This is the second and last installment of our two-part blog post covering our webinar series discussing the advantages that channel analytics and downstream inventory analytics have when it comes to gross-to-net calculations.

The Importance of Channel Analytics to Gross-to-Net

Manufacturers of brand products typically utilize a demand-and-pipeline accrual methodology to support monthly and/or quarterly accrual processes. This allows them to calculate more precise accruals and maintain visibility of the balance sheet at each NDC and contract level. This methodology, however, requires reliable demand and inventory data. Utilizing channel analytics provides insights into demand and total pipeline inventory.

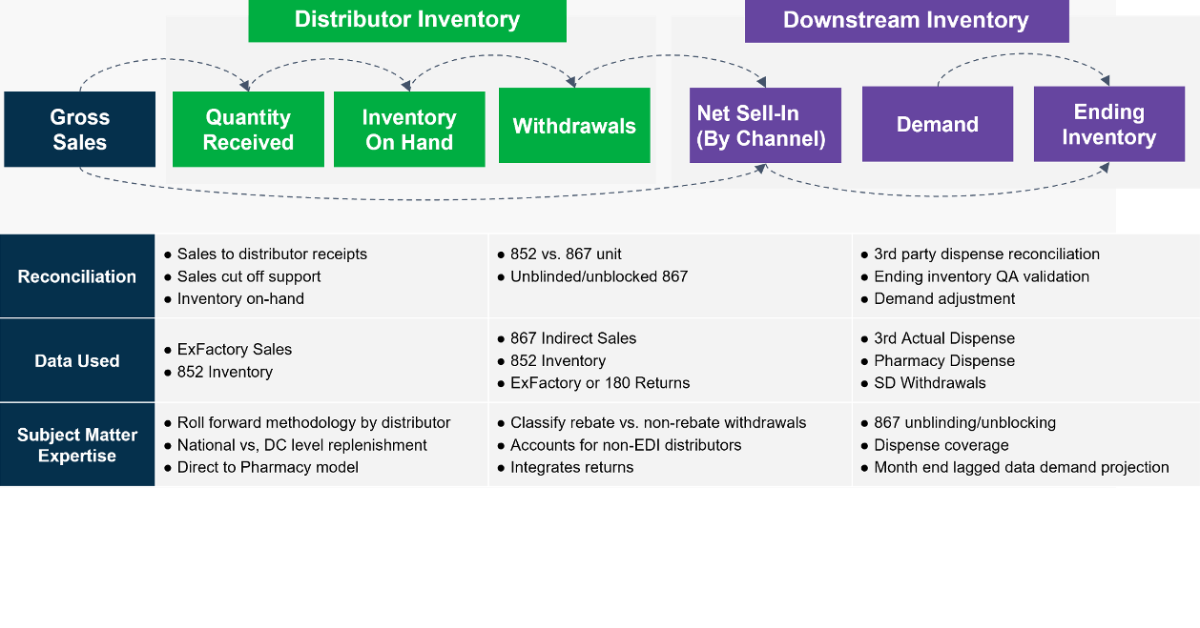

Total pipeline inventory consists of distributor inventory and downstream inventory. In Gross-to-Net (GTN), manufacturers take the monthly total pipeline inventory values, demand values, and apply GTN assumptions such as contract rate, utilization mix, and WAC price.

End-to-End Roll Forward Enable Gross-to-Net Stakeholders

End-to-end Inventory Roll Forward support is a service IntegriChain provides for our ICyte Platform customers who leverage our GTN, Channel Data Aggregation, and Inventory Analytics solutions. This provides our customers with the tools they need to align pipeline and demand figures that improve the gross-to-net close process. End-to-end inventory roll forward provides data that confirms the inputs of inventory pipeline demand sales, providing full GTN visibility. GTN users can take the Roll Forward report to build confidence in accuracy and eliminate gaps within the Distributor Channel.

A robust end-to-end roll forward enables manufacturers to reconcile to revenue recognized in the period while also accruing to appropriate estimates for pipeline (distributor inventory, downstream inventory) and demand. This deep dive roll forward builds confidence in channel data as we are easily able to isolate and explain data discrepancies.

In the first session we looked at common distributor variances in reporting of inventory. Some of those variances are:

- Wholesaler Inventory Roll Forward

- Cross data validations

- Monthly Sales reconciliation to Wholesaler Receipts

Estimating demand and downstream inventory has been a challenge across the industry for decades. Common methodologies that leveraged today compromise the ability to accurately estimate demand and inventory levels downstream. In a use case shared during the last webinar, we applied IntegriChain’s methodology and expertise to triangulate data points and as a result, this customer was able to decrease their reserves drastically. We often see the pain points pharmaceutical Finance teams have, in terms of identifying how much inventory is in the pipeline and how this explains the need for a data-based approach for estimating downstream inventory.

Common ways manufacturers estimate downstream inventory are:

- Applying wholesaler to downstream

- Pharmacy survey methodology that doesn’t cover any atypical distribution

- 3rd Party roll forwards

There are multiple use cases IntegriChain’s Inventory Analytics provide in addition to accrual management. It helps manufacturers in forecasting, syndicated data adjustment, and with the ability to understand market events. IntegriChain does not use projected demand data but rather a data-based approach in estimating downstream inventory. Our downstream inventory roll forward estimation process highlights the use of our National Data for the Net Sell-In component paired with Pharmacy Claims Data from our partnership with PurpleLab. Our industry based assumptions are also gathered from our Analog Benchmarking and market insights

In conclusion of this webinar series, the we presented a full end-to-end Inventory Roll Forward model that incorporates best practices discussed in both Wholesaler reporting as well as Downstream estimations. These are critical components as we look to optimize our GTN models regarding total pipeline, gross sales recognition, and demand. In case you missed this series and have questions regarding these topics, please catch us at our Access Insights Conference in November.