Editor’s Note: The following post is taken from the Q&A session of IntegriChain’s ‘Data Aggregation 3.0’ webinar. Josh Halpern, Co-Founder & Executive Vice President, Product & Strategy, led the presentation. Josh’s responses have been edited for clarity. Click here to view the full webinar recording.

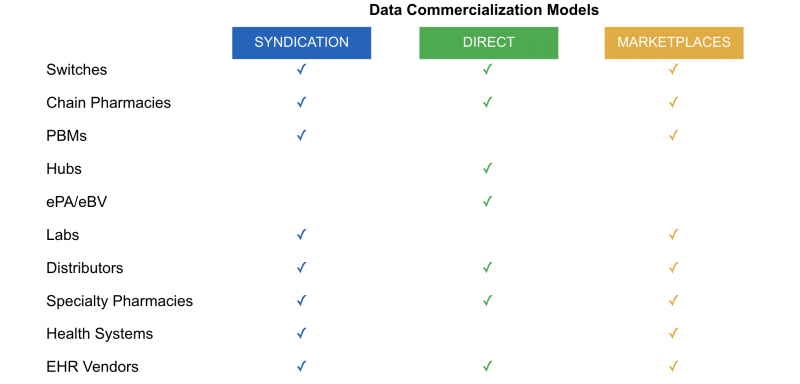

Q: Of all the data source types, which ones beyond EPS, Hubs, and Distributors are we seeing most often in the direct model?

A: I would say labs, Real-Time Benefit Verification (eBV) and ePrior Authorization (ePA) to an extent are coming up the most often right now. More hub providers have either in-house e-prior authorization capabilities or have tightly integrated with something like CoverMyMeds. A lot of data aggregation projects that were set up maybe five or six years ago are kicking themselves now because they’re not able to as easily integrate data sets – like lab genetic test results for example– as they might have been if they’ve gotten it right out of the gate.

A data source type that we’re seeing a lot of right now is channel models where more of these small, independent pharmacies are finding ways to make dispensing data available, even though their capabilities might be fairly rudimentary. This has big implications for the aggregators involved. This is not the same thing as aggregating dispense data from a huge distributor like Caremark, for example. Their capabilities are much more limited and there’s much more handholding to do to help them be successful. In an integration, we’re always thinking about how we can work with those independents more smartly to help make them successful because their success is critical for our customers’ success.

Direct data sales and emerging data marketplaces are upending the traditional data “syndication” model and fast becoming the norm.

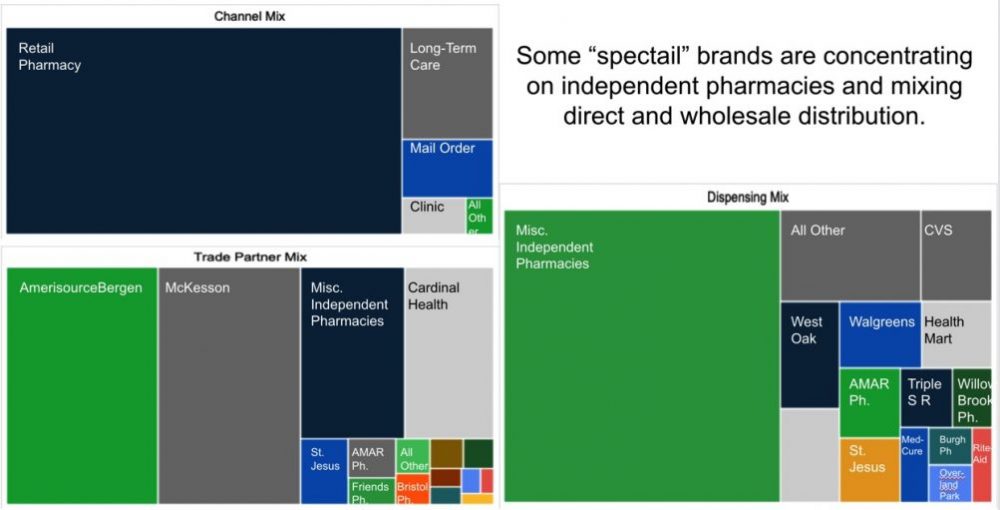

Q: What types of brands are you seeing pursue direct-to-pharmacy distribution models for drugs with tens of thousands of patients a year or more?

A: There are a few. I think it really comes down to the price point, the policy restriction landscape, and a bit about the patient journey.

Starting with the price point: drugs that are $1000 to $2000 are in “no man’s land” between retail and specialty and need alternative models. We are seeing some impact as well with the size of the manufacturer. Larger manufacturers can commercialize more therapies through the traditional wholesale channel because their overall portfolio of business is such that their distribution fees are manageable. Smaller manufacturers might have brands that a larger manufacturer would have put through wholesale distribution where because of their size they’re paying a steep penalty in terms of the price they have to pay for wholesale distribution and therefore they’re going after alternatives. I would certainly say dermatology and women’s health are really embracing these models.

Then there are also examples where it’s more to do with the patient journey. For example, antibiotics in which the patient might start treatment in the hospital and then transition to at-home care, and the product needs to be available to them at home the next day. This price point is not a specialty pharmacy price point. This is why the patient journey really does benefit from having pharmacies that are specialized in the space but are willing to work with a product that’s at a bit of a lower price point.

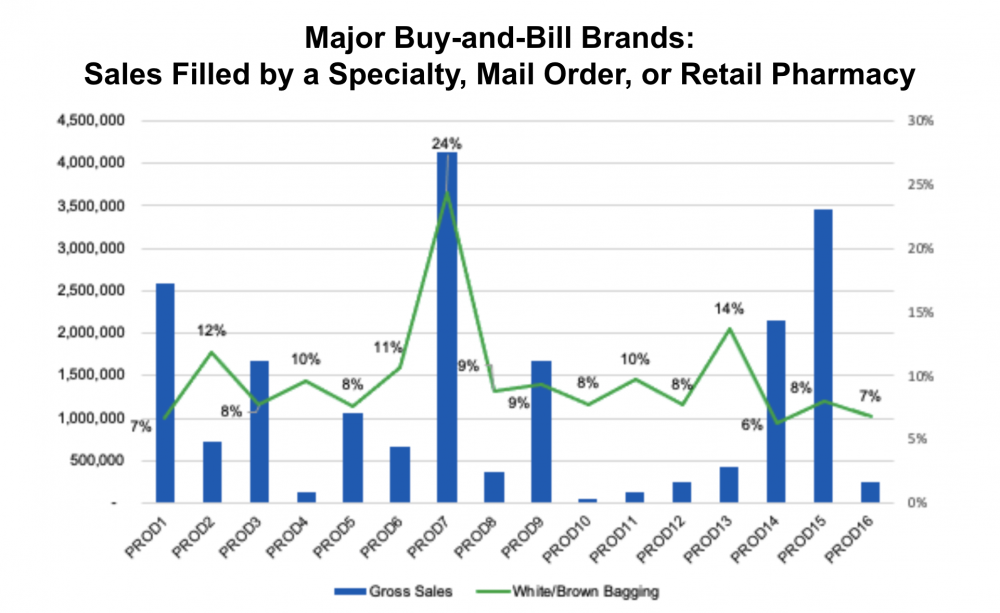

And lastly, let’s not forget about what’s happening in buy-and-bill. We’re seeing a lot of shift of business from buy-and-bill into big-box specialty pharmacy payer owned and we’re also seeing growing amounts of volume go through the health system’s own specialty pharmacies, likely driven by 340B.

Buy-and-bill analysis of the last ~50 brands that launched with IntegriChain.

Q: Why do we think a new stewardship model can work if they can’t do it now? Why can an aggregator of the future succeed?

A: I’m going to give an answer that is half a reflection of things we’re doing right now and half “betting on the calm,” if you will.

There’s always success in doing things such as increasing your knowledge level of specialty pharmacy business, bringing that knowledge to the table, engaging in triage conversations, and having the right caliber and seniority of specialty pharmacy liaisons. These are all things that we’re doing right now and investments we’re making that we firmly believe will help. We already see it helping where we’re getting to better data quality than we would have three or four years ago from pharmacies that are not names you’d typically associate with data quality.

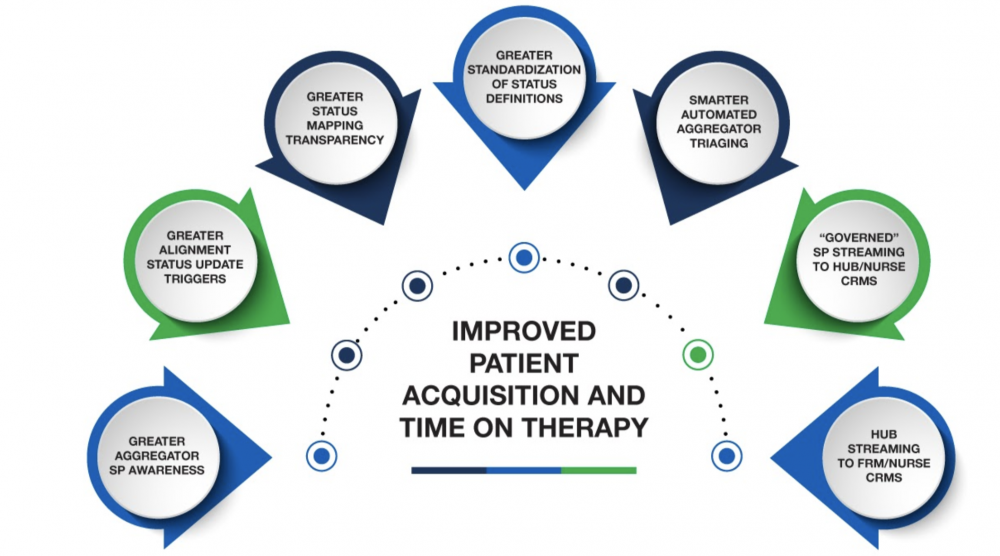

New data aggregation stewardship model improves patient initiation and adherence.

Part of my conviction that this will get better is that data quality catches up. What I’ve seen happen in 20 years working in Life Sciences commercial data and analytics is the data set starts out pretty weak in terms of quality, and then the use cases start to grow and the data quality catches up to the use cases out of necessity because if there are more eyes on it there’s more pressure. That pressure translates to more pressure on the data providers whether it’s pharmacies or hubs, and the data quality follows. I do believe that we’ll see the emergence of quality catch up with the use cases just like we saw with claims data or other data sets in the past that went through the syndication model.

Want to learn more? Watch the Data Aggregation 3.0 webinar now