Editor’s Note: This month, we offer updates on four significant pharmaceutical regulatory topics and offer our advice to manufacturers on steps they should consider now and in the coming months. As always, if you have questions on any of the content found in this or previous market updates, please reach out to our IntegriChain pharma regulatory consultants or contact consulting@integrichain.com and we would be happy to talk you through it.

Drug Pricing Reform Impacts Coming up in October

Last month the Senate passed the Inflation Reduction Act of 2022, which will initiate a series of drug pricing reforms that could have considerable implications on manufacturers of all sizes. As a result, starting on October 1, 2022, manufacturers could owe Medicare Part D & Part B inflation rebates.

IntegriChain will be speaking on the impact of the Inflation Reduction Act on pharma and the upcoming requirements at the 2022 Access Insights Conference. The following topics will be covered in depth from both a Government Pricing and Gross-to-Net standpoint:

- Medicare price negotiations on Part D & Part B drugs

- Maximum fair price (MFP)

- Medicare Inflation Penalties

- Government Pricing implications

- Coverage Gap redesign

We will be on the lookout for any emerging legislation and bring to your attention any newly passed measures.

FSS Public Law Season is Coming

Like other autumn chores, the annual FSS Public Law season might require some preparation. All manufacturers with FSS contracts containing “covered drugs” will be required to report 3Q2022 (New NFAMP) and Annual NFAMPs by November 15, 2022.

The 2023 PBM Annual Guidance Dear Manufacturer Letter will likely be released to manufacturers the week of October 10. It might accompany your company specific NFAMP workbook from the PBM. You can review last year’s letter on the 2022 guidance for a sign of things to come. Also, the annual guidance is a great reference throughout the year.

The government FSS US Department of Veteran Affairs (VA) is planning a Public Law training webinar. As of this writing, it has yet to be scheduled. Check the VA Training website for updates.

Prior to the Public Law kick-off, you should:

- Assure points of contact are confirmed. The PBM process is restricted to only one email address.

- Assure that all covered drug additions, deletions, and price reductions (PRC and voluntary) RFMs are signed and processed by the VA National Acquisition Center (NAC) by September 30, 2022.

- Assure that all eligible Economic Price Adjustments for Dual pricers submitted and approved by NAC.

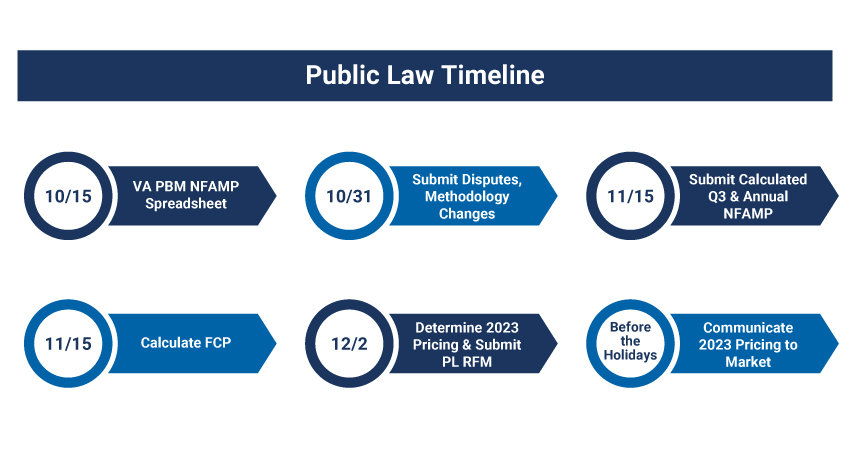

Below is a representation of the public law timeframe.

US Territory MDRP Inclusion: Are Manufacturers Prepared?

“CMS previously delayed the changes to the definitions of “States” and “United States” at 42 C.F.R. § 447.502 to include the U.S. territories of American Samoa, Guam, the Northern Mariana Islands, Puerto Rico, and the Virgin Islands, from the provision’s original effective date of April 1, 2017, to April 1, 2020, and then again to April 1, 2022.” ↿

As covered earlier, in November 2016, the Centers for Medicare and Medicaid Services (CMS) publicized the Medicaid Program: Covered Outpatient Drug final rule to include U.S. territories, which would allow them to participate in the Medicaid Drug Rebate Program (MDRP). However, this has been delayed until January 1, 2023. The time will provide US territories with additional time needed to develop systems to ensure any interested territories are able to participate in the MDRP. This will also accommodate territories that are preparing waivers to opt out of participation.

What’s next for pharma manufacturers?

Before January 1, 2023, manufacturers should make the necessary changes to their government pricing system by including sales to the US territories in their Average Manufacture Price (AMP) and best price calculations. That way, when the interested US territories are able to fully participate in the MDRP, manufacturers are ready.

Source:

- Hogan Lovells – CMS rulemaking: Further delay of inclusion of territories in definitions of “states” and “United States” in the MDRP

- Federal Register

- CMS Fact Sheet

Branded Prescription Drug Fee Invoice to Drop – Reasonableness Assessment Report

Since the inception of the Branded Prescription Drug (BPD) fee in 2011, manufacturers and importers of brand name pharmaceuticals that exceed $5 million in annual government sales have been subject to an annual fee (or excise tax). The BPD fee was established under the Affordable Care Act and can commonly be referred to interchangeably as the Healthcare Reform fee, Pharma Fee, and Excise Tax. Regulations were finalized and issued by the IRS on July 24, 2014 (26 CFR Parts 51 and 602). They require that all fees must be paid no later than September 30. To allow manufacturers time to review, contest, and/or allocate the appropriate funds for the BPD fee, the IRS issues the preliminary invoice in March and the final invoice in August. With the total annual excise tax levied from 2011 to 2019 ranging from $2.5 to $4 billion, being well informed and prepared to navigate this crucial five-month period is essential for many reasons.

First, the fee encompasses multiple different programs (e.g., Medicare Part B, Part D, Medicaid, TRICARE, and the VA and DoD) under the umbrella of “government sales,” consolidating multiple books of business is essential to reviewing IRS invoices. Regulations on inclusion and exclusion criteria for different types of sales can further complicate calculations.

Second, $5 million dollars in government sales is the minimum threshold to trigger a BPF fee covering 10% of the manufacturer’s sales. The IRS has three more revenue ranges, scaling up in 30% increments of taxable sales. Manufacturers exceeding $400M in sales are taxed on 100% of their sales. Knowing where you fall based on current and projected government sales revenue is essential to appropriately allocating funds for the September 30 deadline.

Lastly, all of these processes require a strong coordination of subject matter experts to give the manufacturer confidence in the validation of government contracts, gross-to-net forecasting, data management across multiple different sources, and the timely filing that meets IRS guidelines. If you are interested in learning more about the Branded Prescription Drug fee and the best practices for navigating the filing with the IRS, please get in touch with us. Our pharma regulatory consultants offer expert assistance across all of these capabilities with a trusted track record of preparing manufacturers of all sizes, leveraging current trends and historical data to put manufacturers in the best place to navigate this decade old IRS excise tax.

Source: