In the lead-up to a product launch, there are several line items that can be difficult to predict. Product returns and inventory pipeline reserve are perhaps the most difficult, as well as a critical component of gross-to-net (GTN) balance sheet reserves, as they account for the GTN liability related to product units on hand throughout the distribution channel at any month close.

Here is an overview of the importance of returns and inventory pipeline reserve management and some of the challenges pharmaceutical manufacturers face when incorporating this data into the GTN process:

Calculating Returns Accrual Estimates

When it comes to returns, it’s a good idea to find a commercialization partner that can create returns analogs. The industry has decades of returns data that you can leverage when calculating a returns reserve. Lot/batch detailed returns analyses are more accurate but can prove to be an extremely time-consuming and manual process.

Ideally, a returns analog of a comparable product will provide you with a good basis to predict anticipated returns. It is also a good practice to benchmark your product to those with similar delivery criteria. For example, choosing another self-injectable, cold-storage product as an analog can be useful, even if that product treats something dramatically different than your product. The type of product and delivery that will mostly drive the likelihood of returns, and being able to have supporting documentation for the auditor is the gold standard for returns.

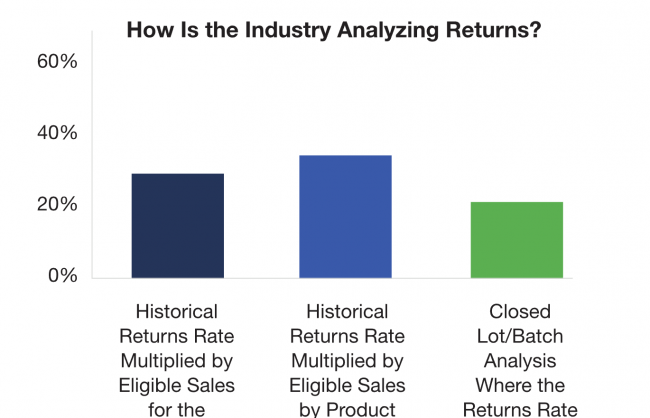

In fact, according to IntegriChain’s 2021 internal Gross-to-Net Benchmark Survey Report, there is no one way the industry has standardized on analyzing returns data.

Inventory Reserve Estimates

Unless you drop ship your product, every manufacturer requires an inventory pipeline reserve. Think of it as a “rainy day” reserve. If a company were to stop manufacturing for whatever reason, the inventory on hand at distributors, institutions, pharmacies, etc. would keep flowing to patients and trigger GTN discounts. The GTN discounts related to this inventory are calculated and an inventory pipeline reserve is established and managed each month.

There has been an ongoing dialogue in the industry related to what GTN rates to apply to this inventory pipeline reserve. The inventory on hand at the end of the month will flow to the patient in the next month; therefore, it is a popular practice to leverage the GTN rates of the month to come. However, forecasting the GTN rates of the month to come or not calculating a reserve opens your business up to auditor examination. This is why the majority choose to use GTN rates of the month they are closing.

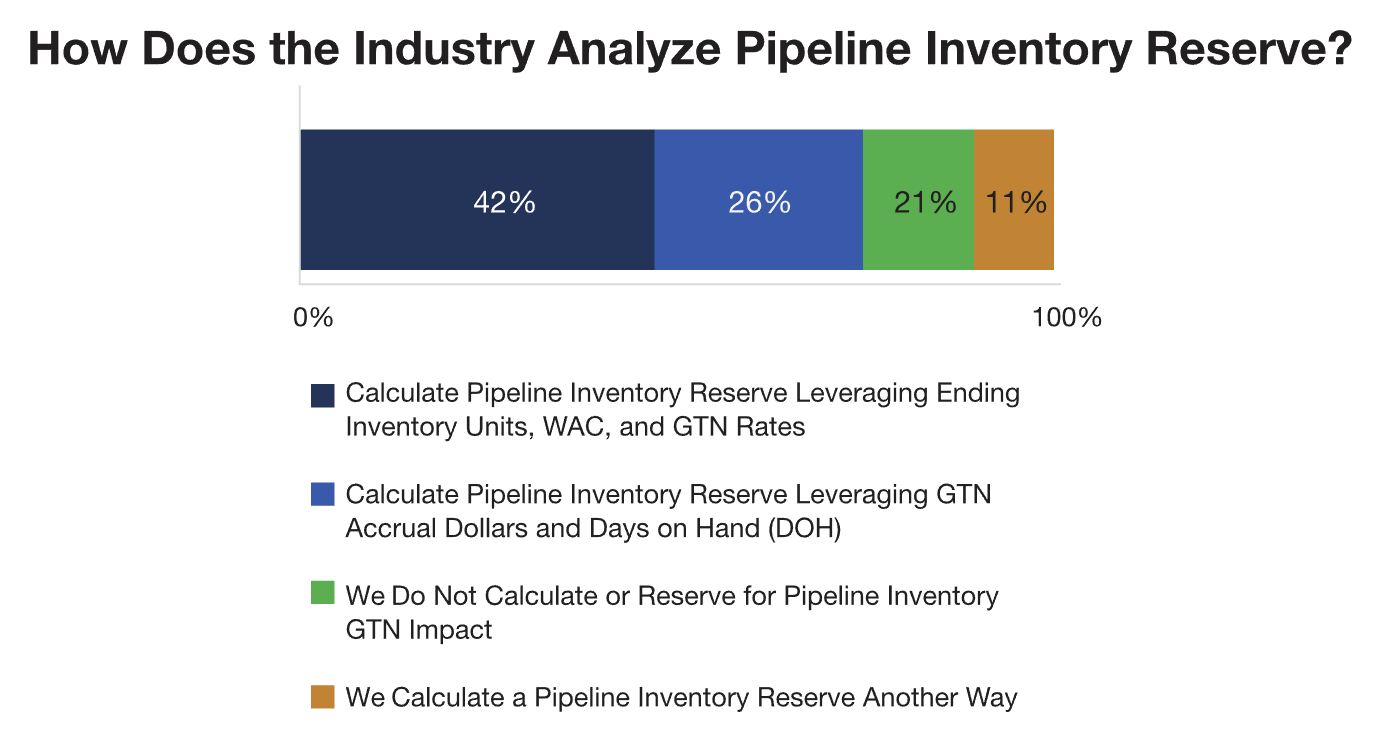

IntegriChain’s Gross-to-Net Benchmark Survey Report, reflected that manufacturers calculate pipeline inventory reserves in several ways, with 21% not calculating reserve for pipeline inventory GTN impact at all.

If you’re interested in taking a deeper dive into returns and inventory reserve methodologies and many other financial topics, I invite you to join in the conversation at the Revenue Analytics Collaborative.

About RACollab:

Sponsored by IntegriChain, the mission of the Revenue Analytics Collaborative is to facilitate timely and anonymous knowledge sharing amongst Life Sciences industry colleagues working in Commercial Contracting, Government Pricing, Gross-to-Net, and Trade/Channel business and financial roles.