At IntegriChain’s Access Insights Conference, we explored and discussed key industry trends that affect the patients’ ability to access therapy and hamper health care providers’ will to write prescriptions for innovative brands. In today’s blog post, we share insights into specialty lite challenges and a new pharmaceutical distribution channel strategy that has emerged to help manufacturers balance patient access with their gross-to-net, outlined in the State of the Channel presentation given at the Trade & Channel Strategies event in December of 2022.

Specialty Lite: The Barriers to Success

In the last few years, manufacturers have launched brands that fall outside the capabilities and typical price range of traditional retail chains. These drugs are known as “specialty lite” brands for which the price and complexity make them too expensive for traditional retail pharmacies but they don’t qualify as full specialty products either. Traditional pharmacies push back on manufacturers because the sheer economics of these high cost brands prevents them from dispensing the drugs and expecting a reasonable return on investment. At the same time, specialty pharmacies are unable to accommodate these drugs because their prices are too low.

Specialty lite brands are expected to grow and might dominate FDA approvals in the coming years as manufacturers leverage new technology to treat specific diseases. This means that manufacturers will have to pay continuous attention to address the pain balancing enhanced patient support and provider services while maintaining a profitable gross-to-net in an environment in which both the cost and risk of launching a new drug are rising.

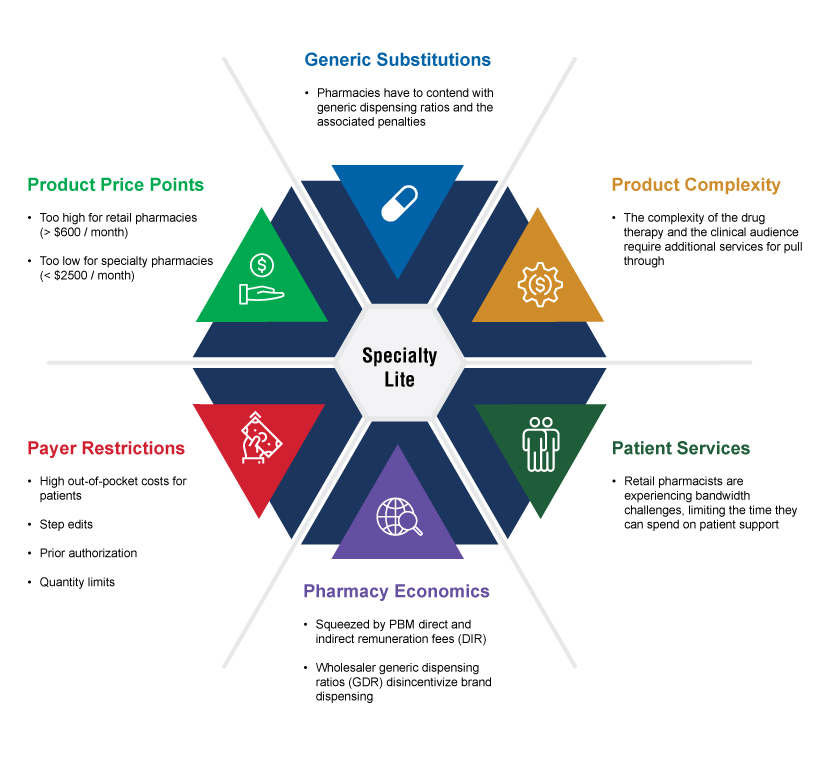

There are several factors driving these trends:

Price: Specialty products tend to cost a minimum of $500 per month but less than $2,500 a month. Drugs in that category are under a lot of pressure; the manufacturer has to market a drug that is very complex and doesn’t leave much room to grow margin.

Payer Restrictions: These drugs also encounter payer restrictions such as high out-of-pocket costs for patients, step-edits, quantity limits, and prior authorization requirements. The science might be great, and the clinical benefit might be clear, but these restrictions introduce additional steps and challenges when trying to get the drug into the patient’s hands.

Pharmacy Economics: Retail pharmacies are pressured by reimbursements as well as by PBM direct and indirect remuneration fees from payers, and they are disincentivized from prescribing brand products due to generic dispensing ratios and the penalties associated with them.

Patient Services: In addition to economics, pharmacies have to consider the bandwidth of their workers. Pharmacists are incredibly busy, leaving less time to dedicate to patient services and support such as answering questions. These factors have come together to create a new channel to mitigate the effects of these challenges while balancing a profitable gross-to-net.

Emergence of the Direct Selling Pharmaceutical Channel

Necessity is the mother of innovation, so it comes as no surprise that channel trends are experiencing an evolutionary shift. More and more, manufacturers are choosing to ship their products directly. Using IntegriChain’s internal data, we analyzed three years of channel data for 12 specialty lite products. These products included therapy areas such as immunology, respiratory, and women’s health and were mostly self-administered drugs. The data shows a steady increase in the shift to direct shipment, up to 32%. This trend is more prevalent in smaller manufacturers that are paying substantial, and ultimately unaffordable, wholesale fees. Large pharma companies are seeing a less rapid increase because they tend to have better full-line wholesale fees, but we might see them follow this market trend as contracts are renegotiated.

Manufacturers that choose a direct selling distribution channel are often selling to a pharmacy warehouse. Upon observing specialty and retail models or independent pharmacy cooperatives, we have seen that many of them now have some form of regional warehousing capability. It could be Walgreens Specialty and retail or CVS Specialty and retail situations in which manufacturers ship direct to regional warehouses and within that they’re distributing to a limited network of stores in a preferred geography or network of independent pharmacies.

There are pros and cons to direct selling. Direct selling is more cost effective and gives the manufacturer the ability to configure exactly where the drug goes, resulting in better visibility as a byproduct. There is far less blinding than what we see in traditional retail. The main challenge of this emerging direct sell trend is scale. Smaller manufacturers will face the challenge of seeing if their 3PL is able to deal with higher order volumes and set up new pharmacies in their systems without disruption. Larger manufacturers will have to contend with challenges such as adjusting processes for their order-to-cash systems as well as higher credit and collections volume. We will monitor this trend to see if it proves itself to handle a massive product scale. For now, we can say that the sustained growth in shipping direct is likely occurring because this new channel is proving itself to manufacturers.

What Next?

As manufacturers launch more drugs that fall between traditional and specialty treatments, they might find that the long-established channels might not work as well from an economic perspective. If a manufacturer decides to use specialty pharmacies as their end dispenser point, they need to perform a detailed channel assessment to understand what the pharmacy’s economic tolerance will be for the product based on WAC, AWP dispensing service fees, contracted rates. These insights will enable the manufacturer to determine whether or not they need to be direct or indirect in supporting their product or that particular pharmacy. As always, you can reach out to us directly or on LinkedIn to continue the conversation or share your insights.

For more on the State of the Channel, watch Dave Weiss’s presentation at the December Trade & Channel Strategies conference.