of the content found in this or previous market updates, please reach out to your IntegriChain Consulting Lead or consulting@integrichain.com and we would be happy to talk you through it.‘

Table of Contents

- Notice of New Medicare Part D Agreement

- Navigating the New Terrain of Medicaid Rebates and WAC Drug Pricing

- 2023 State Price Transparency Reporting (SPTR) Recap

Notice of New Medicare Part D Agreement

As you are likely aware, a new Medicare Part D Program will be in effect starting January 1, 2025 and will require a newly signed Manufacturer Discount Program agreement by March 1, 2024.

If you have not already started the process or have any questions, please reach out to your Government Pricing Advisory account lead for assistance.

More information and guidance from CMS can be found here.

Navigating the New Terrain of Medicaid Rebates and WAC Drug Pricing

The start of 2024 marked another critical change for pharmaceutical manufacturers. The removal of the Medicaid Average Manufacturer Price (AMP) cap, as part of the American Rescue Plan Act (ARPA) of 2021, has substantially impacted certain name-brand drugs. This applies specifically to brand drugs that had already hit the rebate cap or experienced price increases outpacing inflation. Before the AMP cap removal in 2024, rebates given for Medicaid were limited to the drug’s AMP at 100%. However, in 2024, the total rebates were estimated to be substantially higher than the Medicaid gross spending on those drugs.

The consequences of the AMP cap removal led some drug companies to lower their drug prices or altogether discontinue certain drugs in favor of less expensive alternatives to mitigate the financial impact of increased Medicaid rebates. The data shows that between December of 2023 and January 2024, 30 brand products taking drug price decreases, which is a new record from a historical perspective. For example, significant price cuts by insulin manufacturers of over 70% Wholesale Acquisition Cost (WAC) reduction have been a direct response to this policy change.

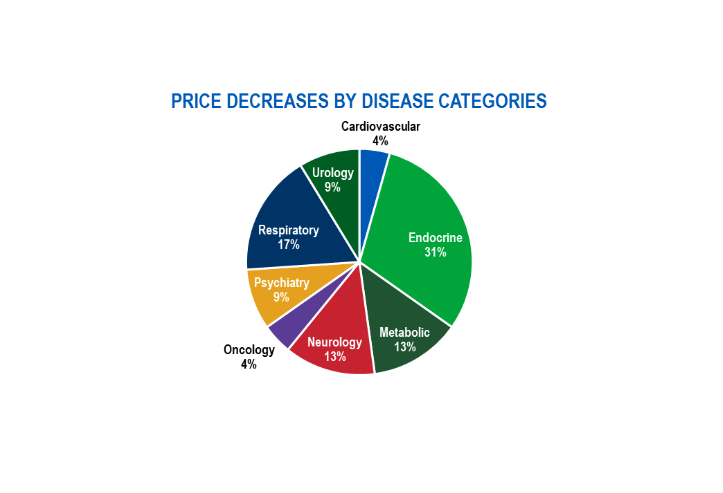

How the AMP Cap Removal in 2024 Impacts WAC Drug Pricing by Disease Categories

Figure 1 – Price Decreases by Disease Categories

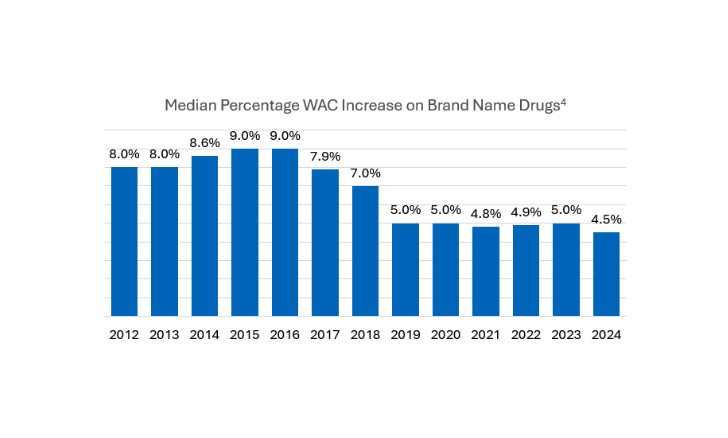

The AMP cap removal and the Inflation Reduction Act (IRA) have played a considerable role in the manufacturer’s drug pricing decisions. The IRA requires drug companies to pay a rebate if drug prices rise faster than inflation in Medicare, a requirement that already exists in Medicaid. The addition of Medicare inflationary rebates has slowed the increase of drug prices over time but has also led to lower Medicaid inflation-related rebates. The median percentage of price increases on brand-name drugs in 2024 is at a historic low of 4.5%. In the current policy environment, this trend is poised to continue to track close to inflation as manufacturers’ era of uncapped price increases has come to an end.

A Historical Low for Median Brand-Name WAC Drug Pricing in 2024

Figure 2 – Median Percentage WAC Increase on Brand Name Drugs4

There are also potential impacts on Pharmacy Benefit Managers (PBMs). Reducing the Wholesale Acquisition Cost (WAC) of a rebated product can considerably impact the product’s rebate yield. If a pharmaceutical manufacturer lowers the WAC drug pricing of their product, the rebates on discounts they offer may also decrease. PBMs often receive rebates when they promote or include a drug in their preferred list. However, this financial incentive can get complex due to regulatory and market dynamics. Therefore, most PBMs are expected to consider substantial WAC pharma reductions as a market event, prompting them to invoke their contractual provisions and potentially adjust their pricing guarantees appropriately.

The recent elimination of the Medicaid Average Manufacturer Price (AMP) cap is causing momentous and mixed impacts on the pharmaceutical industry. Drug manufacturers are responding by modifying their WAC pharma prices and discontinuing certain drugs to cope with additional rebate costs. Meanwhile, pharmacies and PBMs must acclimate to the shift in drug pricing and rebate landscape.

References:

- Costs and Savings Under Federal Policy Approaches to Address Medicaid Prescription Drug Spending

- What Are the Implications of the Recent Elimination of the Medicaid Prescription Drug Rebate Cap?

- Analyze Changes in Brand Drug List Prices

2023 State Price Transparency Reporting (SPTR) Recap

As the 2023 reporting season comes to an end, the IntegriChain Price Transparency team would like to provide a recap of the changes to the SPTR landscape. Eight (8) states [California, Connecticut, Florida, Illinois, New Hampshire, New Jersey, New York, Minnesota] have recently issued updates to the SPTR regulation landscape. Below are highlights manufacturers should be aware of:

Most Active State Changes – MN

Minnesota

SF 2774 – Prohibition of Excessive Price Increases Regulation Suspended

- On Dec 4th, 2023 a Federal Judge issued a preliminary injunction prohibiting the Minnesota Attorney General from enforcing this regulation. The regulation was set to prohibit excessive price increases on generic and off-patent prescription drugs.

- The Minnesota court ruled that the law is unconstitutional and unlawfully regulates transactions outside of the state violating the Dormant Commerce Clause.

- Under this law, an excessive price increase was defined as an increase exceeding

- 15% of the wholesale acquisition cost over the immediately preceding calendar year; or

- 40% of the wholesale acquisition cost over the immediately preceding three calendar years; and

- The price increase, adjusted for inflation utilizing the Consumer Price Index, exceeds $30 for (i) a 30-day supply of the drug; or (ii) a course of treatment lasting less than 30 days.

- A manufacturer of a generic or off-patent drug was also prohibited from withdrawing that drug from sale or distribution within this state for the purpose of avoiding the prohibition on excessive price increases and could be subject to fines up to $500,000 for failure to comply

- SF 2774 also established a Prescription Drug Affordability Board to conduct cost reviews on certain prescription drugs and establish upper payment limits on certain high-cost drug products sold in the state.

SF 2995 – Drugs of Significant Public Interest Reporting Requirement

- No later than January 31, 2024, and quarterly thereafter, the commissioner shall post a list of prescription drugs that the commissioner has determined to represent a substantial public interest and intends to request data

- Inclusion on this list will be based on “any information the commissioner determines is relevant to providing greater consumer awareness of the factors contributing to the cost of prescription drugs in the state”, and the commissioner shall consider drug product families that include prescription drugs:

- That triggered reporting under the MN SF 2995 price increase and new drug reporting requirements during the previous calendar quarter

- for which average claims paid amounts exceeded 125% of the price as of the claim incurred date during the most recent calendar quarter for which claims paid amounts are available; or

- that are identified by members of the public during a public comment process.

- Reporting entities that are required to report shall be notified no sooner than 30 days after the list is publicly posted. Reports are due no later than 60 days after the notification

- Reported information includes description of the drug, direct costs to manufacture, market and distribute the drug, number of units sold, net profits, total rebate payable amount, total sales revenue, and total financial assistance provided during the 12-month period prior to the date of the notification to report, etc.

SF 2995 – Updated Reporting Guidance and Technical Fixes

- On May 24, 2023, Minnesota signed SF 2995 into law, amending the current Minnesota drug price transparency law. Following this, the Minnesota Department of Health released updated reporting guidance incorporating the changes to Minnesota’s Prescription Drug Price Transparency reporting.

- Technical fixes to existing reporting for drugs with applicable price increases and introductions for sale including new and revised definitions e.g for brand drugs, inclusion of biosimilars in price increase reporting, incorporation of drug acquisition information into applicable price increase reporting for drugs acquired 12-months prior to increase, registration requirements, additional penalties for failure to register, and additional clarifications.

- These changes became effective July 1, 2023. The first reporting deadline under the updated guidance is August 30, 2023 (60 days after the effective date of a new or increased price per the MN statute).

New Kids on the Block – CT, FL, IL, NJ, NY

Connecticut

- Connecticut amended its existing drug price transparency law on June 27, 2023, signing HB 6669 into law. This bill, effective October 1, 2023, amends the existing trigger for potential inclusion on the state’s annual list of ten outpatient drugs to state drugs are only included if:

- WAC has increased by not less than 16% cumulatively during the immediate preceding two calendar years; and

- WAC is not less than $40 for a course of treatment.

- The executive director will create a preliminary list and post for public comment.

Florida

- The Florida Department of Business and Professional Regulation has published two emergency rules to implement its recent state drug transparency law, SB 1550. These rules provide the process and reporting forms for submission.

- The reporting forms require manufacturers to submit their current permit information, reporting establishment information, and the required price increase information. The online or printable forms for submitting the price increase report and annual price increase report are available on the Department’s website. These rules were effective July 12, 2023.

Illinois

- The Governor of Illinois has signed HB 3957 into law, prohibiting manufacturers and wholesale distributors from engaging in price gouging in the sale of an essential off-patent or generic drug that is ultimately sold in Illinois.

- Price Gouging here is defined as “an unconscionable increase in a prescription drug’s price that would result in the WAC of a 30-day supply of the essential off-patent or generic drug exceeding $20 and would result in an increase in the WAC of the essential off-patent or generic drug of 30% or more within the preceding year, 50% or more within the preceding 3 years, or 75% or more within the preceding 5 years, and is otherwise excessive and unduly burdens consumers because of the importance of the essential off-patent or generic drug to their health and because of insufficient competition in the marketplace.”

- If the Attorney General has reason to believe that a violation has occurred, they may send a notice to the manufacturer or wholesale drug distributor requesting additional information. The Attorney General may also impose a civil penalty for each violation of the Act. The bill is effective Jan 1, 2024.

New Jersey

- On July 10, 2023, New Jersey passed a new State Price Transparency Reporting bill, S 1615 which:

- Requires drug manufacturers to submit new drug and price increase notifications and reports;

- Establishes annual registration and assessment payment requirements; and

- Establishes a Drug Affordability Council to formulate legislative and regulatory policy recommendations related to drug pricing.

- The notices for this regulation are required within 10 days of triggering the requirements and the follow up reports are due within 20 days. Failure of a reporting entity to comply may result in a civil penalty. The reporting obligations for this bill will become operative the first day of the thirteenth month following the date of enactment, approximately August 1, 2024.

New York

- On December 22, 2023, New York signed S.599-A/A.1707 into law which requires manufacturers to notify the state of:

- WAC increase of more than 16%, including the proposed and cumulative increases that occurred within the 24 months prior to the planned effective date of the increase, in a prescription drug with a WAC of more than $40 per course of therapy

- The notice shall include the date of the increase, current WAC, dollar amount of future increase and a statement on whether a change or improvement in the drug necessitated the price increase

- Manufacturers are required to provide this notice in writing at least 60 days prior to the planned effective date of the increase

- Manufacturer notices shall be published within 5 days of its receipt

- Manufacturers that fail to comply with this requirement may be subject to penalties up to $5,000 per day after the reporting period.

- This regulation will take effect 180 days after its enactment, approximately June 19, 2024.

Biggest Turnaround – NH

New Hampshire

- On June 20, 2023, New Hampshire signed HB 2 into law, amending one of the state’s price transparency regulations – HB 1280 (RSA 126-BB:9), the state’s Prescription Drug Affordability Board transparency law.

- HB 2 suspends the drug price notification and disclosure requirements, confidentiality provisions, assessment fee provisions, civil penalties and registration requirements within HB 1280 for the biennium ending June 30, 2025.

- The HB 2 amendments do not impact the new drug notification and reporting requirements under HB 703, which are administered by the Insurance Department. HB 2 was made effective July 1, 2023.

Most Likely to Clarify – CA

California

On December 21, 2023, the proposed revisions to CTRx regulations were approved by the Office of Administrative Law (OAL) and filed with the Secretary of State. These revisions will be effective April 1, 2024. Some of these revisions include:

- WAC Increase Notifications & Reports (Clarification)

- Lookback Period: The state has clarified that the WAC increase notifications and reports shall be required for products with a W AC >$40 and a total WAC increase of more than 16% above the wholesale acquisition cost of the drug product on December 31 of the calendar year three years prior to the current calendar year

- Report:

- Sales Volume: Manufacturers meeting the reporting threshold shall report the Total volume of gross sales in the US of the drug sold in the US during the one year period prior to the price increase effective date

- New Drug Reporting

- Estimated Number of Patients (Clarification): Manufacturers meeting the new drug reporting requirements are to report the estimated annual number of patients in the United States with a condition for which the new prescription drug may be prescribed. This estimated number shall account for the total number of patients with a condition for which the new prescription drug may be prescribed and shall not be limited to or based on the quantity of the particular new prescription drug introduced to market, anticipated to be introduced to market, or anticipated to be prescribed.

- Good Clause for Penalty Waivers:

- A penalty for a late report may be reduced or waived if the hearing officer finds good cause for the late filing of the required report.

- Good cause for the late filing of a required report shall be lateness due to circumstances beyond the control of the manufacturer and does not include neglect or administrative inadequacy on the part of the manufacturer or any of its offices, officers, employees, or agents.

For more information, please contact the IntegriChain State Price Transparency team: Price.Transparency@integrichain.com.