Regulatory Market Update

We want to keep you up-to-date with relevant, timely industry insights and regulatory updates that may impact your business. If you have questions on any of the content found in this or other newsletters, reach out to your IntegriChain Consulting Lead or advisory@integrichain.com and we would be happy to talk you through it.

Upcoming Industry Events:

Two senior consultants from IntegriChain will present at Informa’s upcoming Medicaid & GP Congress. Jeff Baab, Vice President, and Rupal Patel, Senior Director, will be holding sessions around Current CMS Final Rule updates, Regulatory legal and compliance issues, as well as a deep dive into IntegriChain’s Process and Compliance Consulting Services. You can see the full agenda and register here. If you’d like to attend and would prefer to use a coupon code, please reach out to advisory@integrichain.com for a referral.

Registration is now open! Please join us at the IntegriChain Access Insights Conference 2021 for thought leadership, benchmarks, strategies, and tactics for data-driven patient access and therapy commercialization. We’ve beefed up our agenda this year with more industry speakers, thought leaders, ecosystem partners, benchmarks, and networking and fun. Learn more and register here.

Co-Pay Accumulator and Maximizer Update: Adoption Accelerating As Pushback Grows

Pharmaceutical manufacturers offer copayment offset programs or coupons that cover some of the beneficiaries out of pocket costs for a branded drug. These cannot be used by enrollees in government programs under Medicare Part D but can support beneficiaries with commercial insurance. Over the past few years, sponsors began adopting benefit designs that exclude the manufacturer’s payments from the patient’s deductible and out-of-pocket obligations which broke down into two different models.

Co-pay Accumulator:

- Manufacturer funds prescriptions until the maximum value of the copayment program is reached

- Patients out-of-pocket spending begins counting toward the annual deductible and out-of-pocket maximum

- Accumulators reduce plans cost by shifting drug cost to patients and manufacturers

- Decrease patients adherence to specialty therapies

- Most drugs are single-sourced therapies

- Arizona, Illinois, Virginia, and West Virginia have banned the use of accumulators in individual and small group healthcare plans

Co-pay Maximizer:

- Based on the maximum value of a manufacturers copayment program

- Beneficiaries must enroll in a separate co-pay maximizer program to avoid high costs

- Plans will deem many specialty drugs as non-essential health benefits to implement a maximizer

- Non-essential drugs are covered but not subject to the Affordable Care Act

- Reduce plans cost by shifting drug cost to manufacturers

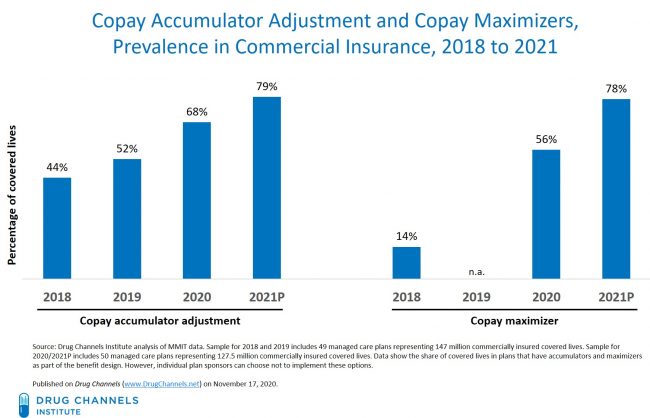

These two aspects have been broken down to see the difference between the two. As you can tell, accumulators reduce plans by cost-shifting drug costs to patients and manufacturers. As maximizers must enroll in a separate co-pay maximizer program to avoid high drug costs. The chart above shows the covered lives that have plans that have accumulators and maximizers as part of their benefit design.

Read more about co-pay accumulators and maximizers at drugchannels.net

340B Administrative Dispute Resolution

In an update to our 340B Dispute post from February, the U.S District Court for the Southern District of Indiana issued an order granting Eli Lilly’s request for a preliminary injunction to halt the 340B Administrative Dispute Resolution Final Rule (ADR Rule) on March 16, 2021. This rule was issued to provide a binding and precedential way for 340B safety-net providers and manufacturers to solve disputes over 340B charges. Besides Eli Lilly, other drug companies such as AstraZeneca, Sanofi-Aventis, and Novo Nordisk are involved.

The court’s order was based on an alleged procedural defect in the way that HHS issued the rule, rather than a substantive defect in the content of the rule. HHS could immediately reissue the rule by fixing the procedural defect. This could be a long process and 340B safety-net providers will have to wait at least 90 days to continue or initiate claims against the drug company. Many 340B companies believe the court’s decision is mistaken as many safety-net providers will continue to suffer. The restrictions on 340B discounts have severely limited the resources available to the U.S. healthcare safety net, especially during this global pandemic.

ASP Reporting – HR133 (COVID Stimulus)

In December 2020, The Consolidated Appropriations Act of 2021, H.R. 133, was passed as a dual government funding bill and COVID-19 economic stimulus package. The package brings an expansion of average sales price (ASP) reporting obligations for manufacturers that do not participate in the Medicaid Drug Rebate Program (MRDP).

Requirements: The bill requires that manufacturers drugs or biologics covered under Medicare part B and do not have a Medicaid Drug Rebate Agreement, shall calculate and report the average sales price (ASP) to the Secretary in a time and manner specified by the Secretary. The legislation clarifies that drugs and biologicals include items, services, supplies, and products that are payable under Medicare Part B. For qualifying manufacturers, reporting requirements begin for calendar quarters beginning on January 1, 2022.

Compliance: Qualifying manufacturers are subject to Audit by the Inspector general of the Department of Health and Human Services. The Secretary may survey wholesalers and manufacturers that directly distribute drugs or biologicals when necessary, to verify manufacturer prices and ASP.

Penalties: The secretary may impose a civil monetary penalty of up to $100,000 on a wholesaler, manufacturer or direct seller of qualifying drags or biologicals if the entity refuses a request for information about charges or prices in the survey described above. The penalty also applies if a wholesaler, manufacturer, or direct seller of qualifying products provides false information. If a qualifying manufacturer fails to report required ASP information, a civil monetary penalty will be applied in the amount of $10,000 for each day the manufacturer has failed to report such information.

Confidentiality: Notwithstanding any other provision of law, information disclosed by manufacturers or wholesalers, other than wholesale acquisition cost (WAC), is confidential.

If you’re interested in finding out more, here are some additional external links that summarize this requirement: