Editor’s Note: This month, we offer updates on three topics: Upcoming Medicare Part D Prescription Drug Benefit Changes, IRA Guidance Updates, and 340B Updates. As always, if you have questions on any of the content found in this or previous market updates, please reach out to your IntegriChain Consulting Lead or consulting@integrichain.com and we would be happy to talk you through it.

Table of Contents

- Upcoming Medicare Part D Changes for Prescription Drug Benefits

- IRA Guidance Update

- 340B Updates: Genesis Case

Upcoming Medicare Part D Changes for Prescription Drug Benefits

Over the past year, we have been considering the impact of the Inflation Reduction Act (IRA) and how the Part D benefit design, including changes to the Medicare Part D Coverage Gap program, will have a massive impact on manufacturers, payers, and patients. Much focus has been on 2025 when the biggest changes begin, but as we head into 2024 we should not lose track of some of the more subtle changes in deductibles as well as the Initial Coverage Limits and Catastrophic Coverage thresholds that occur annually and which also have an impact on manufacturer liabilities.

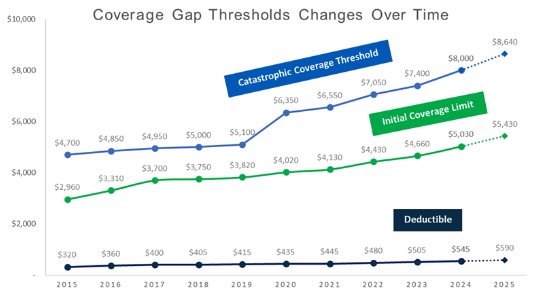

Figure 1 below shows how these thresholds are increasing in 2024, and these revised thresholds should be incorporated into all Medicare Part D Coverage Gap forecasts for 2024.

The Medicare Part D Coverage Gap

Figure. 1 – Coverage Gap Thresholds Changes Over Time

Of the various IRA provisions, the one that seems to be a clear win for Part D beneficiaries is the $2,000 out-of-pocket cap. However, the aspect of this change that we see some confusion about is the related provision that will limit increases in the Part D base beneficiary premium (BBP) to 6% growth each year. Importantly, this does not mean that all premiums are strictly capped at a 6% growth.

Under premium stabilization, the 6% limit is applied to the BBP but not to each individual plan’s premium. As a result, for the 2024 plan year standalone prescription drug plans (PDPs) premiums are increasing by an average of more than 20%.

CMS may subsidize the increase in the BBP beyond the 6% cap but the contractual arrangements between CMS and standalone PDPs are complex. The additional premium stabilization subsidy may mitigate premium growth, but the subsidy may not entirely offset premium growth for plans with large premium increases for each patient.

On the other hand, Medicare Advantage Prescription Drug Plans (MA-PDs) have more flexibility to lessen the premium increases. For example, sponsors can use rebate dollars from Medicare payments to lower or eliminate their Part D premiums and the average premium for drug coverage in MA-PDs is heavily weighted by zero-premium plans.

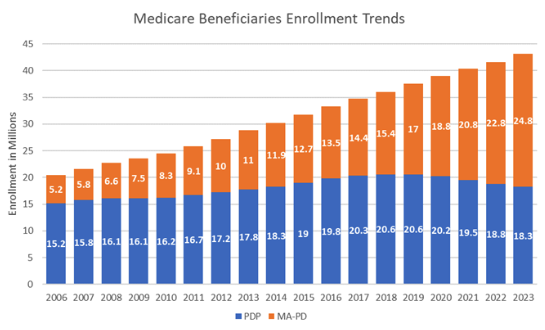

This premium imbalance between PDPs and MA-PDs could amplify as plans assume greater liability for high drug costs above the catastrophic threshold in 2024 and 2025. The increasing availability of low or zero-premium MA-PDs, while PDPs charge substantially higher premiums, may make MA-PDs more attractive from a beneficiary perspective. Enrollment has already been shifting away from PDPs towards MA-PDs and we may see that shift accelerate in 2024.

Medicare Advantage and Prescription Drug (MA-PD) Enrollment

Figure. 2 – Medicare Beneficiaries Enrollment Trends

As MA-PD enrollment continues to expand, it is important for market access leaders to understand the implications on coverage and patient out-of-pocket cost. While MA-PD plans tend to have lower premiums and deductibles, they also have different cost-sharing structures, limits on provider networks, and more widespread utilization management restrictions (such as Prior Authorization requirements).

If you have any questions or want to know more about the overall consequences of IRA specific IRA Part D redesign changes to your business, please reach out to your IntegriChain Operational Consulting point of contact.

References:

- Drug Channels

- IRA Shift Part D

- Part D Premiums Increasing

- Impact on Medicare Advantage

- Overview of the Medicare Part D Prescription Drug Benefit

IRA Guidance Update

On November 17, 2023, CMS published several guidance documents that addressed numerous operational matters and at least one meaningful policy issue related to the Medicare Part D Coverage Gap redesign as part of the Inflation Reduction Act. Below we share some of the key points from the latest IRA guidance:

- Establishes next steps and deadlines for manufacturers to establish the new Medicare Part D Manufacturer Discount Program (MDP) agreement within the HPMS system:

- Effective November 17, 2023, the HPMS system allows manufacturers to attest to certain “Ownership Information” used by CMS to determine if and how the MDP phase-in applies for each manufacturer

- Manufacturers may complete this attestation optionally by December 15, 2023 to receive an early, non-binding determination of the phase-in eligibility by January 31, 2024

- Alternatively, manufacturers must still complete the attestation, as well as execute the new MDP agreement, by March 1, 2024 to participate in the MDP in 2025

- Clarifies that if a manufacturer is eligible for the phase-in, the plan will be responsible for the remaining prescription liability (i.e., 9% or 19% in 2025 t).

- Indicates manufacturers cannot opt out of the phase-in if they are deemed eligible.

- Confirms CMS will use the existing Third Party Administrator (TPA), Palmetto GBA, to administer the new MDP.

If you have any questions about the latest IRA guidance and policy issue related to the Medicare Part D Coverage Gap redesign, please contact your account representative or send an email to consulting@integrichain.com.

References:

340B Updates: Genesis Case

The Genesis Healthcare, Inc . v. Becerra court case has caused much chatter in the 340B space since 2018 when HRSA claimed Genesis committed diversion tactics by providing 340B discounted drugs to patients that were not eligible under the 340B covered entity (CE) providers. This was an instrumental case pushing back against HRSA’s ability to put their own guardrails surrounding terms defined in the law.

On November 3, 2023, the US District Court of South Carolina ruled in favor of Genesis in a landmark ruling indicating that HRSA’s definition of “patient” appears to be inconsistent with the 340B statute definition (see Section 340B of Public Health Services Act). The court also contended that the term “patient” does not have a temporal requirement. Meaning, there is no such requirement indicating a patient must have visited the covered entity a certain amount of times to be considered a “patient”. Although this ruling currently only impacts Genesis and their patients, this could have a domino effect for other covered entities to be able to provide drugs at the 340B price for many more patients than they previously had.

The Court’s ruling against HRSA defining the term “patient” raises questions about other court cases. Can this also be a precursor to how the courts will rule for the CMS best price stacking proposal and the contention around CMS defining best price? Will the Genesis case impact other existing cases against HRSA (e.g., manufacturers restricting sales to CEs which have contract pharmacies) with the notion that HRSA is overreaching its statutory authority? Will there be more CEs that push against HRSA and their definition of “patient” in the same vein as Genesis in order to expand their patient reach while purchasing drugs at a lower 340B price?

Reach out to your IntegriChain contact or consulting@integrichain.com for further understanding of the potential impacts of the 340B ruling.

References: