In a complex industry landscape, including recent Inflation Reduction Act legislation, state price transparency laws, and aggressive pharmacy benefit managers (PBMs) price protection language, taking a Wholesale Acquisition Cost (WAC) price increase can have multiple impacts on a pharmaceutical manufacturer’s overall business, as well as their Gross-To-Net (GTN) processes.

For example, when it comes to Commercial and Part D GTN impacts, an increase in WAC (which therefore results in an increase in your gross sales) will increase base rebates and admin fees.

Effects of Price Protection and WAC on Gross-to-Net

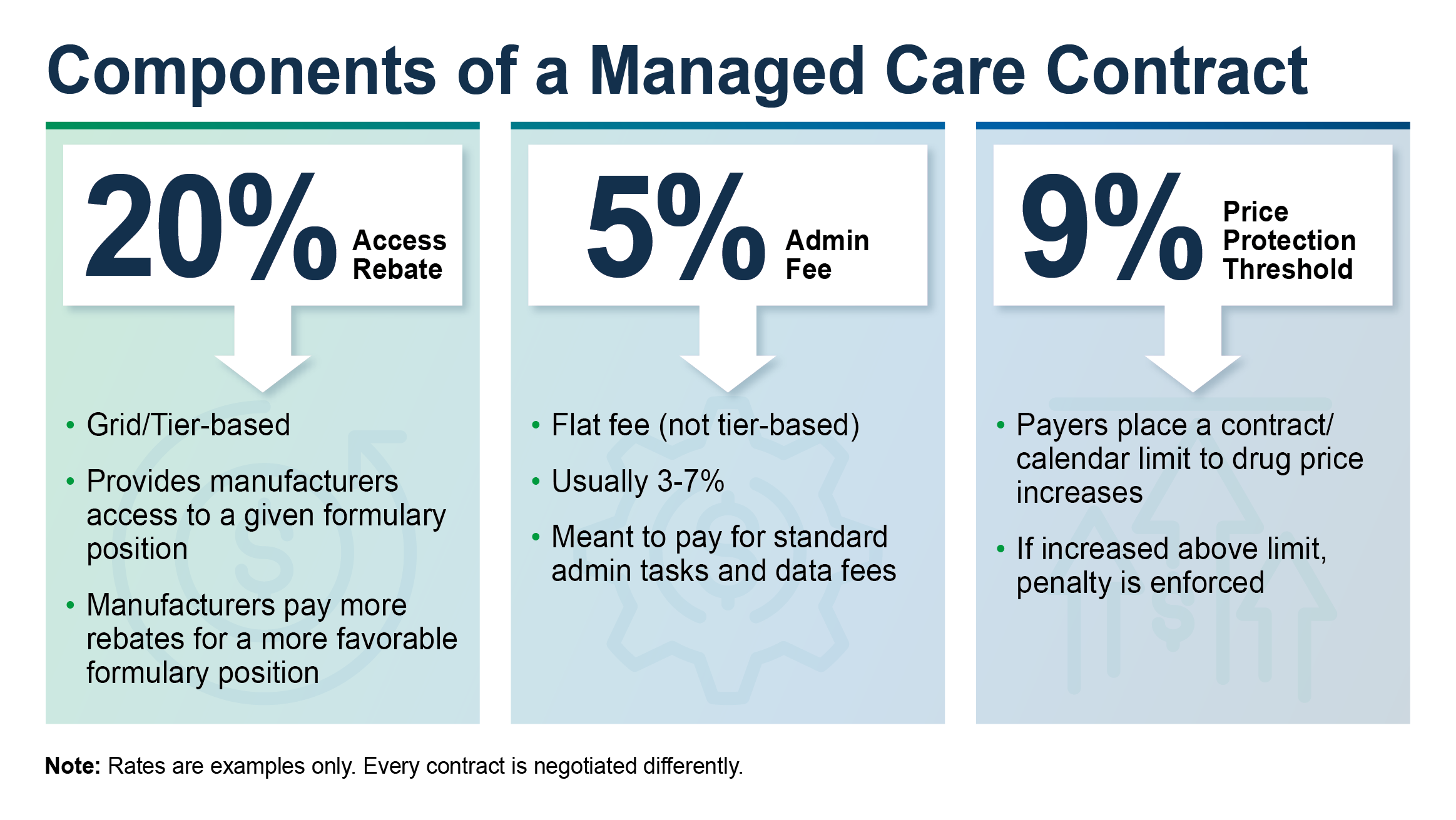

Another area of consideration and one of the biggest impacts on a manufacturer’s GTN can come from price protection terms when contracting with pharmacy benefit managers. Depending on the PBM, there are various ways to calculate price protection. Here are two examples of what we have seen with the Big 3 PBMs:

Price protection is language in a commercial or Part D contract that limits what a contracted customer must pay or reimburse for a product in the event that the manufacturer takes price increases above a level defined in the contract.

Therefore, even though a manufacturer might take a WAC price increase that is less than the allowed price increase threshold, the result can still lead to a Price Protection rebate. For example, if a manufacturer wants to take a 7% WAC increase, the PBM will only pay the additional to a specified threshold of say 5%. Anything above 5%, the manufacturer will give back to the PBM in the form of a price protection rebate, on top of any existing rebates.

For a pharma manufacturer, price protection payments can significantly affect how much a manufacturer pays in rebates in a given period. This affects overall margins for contracted sales as well as the net price realized by the customer (which can affect Best Price and Tracking Customer prices).

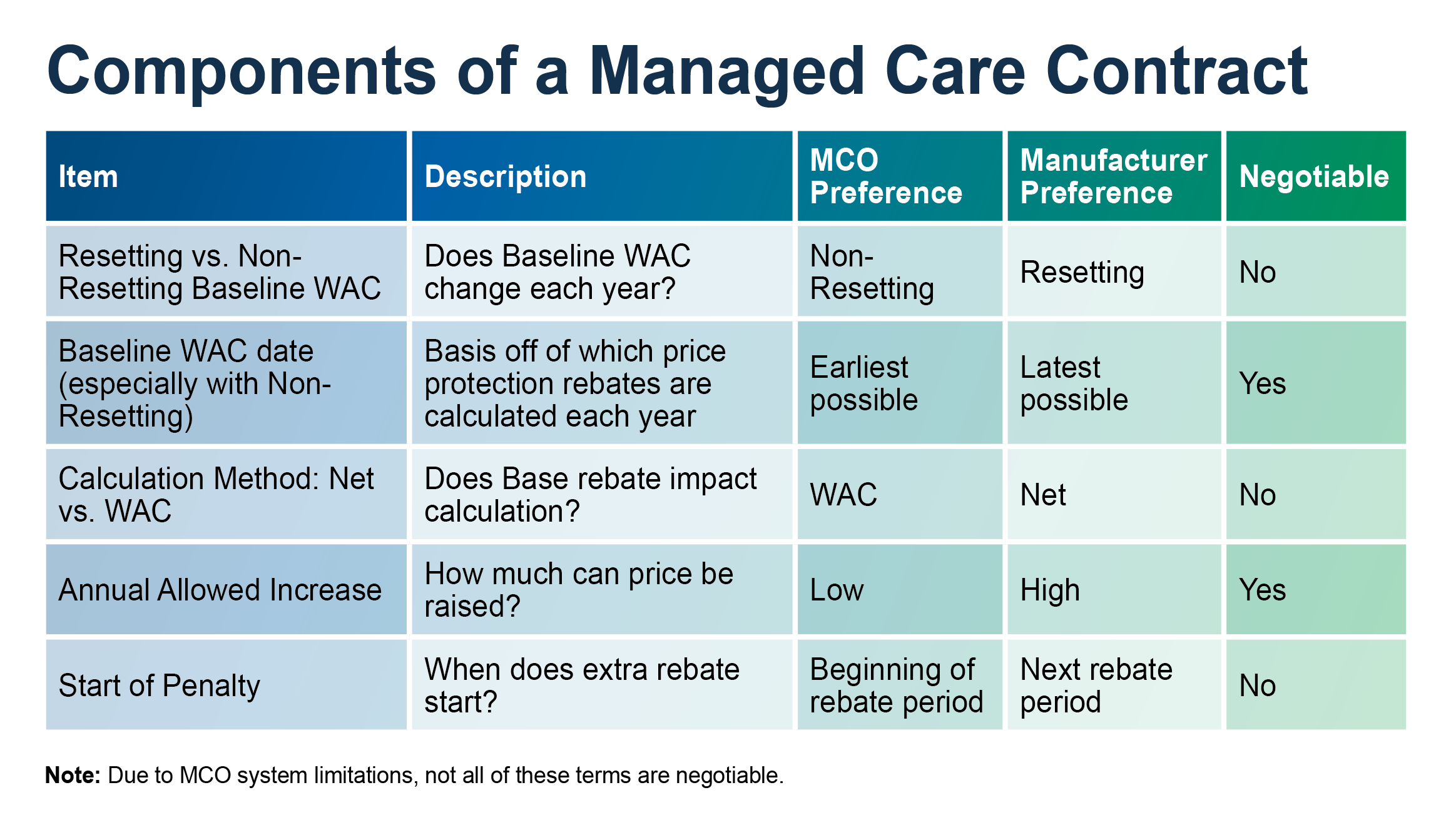

Price Protection Calculations Using a “Gross” Method or “Net” Method.

- The “Gross” method uses the Allowed WAC and Current WAC. If there is a 3% Price Protection threshold, and the Current WAC is $100 and a 5% WAC increase is taken, the Current WAC would go to $105, the Allowed WAC would be $103, so the $2 difference is the Price Protection rebate.

- The “Net” method calculation will “Net” out the Base Rebate %. Using the same assumptions as the Gross Method would result in a lower Price Protection rebate. Assume a Base rebate of 20%. The Current Net WAC of $84 ($105 less 20% Base Rebate) and Allowed WAC would be $82.40 ($103 Allowed WAC less 20% Base Rebate). The Price Protection rebate would only be $1.60 using the “Net” method vs the $2.00 in the “Gross” Method.

Some PBMs may have language for Inflation Protection and Predictability (IPP). In this contract, you may pay a price protection rebate even if your WAC increase is below the threshold. Using the Inflation Limitation Percentage (ILP), the Price Protection Calculation is divided into two groups, up to the ILP and above the ILP. Any WAC increase up to the ILP could result in a Price Protection rebate, even if the WAC increase is at or below the threshold.

These are just a few of the critical things to think about when considering a price increase. If you have further questions regarding how WAC price increases impact gross-to-net, reach out to your IntegriChain contact or email us at consulting@integrichain.com.