Regulatory Market Update

We want to keep you up-to-date with relevant, timely industry insights and regulatory updates that may impact your business. If you have questions on any of the content found in this or other newsletters, reach out to your IntegriChain Consulting Lead or advisory@integrichain.com and we would be happy to talk you through it.

Mark Your Calendar!

On April 8th, 2021 at 1 PM ET, IntegriChain is hosting an informative discussion with Rupal Patel, Director of Advisory Services, and John Whitridge, Senior Advisory Services Consultant, discuss the current state of drug pricing transparency laws. With customer use-cases and lessons learned from over 50 customer implementations, this is one you won’t want to miss. Register Now!

Tracking AMP Cap Proposal

On January 1, 2024 Medicaid Rebates (I.e., Unit Rebate Amount “URA”) will no longer be capped at 100% of AMP. This is impactful for manufacturers who are taking price increases greater than the rate of inflation. Ultimately, they will end up paying higher rebates. Under current law, there is a cap of 100% Average Manufacturer Price (AMP) on how much rebates a state can collect. With the elimination, the benefits here would produce major prescription drug savings for the federal government and the states; however, increase manufacturer liabilities. Lifting the rebate cap under the Medicaid Drug Rebate Program (MDRP) would reduce federal Medicaid spending by $15.9 billion over the next 10 years.

With the removal of the cap, the inflationary rebate will lead to higher rebates owed for manufacturers when taking large price increases on their drug products. This has the effect of reducing the net drug product price and allows savings for the Medicaid program than the current position it is in today with increased savings in the state and federal governments, but increases manufacturers’ rebate liabilities.

Link to read more:

Elimination of Medicaid Rebate Cap

H.R.1319 – American Rescue Plan Act of 2021

OIG Final Rule

Following up on our update to the OIG Final Rule from last month, the Office of the Inspector General of the Department of Health & Human Services (OIG) released its final rulemaking changes to the Anti-Kickback Statute (AKS) and the Beneficiary Inducements Civil Monetary Penalties Law (CMP Law). The OIG has finalized a new change to the exemption of remuneration under CMP. The additions and changes to the safe harbor regulations are made to allow for innovative partnerships with health care providers and supplies, vendors, technology companies, and other health care entities to boost patient results and manage the costs under the federal healthcare programs. This will likely improve outcomes and lower healthcare costs. The OIG states, safe harbors are meant, “to remove potential barriers to more effective coordination and management of patient care and delivery of value-based care.” The new safe harbors will also provide significant expansion or flexibility for healthcare providers to enter in order to design and prompt quality and lower costs.

Link to read more:

Final Rules Published on Stark Law and Anti-Kickback Statute

Washington State Price Transparency Reporting

IntegriChain has confirmed with the WA Health Care Authority (HCA) and outside counsel that the report due date for any pipeline NDA/BLA products, submitted by October 16, 2020, is within 60 days after receipt of the PDUFA date acceptance letter. For example, a new product receives acceptance from the FDA on 12/3/2020 the manufacturer would be required to submit within 60 days of 12/3/2020 which is 2/1/2021. For all new drug applications or biologic license applications for pipeline drugs submitted on or after October 1, 2019, through October 15, 2020, the submission deadline was 12/31/2020. WA is expecting to release updated reporting templates and a new user guide in the coming weeks for manufacturers to use. If you believe this has a direct impact on your product, missed the reporting deadline, would like to be notified when the new user guide is released, or would like to learn more, reach out to our pricing transparency consulting services at price.transparency@integrichain.com.

Link to read more:

Manufacturer Data Submission Guide

Changes to Medicare Part D

Congress has proposed several changes to lower prescription drug costs. They targeted four different components of Medicare Part D consisting of capping beneficiary Out of Pocket (“OOP”) spending, increasing insurer liability, requiring manufacturer liability to increase along with a drug’s price, and decreasing the government’s reinsurance liability. The proposal to reform the Medicare Part D structure was first proposed by the American Action Forum. The Senate Finance Committee approved the Prescription Drug Pricing Reduction Act (PDRPA) which includes a redesign of the Medicare Part D Prescription Drug Program.

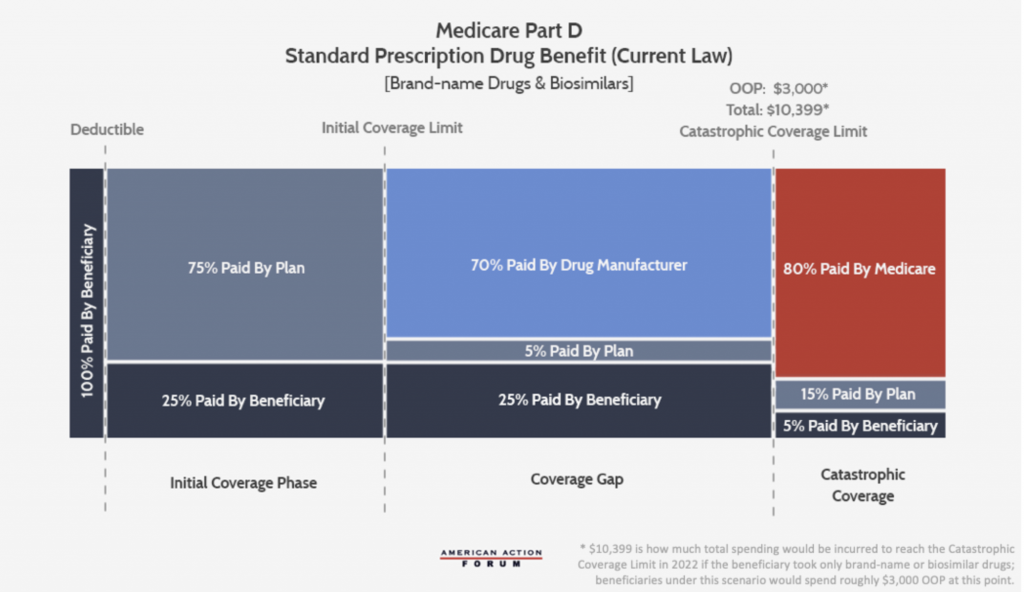

This illustration below is the current Part D benefit structure where 70% of the cost is paid by the drug manufacturer while only 5% is paid by the insurer. When insurer liability is low and limited beyond the deductible, there is little incentive to keep beneficiaries out of the overage gap and catastrophic phases.

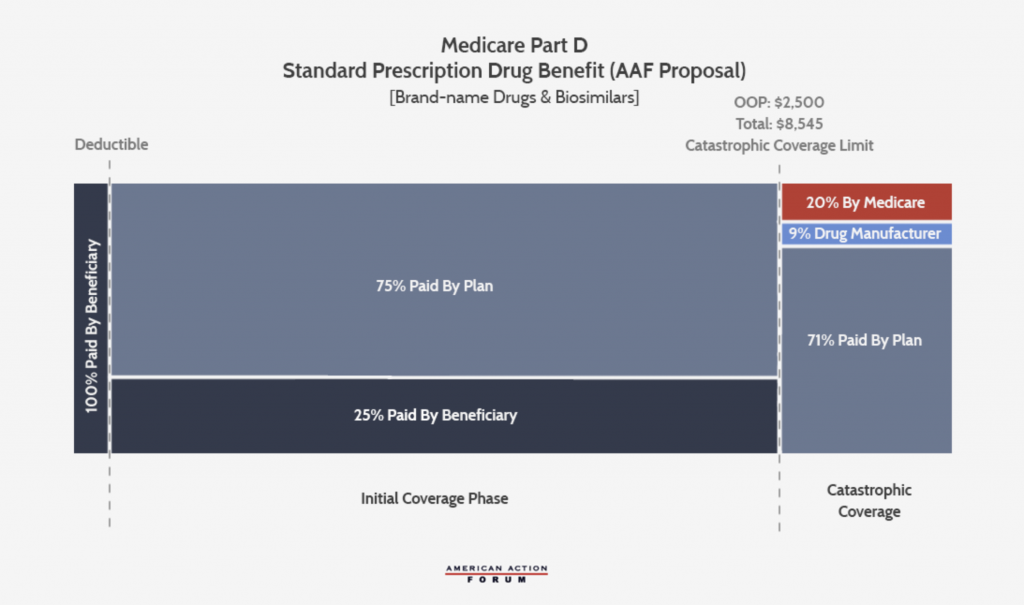

The AAF proposal (below) increases insurer liability in the catastrophic phase and places a cap on OOP liability. An estimate of a $2,500 OOP cap would yield manufacturer rebates if the manufacturer paid a 9% discount in the catastrophic phase. With these changes, taxpayers and beneficiaries should have less financial risk and it will increase insurers’ and drug manufacturers’ incentive to keep drug costs down. It would eliminate the coverage gap and reduce it to three phases.

Link to read more:

UPDATE: The Many Competing Proposals to Reform Medicare Part D

Virginia Department of Health Announces Annual Price Increase and New Drug Reports

Virginia has recently announced its annual price increase and new drug reports that manufacturers have to submit annually on April 1 beginning in 2022. Simplified information for the New Drug & Price Increase reports outlined below:

Annual Price Increase

Who: Manufacturers of branded and generic drug products who took a price increase above the specified threshold

What (to report):

- The name of the prescription drug

- Whether the drug is a brand name or generic

- The effective date of the change in wholesale acquisition cost

- Aggregate, company-level research and development costs for the most recent year for which final audit data is available

- The name of each of the manufacturer’s new prescription drugs approved by the U.S. Food and Drug Administration within the previous three calendar years

- The name of each of the manufacturer’s prescription drugs that, within the previous three calendar years, became subject to generic competition and for which there is a therapeutically equivalent generic version

- A concise statement regarding the factor or factors that caused the increase in WAC

Where (to whom): VA Department of Health is in the process of contracting which nonprofit organization will process the reports

When: Reports are due annually on April 1st beginning in 2022

Why: Products that took a price increase above the below thresholds need to report information from the What (to report) section:

- Branded products (including Biosimilars with WAC > $100 for a 30 day supply or single course of treatment): price increased by 15% or more during the previous calendar year

- Generic products: price increased by 200% or more during the preceding 12-months*

*calculated for products with WAC equal to or greater than $100 (annually adjusted by the Consumer Price Index for All Urban Consumers for a 30-day supply) by the difference between the WAC after increase and the average WAC of the product during the previous 12 months

Annual New Drug Report

Who: Manufacturers who release a new biosimilar with an initial WAC of not less than 15% of the WAC of the branded biologic at the time of biosimilar launch

What (to report):

- The name of the prescription drug

- Whether the drug is a brand name or generic

- The effective date of the change in wholesale acquisition cost

- Aggregate, company-level research and development costs for the most recent year for which final audit data is available

- The name of each of the manufacturer’s new prescription drugs approved by the U.S. Food and Drug Administration within the previous three calendar years

- The name of each of the manufacturer’s prescription drugs that, within the previous three calendar years, became subject to generic competition and for which there is a therapeutically equivalent generic version

- A concise statement regarding the factor or factors that caused the increase in WAC

Where (to whom): VA Department of Health is in the process of contracting which nonprofit organization will process the reports

When: Reports are due annually on April 1st beginning in 2022

Why: Biosimilar product launch WAC price must be no less than 15% of the WAC when compared to brand biologics

Link to read more:

You can read House Bill No. 2007 in its entirety here.