Key Considerations for Gross-to-Net

For the majority of life science and biotech companies, January is a time of closing the books, wrapping up year end results, and preparing for the annual audit. This blog is to discuss key considerations from a Gross-to-Net (GTN) perspective when planning and supporting the year end financial audit.

Tip 1: Analyze, Understand, and be able to Explain the Balance Sheet

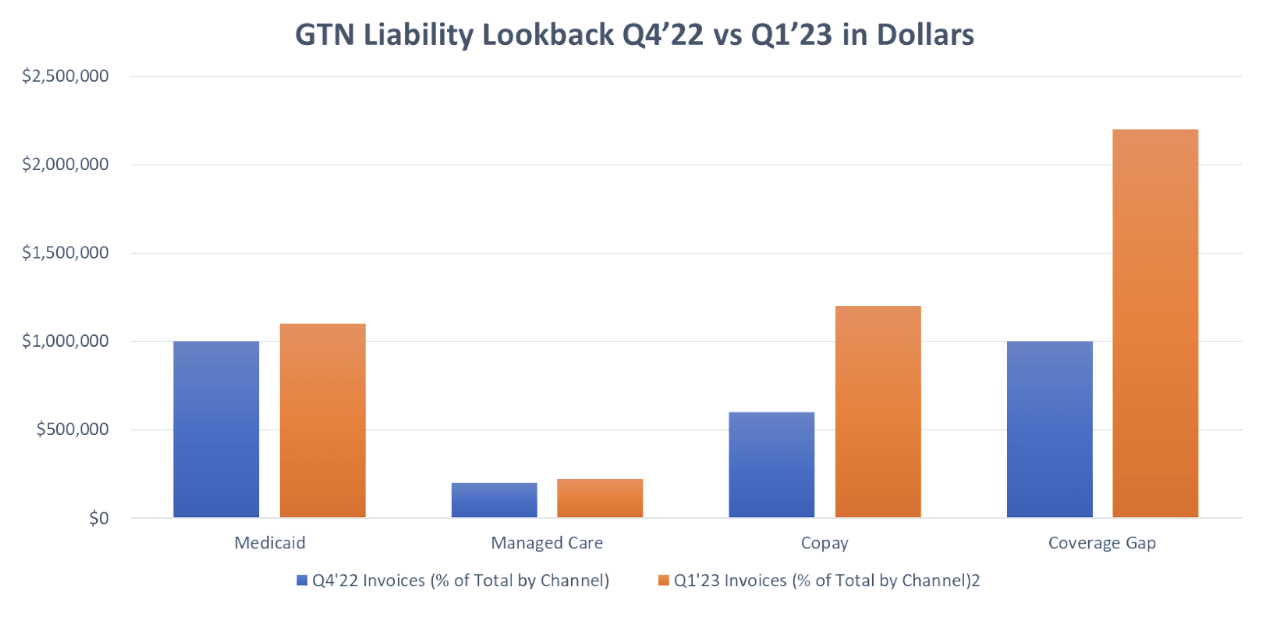

- Pipeline Accruals. Understanding total pipeline units in the channel at the end of the year can be critical to a company’s Balance Sheet accuracy. This requires a reconciling Inventory Roll Forward supporting pipeline assumptions. Additionally, units in the pipeline need appropriate future GTN rates applied for more accurate reporting. For instance, companies with a large Coverage Gap invoice or high Copay dollars ($) in Q1 every year may want to consider adjusting their pipeline accruals, especially if they have significant inventory at wholesalers and downstream. See illustrated example below of the difference in liability a company may have in Q4 vs Q1 invoices. This can have a dramatic impact on pipeline calculations.

- Open Invoice and Prior Period Lag. Being able to confidently explain the balance sheet with readily available detailed evidence greatly improves year end audit efficiency. It is important for manufacturers to understand what is being reserved on their balance sheet and why. Here are few questions for companies to think about:

- Has the company analyzed its Medicaid rebates and identified its prior period lag? Has the company released open invoices that they do not expect to receive and are they holding open periods that still appear to be missing key states or following lag trend analytics?

- Does the company have lagging claims for TriCare, Coverage Gap, and Pharmacy Benefit Managers (PBMs) that they have been holding open from the first half of the year that you can close out?

- If the company analyzes prior trends, are they holding a large enough accrual for open invoices and have they compared open invoices to actual invoices received but not yet paid?

- Return Accruals. Returns is another GTN line item that can be difficult to manage if a company is not managing data sources well and leveraging benchmarks and data analytics. This is especially important as launch products start to approach lot expiry. A returns benchmark and lot analysis can improve returns balance sheet accuracy and help calculate a more accurate return reserve.

IntegriChain Customer Experience: Being able to explain the Balance Sheet

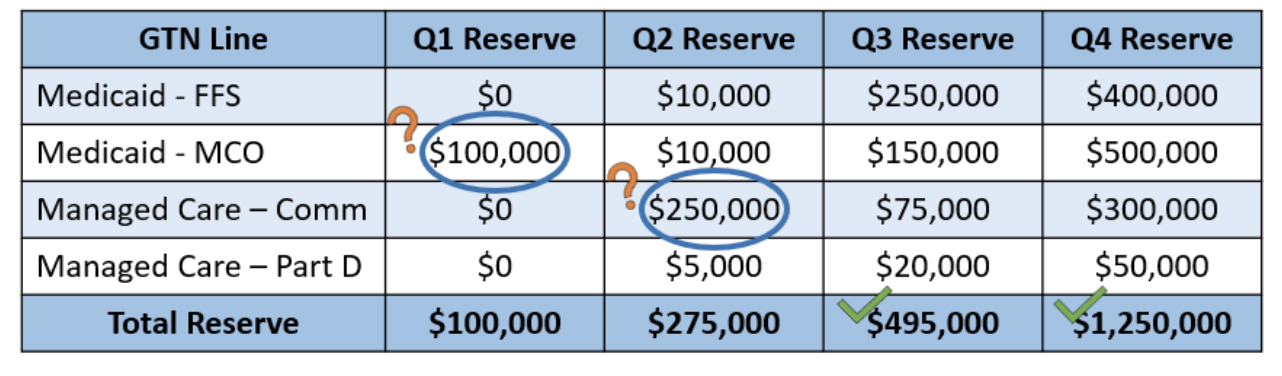

IntegriChain’s Required Reserve Snapshot is a month-by-month view of a company’s balance sheet. It allows the company to be able to see exactly where their outstanding balances lie, by earned period, by contract, and by NDC, to enable enhanced analysis. Being able to visualize their balance sheet in this manner promotes transparency that isn’t otherwise easily achieved.

Year End Audits typically demand that the balance sheet owner be able to speak on behalf of any outstanding balance left on the balance sheet. Having a detailed yet digestible report like the Required Reserve Snapshot allows the balance sheet owner to be able to isolate individual outliers that otherwise would be buried within the data. The report spells out clearly where total balances are coming from, which saves the viewer both the time and the frustration of parsing out which pieces of the data belong where, and why.

The example below is illustrative of how managing the Balance Sheet by earned period allows companies to identify outliers like the Q1 Medicaid – MCO Reserve that is still holding excess Reserve from the Q1 invoice cycle and the Q2 Managed Care – Commercial that should have been released.

Required Reserve Snapshot Helps Isolate Potential Problem Areas in a Balance Sheet

Tip 2: Have tools and resources at your fingertips to explain actual discounts/rebates compared to variances at the contract level

- Actual Invoice data by earned period. Invoice data by earned period is a key report for auditors to understand payment trends especially for rebate channels. When looking only at actual data by paid period, there are gaps in understanding what is actually open. Actual data by earned period better supports Balance Sheet analysis and an understanding of lagging claims and open invoices. The ability to provide actual invoice data by earned data and explain data trends can improve auditor conversations.

- Analysis over assumption misses (rate vs mix). Additionally, when performing analytics at year-end close of the prior year it’s important to be able to explain misses. Was an accrual over because the company expected a shift in volume that didn’t occur. Was the rate too low because the company expected a PBM contract to stay in a particular formulary tier and instead volume of business shifted to a higher tier. Having the ability to quickly dive in to rate/mix misses over the year, better supports balance sheet explanations.

IntegriChain Customer Experience: Budget vs Actual

IntegriChain’s calculations work off of methodologies called Explain Reports (ERs). These ERs direct IntegriChain’s system, ICyte, to point to specific cells of data that have been uploaded or otherwise maintained by the user. While IntegriChain has Out of the Box methodologies that are aligned with industry standards, ERs are largely customizable.

As there are endless unexpected hurdles and obstacles in the world of GTN, having a tidy and reliable reconciliation process is important to ensure that you’re not tripped up by untimely invoices and are instead appropriately prepared to absorb any deviations from plan. Depending on the frequency preference of the customer, IntegriChain undergoes a monthly/quarterly process of reviewing “true ups” and Balance Sheet Adjustments (BSAs). Any invoice that comes through at an amount different than what was originally forecast will ultimately need to be reconciled, or trued up. What this means is that there will need to be a corresponding accrual or release to align the balance sheet with the payment and accrual activity that has taken place. For example, let’s say you originally accrue $160,000 for Part D utilization for a given period but the invoices for that period come through at $180,000. IntegriChain’s system would automatically flag a true up amount of $20,000. The balance sheet owner would then need to accrue an additional true up value of $20,000. The additional $20,000 that came through in the invoice will flatten against true up leaving the balance sheet clean and whole. Additionally, within our application, we’d be able to identify the miss was related to a volume shift from a PBM with a lower rebate rate to a PBM with a higher rebate rate.

Tip 3: Ensure control documentation and evidence of controls is readily available

As a part of year end activities (and all monthly activities) companies should ensure all controls around the GTN process are operating as documented. Such controls may include:

- Controls around Data Integrity – A key data control is to ensure transactional data leveraged in GTN calculations is reconciled to the general ledger. This can provide evidence of completeness and accuracy of data in the GTN calculations. Companies with procedures around data reconciliation decrease their audit risks.

- Evidence of Preparer and Reviewer for GTN calculations – Preparer/review procedures may vary company to company, but it is important to keep a monthly record of the preparer and reviewer of GTN calculations. Having appropriate documentation of sign off of financials is a key GTN control process.

- Documentation of GTN Assumptions – All assumptions for the GTN close should be documented and sourced accordingly. This may be inclusive of Inventory Roll Forward analysis supporting demand and pipeline assumptions, GTN mix of business assumptions supported by analytics, and GTN discount rate assumptions supported by contracts and trend analytics.

IntegriChain Customer Experience: GTN Controls

IntegriChain adheres to SOC 1 Reporting which focuses on financial controls. Manufacturers are able to leverage IntegriChain’s SOC 1 report as confirmation that their own financial controls as they relate to GTN have been fully audited and signed off on. We deliver monthly deliverables to our customers that cover the control objectives listed in the SOC 1 guidelines. Within these deliverables, customers and their auditors are able to see that IntegriChain performs a list of controls and checks that confirm the integrity of the data that is being reviewed. Any and all assumptions and data points that are utilized within a given period’s close are agreed upon and documented for reference during audit periods.

IntegriChain adheres to SOC 1 Reporting which focuses on financial controls. Manufacturers are able to leverage IntegriChain’s SOC 1 report as confirmation that their own financial controls as they relate to GTN have been fully audited and signed off on. We deliver monthly deliverables to our customers that cover the control objectives listed in the SOC 1 guidelines. Within these deliverables, customers and their auditors are able to see that IntegriChain performs a list of controls and checks that confirm the integrity of the data that is being reviewed. Any and all assumptions and data points that are utilized within a given period’s close are agreed upon and documented for reference during audit periods.

Dive deeper into the ongoing discussion about Gross-To-Net strategies and methodologies by attending the RAC Summit, sponsored by IntegriChain. For more information and to register for the March 12 event, click here.