Regulatory Market Update

Updates for Pharma Manufacturers

As always, if you have questions on any of the content found in this or previous market updates, please reach out to your IntegriChain Consulting Lead or advisory@integrichain.com and we would be happy to talk you through it.

ICYMI: December’s market update discussed what the future of digital pharmacies might look like.

Drug Price Reform: Current Status of the Build Back Better BBB Act (BBBA)

In November 2021’s IntegriChain Market Update blog highlighted the key implications of the relevant components of the BBBA with potential direct impact on manufacturers. Since November of last year, the bill was passed 220-213 by the House of Representatives, then sent to the Senate for a formal senate vote in early 2022. In the evenly divided Senate, the bill’s future is facing uncertainty, especially after Democratic senator Joe Manchin (WV) publicly pulled his support from the bill.

The BBBA includes three components relevant to drug manufacturers: allowing Medicare to negotiate a small amount of high-cost drugs, implementation of inflation rebates, and out-of-pocket maximums for Medicare beneficiaries. After negotiations, the price of the bill was adjusted to $2.2 trillion before it was passed by the House. The bill now requires at least a 50% vote in the Senate to move forward. As of early January 2022, the bill has been formally opposed by Senator Manchin, who envisioned the cost of the total bill to be significantly lower than the proposed amount.

Democrats are facing increasing pressure to gain momentum on this bill, especially prior to the midterm election season. This might provide additional incentives to reopen the negotiations dialogue prior to the formal senate vote. The path forward for this bill may look similar to the Affordable Care Act where the bill went through several rounds of revisions before being formally passed in the senate. Even if the bill fails to receive the required formal Senate vote, it is likely that the above-mentioned healthcare-related provisions, in some form, will make their way to the senate voting table by way of another proposed bill in the future.

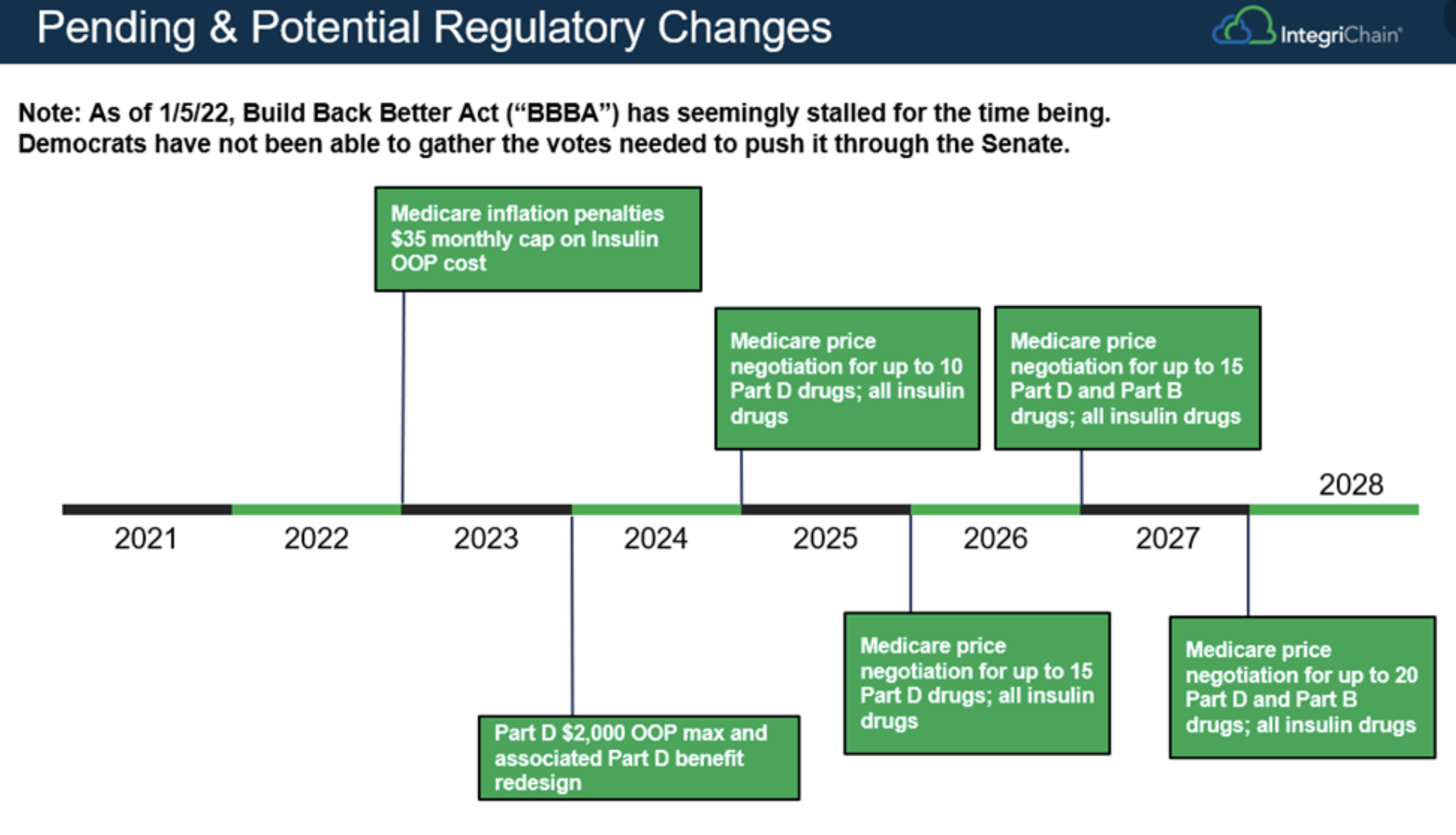

Below is a timeline reference for the potential regulatory changes related to BBBA:

Source: The Build Back Better Plan Is Stalling: What’s The Issue?

2022 Coverage Gap Benefit Design Updates: Key Information to Know

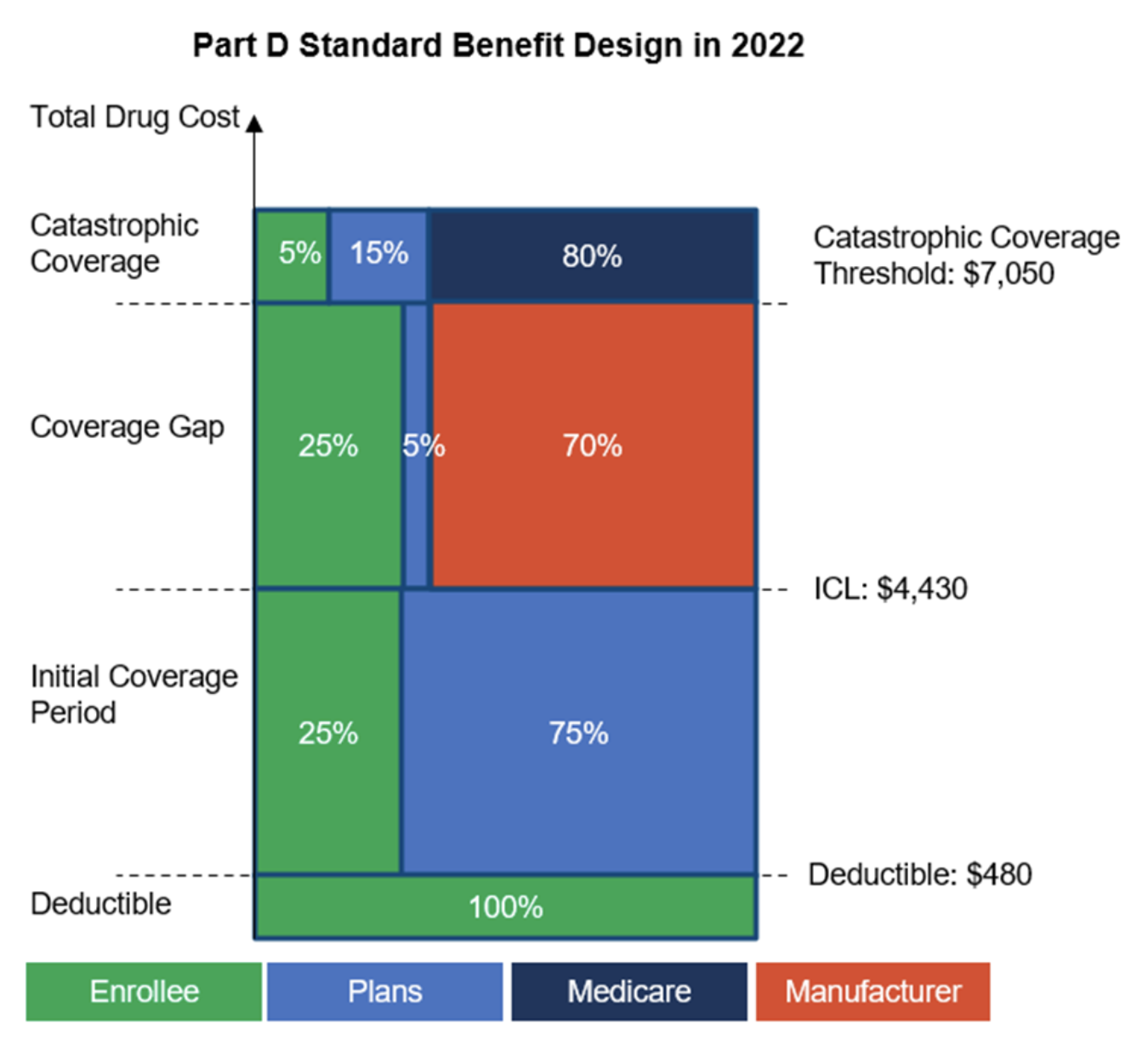

CMS has published the annual updates to the standard Medicare Part D Benefit design for 2022. This includes updated deductibles, Initial Coverage Limits, True Out Of Pocket (TrOOP) cost, and Catastrophic Coverage copays.

- The Medicare Coverage Gap Discount Program (CGDP) is a program through which manufacturers provide a rebate of 70% of the cost of covered Part D drugs dispensed to eligible Medicare beneficiaries while in the coverage gap of their Part D coverage.

- In order to participate in the CGDP, manufacturers must sign an agreement with CMS to provide the discount on its applicable drugs (i.e. prescription drugs approved or licensed under new drug applications or biologic license applications).

- Since 2011, only applicable drugs covered under a signed manufacturer agreement with CMS will be covered under Part D.

- The initial deductible amount has been increased to $480. After meeting this amount, enrollees will pay 25% of covered costs up to the initial coverage limit.

- The Initial Coverage Limit (ICL) has been increased to $4,430. This would allow enrollees to purchase prescriptions worth up to $4,430 before reaching the Part D coverage gap threshold “Donut Hole” where manufacturer coverage will kick in.

- Once the cost reaches the Coverage Gap threshold the manufacturers would be required to cover 70% of the cost, and plans would cover 5%. The remaining 25%, is covered by the enrollee. Both the manufacturer discount (70%) and enrollee coverage (25%) would count towards the TrOOP. Specific to generic prescriptions, the plan is responsible for covering the 75% cost, where only the 25% cost covered by the enrollee would qualify for TrOOP.

- The TrOOP threshold for 2022 has been increased to $7,050. The enrollee will enter the Catastrophic Coverage zone once this threshold has been met. The Medicare Part D coverage will kick in at this stage and 80% of the prescription cost will be covered by the Medicare Part D benefit.

Please reach out to your IntegriChain point of contact if you have additional questions on the 2022 Coverage Gap benefit design.

Source: www.cms.gov

340B Administrative Dispute Resolution Updates

In May 2021, our Market Update highlighted Eli Lilly’s request for a preliminary injunction to halt the 340B Administrative Dispute Resolution Final Rule (ADR Rule). This rule was issued to provide a binding and precedential way for 340B safety-net providers and manufacturers to solve disputes over 340B charges. Besides Eli Lilly, other drug companies including AstraZeneca, Sanofi-Aventis, and Novo Nordisk are involved. There have been a handful of court decisions as of December 2021, however, the cases remain open as these manufacturers continue with the appeal filing process.

The current cases address common questions regarding interpretation of some of the current 340B statutes, including:

- Recognition of contract pharmacies: Manufacturer policies limiting the use of 340B contract pharmacy model

- Specific guidance on participating Covered Entities’ use of contract pharmacies

- Potentially imposing administrative conditions by manufacturers on the Covered Entity’s contract pharmacies, to qualify for the 340B discounted pricing

Legal challenges to Health Resources and Services Administration (HRSA) enforcement

- Five manufacturers have brought lawsuits against HRSA, challenging the agency’s enforcement letters to date. The lawsuits argued that the statute does not permit manufacturers to restrict a provider’s access to 340B pricing based on the method of dispensing.

- On December 28, 2021, the federal government submitted notices to appeal three federal district court decisions related to the use of contract pharmacies under the 340B drug program.

To date, 11 drug manufacturers have announced policies that restrict access to 340B pricing for drugs dispensed through contract pharmacies. While some of the cases (e.g. Eli Lilly and Sanofi) go through the appeal process, since November 2021, other manufacturers like United Therapeutics and Novartis are moving forward with seeking additional guidance or appealing any existing court cases.

Manufacturers should consult with their GP advisor and legal counsel in case they are intending to revise their existing 340B policy documents during this time.

Sources: