Editor’s Note: This month, we’re providing a breakdown of the 2025 Branded Prescription Drug Fee (BPDF), including key IRS deadlines, compliance considerations, and guidance for branded drug manufacturers. If you have questions about BPDF analysis, tax estimates, or form 8947 submissions, please reach out to a IntegriChain Consulting Lead or email us at consulting@integrichain.com, and we’re happy to support your team.

Table of Contents:

- BPDF Tax Calculation

- Branded Prescription Drug Fee Deadlines and Key Dates for 2025

- BPDF Pharma Compliance Considerations for Manufacturers

- BPDF Pharma Analysis: Finance & Accounting Accrual Support

The Branded Prescription Drug Fee (BPDF) is an annual tax created by the Patient Protection and Affordable Care Act to help fund the federal government’s expanded role in the US health care system. This annual fee is imposed on manufacturers/importers (covered entities) with aggregated branded prescription drug sales of more than $5 million to specific government programs, which include Medicare Part D, Medicaid, Medicare Part B, VA, DoD, and TRICARE. The statutory fee to be invoiced and collected for 2025 is $2.8 billion.

BPDF Tax Calculation

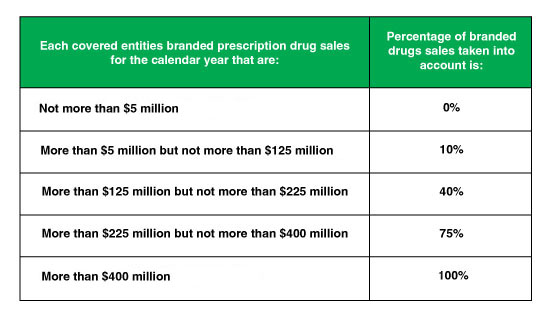

Each manufacturer/importer of branded prescription drug products is responsible for a portion of the $2.8 billion statutory fee. The calculation for the BPDF tax fee is based on the ratio of a manufacturer’s government sales taken into account (the numerator) to the total government sales from all covered entities (the denominator).

Here’s a breakdown of how the branded prescription drug fee is calculated:

- Determine the numerator – The manufacturer’s branded prescription drug sales to the government that are taken into account.

- Determine the denominator – The total branded prescription drug sales to the government from all covered entities.

- Calculate the ratio – Divide the manufacturer’s sales (numerator) by the total sales (denominator).

- Apply the ratio – Multiply the result by the $2.8 billion statutory fee.

- Factor in adjustments – Include IRS adjustments if applicable (see IRS guidance for more detail).

- Review the IRS invoice – It will include this calculation and estimated sales by NDC and program.

The IRS invoice will show this calculation as well as the estimated sales by NDC by the specified program. It’s important to note that the sales data in the 2025 fee year will be assessed based on 2023 sales.

Branded Prescription Drug Fee Tiers Based on Annual Sales

Figure. 1 – Annual BPDF Pharma Sales Tiers

Branded Prescription Drug Fee Deadlines and Key Dates for 2025

To stay compliant and avoid unnecessary fees, it’s important for manufacturers to keep track of key BPDF tax deadlines. Below is a breakdown of important dates to note for the 2025 fee year.

- No later than March 31: IRS Preliminary Fee Notice (letter 4657) mailed

- March 1 – May 15: Opportunity to evaluate and dispute preliminary IRS fee

- No later than August 31: Final Invoice (letter 4658) mailed (including dispute resolution, if applicable)

- No later than September 30: Final fee due

- November 1: Submit form 8947 (note this is an optional form)

BPDF Compliance Considerations for Pharma Manufacturers

We recommend the following to ensure your organization is accruing and paying the appropriate amount:

- Consider developing a process and tools to support the branded drug fee analysis.

- Estimate your sales and forecast for each applicable government program and estimate your share of the annual aggregate BPDF.

- Monitor and update your estimate as actual data becomes available and true up as needed.

- Review your IRS Preliminary Fee Notice to confirm that the IRS sales and estimated fee information appear accurate or reasonable based on your estimates.

- Monitor your data related to specified government programs on an ongoing basis to confirm that the data is accurate.

- If you have an orphan drug and would like to remain in the orphan drug exclusion rules, confirm that you meet the exclusion criteria. Note this exclusion is eliminated if the orphan drug is approved for any non-orphan indication.

- Evaluate whether it is beneficial to voluntarily file form 8947. While the form is not required, timely filing may help confirm the company’s Medicaid Supplemental Rebates and that orphan drug designations are accurately reflected in the BPDF invoice for the IRS.

We understand these activities can be challenging due to factors such as limited program knowledge, compressed timelines, limited team bandwidth, and complexity. Here is how we can help:

BPDF Pharma Analysis: Finance & Accounting Accrual Support

Our team provides tailored support to help estimate your BPDF tax obligations and streamline your financial accrual processes:

- Prepare tools and advice to help estimate your BPDF and accrue appropriately.

- Provide advice and/or assistance necessary for proactively monitoring data and avoid future disputes.

- Assist with developing or enhancing your BPDF accrual process and/or tools.

- Provide guidance and help develop and enhance BPDF pharma tax processes, including documentation (e.g., Standard Operating Procedures).

- Provide BPDF trainings and or develop training materials.

- Provide guidance to navigate the BPDF process.

- Provide guidance to complete IRS Form 8947 and assist with submission.

Looking for support with your branded prescription drug fee process? Reach out to our team for tailored BPDF pharma analysis and guidance to streamline compliance and financial planning.

References: