Whether it’s helping an emerging pharmaceutical manufacturer operationalize their drug commercialization strategy for their first therapy, enabling a mid-market firm to enter a new therapeutic category, or helping large pharma reduce their revenue leakage and Gross-to-Net (GTN) “bubble,” IntegriChain knows a thing or two about market access. Based on more than 15 years of experience with more than 250 manufacturers, here are the 10 most common challenges facing market access pharma operations, broken down into three critical categories:

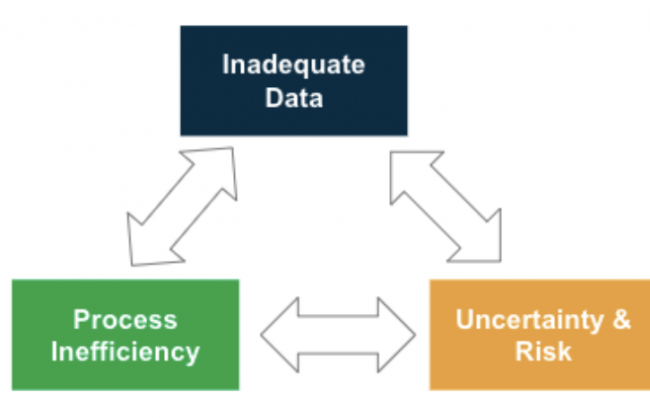

INADEQUATE DATA TO RUN THE BUSINESS

Without accurate and timely data, market access teams face challenges forecasting, analyzing, and understanding the health of the business. The following are the top data-driven challenges facing pharmaceutical market access.

1. Patient Initiation and Adherence Remains a Mystery

In the ideal world, you would know when each patient starts their therapy and their level of adherence. Unfortunately, this is seldom the case, and the culprit is often poor patient status data. This can happen when there is a gap between a referral to a specialty pharmacy (SP) and when the SP begins to report the status of the referred patient. Another example is when an SP delays updating the status for pending new patients who have not yet filled their script or have been canceled. Without accurate data, your entire market access team is forced into a reactive mode and proactive patient intervention is impossible.

2. Lack of Visibility to Downstream Inventory

One of the most common challenges experienced by Market Access and Finance teams is the inability to understand how their inventory pipeline downstream of their distributors fluctuates over time. The root cause is that there is no universal definition and empirical datasets for Demand, upon which to forecast inventory positions needed for financial closes with certitude. In addition, different departments across marketing, sales, and commercial operation use demand data for their own purposes, and arriving at a consensus can be controversial and often cited as a concern by external auditors. Developing a data-driven methodology that provides minimal revenue variability is a difficult challenge across most manufacturers.

3. Modeling the Business Remains a “Pipe Dream”

Another challenge facing market access teams is their ability to model and forecast their business’s fundamentals. How often do you and your teams mutter the words “What if?” For example, ‘what if’ we tweak our WAC price for Brand X… what is the impact on our government pricing, our rebate burden, and our net price? Most organizations simply lack the data, methodology, and manpower to perform such an analysis. In other organizations, this type of analysis can take six to eight weeks. As a result, they’re only able to model a handful of changes per year and can fail to operate at an optimal level. Equipped with timely and accurate data, best-in-class companies can model even complex contract and pricing changes in a matter of days.

INCREASING UNCERTAINTY & RISK

Uncertainty in any business can hinder its ability to grow, or even simply move forward. The following 4 market access pharma challenges highlight how uncertainty and business risk affect operability.

4. Gross-to-Net is Out of Control

Market access teams must be able to calculate, forecast, and analyze their Gross-to-Net models. How well do you understand the true net price of all of your therapies? Do you have a proven, consistent, and transparent way to calculate the net price? Are you certain that you’ve accounted for all of the discounts, rebates, fees, chargebacks, incentives, and other adjustments that are common in most pharmaceutical business models? Can you show auditors a clean GTN waterfall model like the one below to illustrate how you arrive at your net price? If these questions make you tremble, you’re not alone. Drug Channels Institute estimates that the gross-to-net bubble reached $204 billion for patent-protected brand-name drugs in 2021, and could be as high as $236 billion if brand-name drugs that have lost patent protection and face competition from generic equivalents are taken into account1. If you’re still in a manual, reactive mode, it’s time for a change.

5. It Takes More than Three Days to Do a Month-End Close of your Books

How did we do? This is the question every executive asks at the end of the month, quarter, and fiscal year. Unfortunately, this simple question is anything but simple to answer. It often takes an army of financial analysts (and some data/IT help) to pull together and validate all of the information necessary to do an accurate “close”. As a result, many pharmaceutical manufacturers aren’t able to close their books until weeks into the next financial period. If this sounds familiar and you’re not able to consistently achieve a three to four day close, it’s time to re-examine your infrastructure.

6. Turnover in Key Talent is a Large, Growing Problem

The inherent challenges in drug development and commercialization combined with an ever-changing regulatory environment and intense competition (even in niche, specialty categories) create a highly dynamic, risk-filled environment. Couple this with a shortage in critical government pricing, gross-to-net, and analytical skill sets and you have the making for operational challenges for any market access strategy.

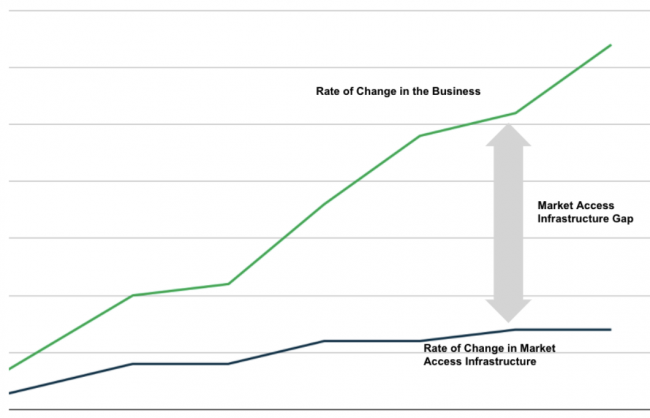

7. Infrastructure Isn’t Agile Enough to Keep Up with the Business

Two questions explain this challenge. First, how much has your business and market access strategy changed in the past five to ten years? Secondly, how much has your core market access technology, data, and processes changed? The graph below represents what we hear most often; not surprisingly, the business is moving far faster than the infrastructure can support. As a result, the business is constrained by legacy processes, outdated revenue management systems, datasets that are aggregated and managed in isolation from other data, and an overload of data with a shortage of insight.

ONGOING PROCESS INEFFICIENCIES

The last challenges facing market access teams are process inefficiencies which can strain teams for time, cause inaccurate data, and hinder the manufacturer’s ability to reach optimal output.

8. It’s all Run by Spreadsheets and Data-Wranglers!

When auditing your market access process efficiencies, ask yourself these important questions:

- How many spreadsheets do you have for managing inventory?

- What about patient initiation and adherence?

- Are there dozens more for tracking specialty pharmacy dispense data, patient status updates, Medicaid and Managed Care rebate payments, Government Branded Fees, and so on?

Given that spreadsheets are not SOC-certified, are difficult to share with others in a protected manager, are easy to make errors, and lack enterprise scalability, this is not an efficient way to run market access operations On top of this, version tracking is impossible when your staff is copy-and-pasting, and importing-and-exporting data to go from one system to another, drowning in complex, repetitive, toil.

9. Unproductive Distributor Meetings and Quarterly Business Reviews

Working with trading partners, especially specialty pharmacies, distributors, and hubs, is a critical element of a world-class pharmaceutical market access strategy. However, many IntegriChain customers report that their engagement with SPs is less-than-ideal and incredibly inefficient. For example, they report that in most cases, the QBR discussed high-level business trends without getting into enough detail to identify actionable operational issues. Digging deeper, the root cause of this was the fact that discussions were limited to very high-level business metrics such as overall Time to First Fill, or overall Fill Rate. Complicating matters was the fact that manufacturers and SPs were each calculating their metrics differently and some weren’t even using the same definition of what constituted a “new patient. This often meant that QBR discussions got tied up in disagreements about the numbers, and couldn’t get beyond how the metrics were calculated. It also prevented the manufacturers from getting the SPs to accept benchmark feedback on their patient initiation and adherence metrics compared to the rest of the network.

Finally, none of the customers had access to benchmark analytics that could show what “good” patient initiation looked like for a given payer mix.

10. New Contracts Take Forever

In most organizations, a new payer or channel contract can take months even if it is based on a fairly standard, common template. Ever dream or actually try to design and execute some type of value- or purchase-based agreement? If so, you’ve probably realized you “hit a wall” due to your inability to bring together combinations of payer-reported utilization data with patient-level data from the channel, labs, and health systems. As a result, you’re stuck with the same basic contracts as you had 10-15 years ago.

IntegriChain has been helping pharma manufacturers develop, execute, and optimize their market access strategies for more than 15 years. Many manufacturers depend on us to help them ensure they’ve got the right product, to the right patient, at the right time, and at an appropriate price. Learn more about our products for market access and our consulting services for pharma manufacturers.

IMPROVE YOUR MARKET ACCESS STRATEGY