Editor’s Note: This month, we offer updates on three topics: Medicaid Best Price Proposed Rule, PBMs, Opportunities and Complexities. As always, if you have questions on any of the content found in this or previous market updates, please reach out to your IntegriChain Consulting Lead or consulting@integrichain.com and we would be happy to talk you through it.

Table of Contents:

- Medicaid Best Price Proposed Rules

- PBM Market Dynamics Update

- New Stakeholders Create Both Opportunity and Complexity

Medicaid Best Price Proposed Rule: A Paradigm Shift in Best Price Determination

On May 26, 2023, the Centers for Medicare & Medicaid Services (CMS) unveiled a pivotal Proposed Rule within the framework of the Medicaid Drug Rebate Program (MDRP). Titled “Medicaid Program: Misclassification of Drugs, Program Administration and Program Integrity Updates Under the Medicaid Drug Rebate Program,” a large portion of this Medicaid best price rule adheres to routine regulatory adjustments and is an embodiment of pre-existing CMS guidance. Yet embedded within is a groundbreaking proposal set to redefine pharmaceutical industry standards.

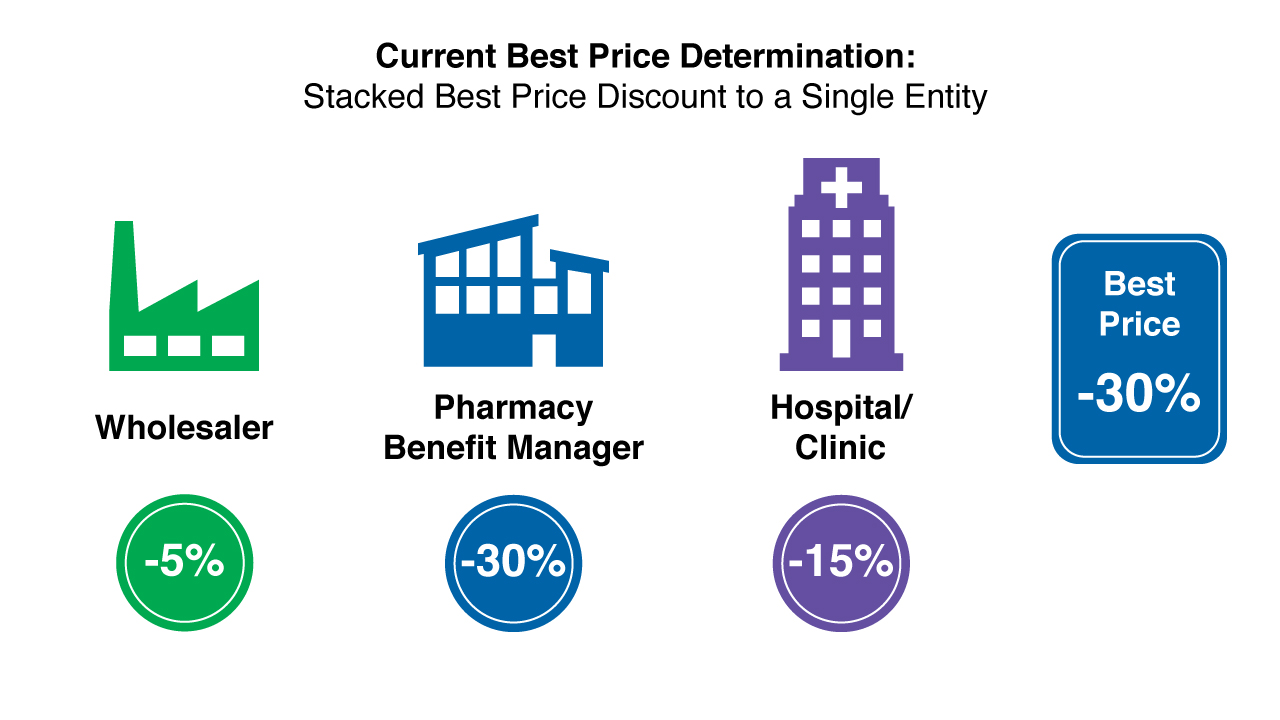

The heart of the matter is the determination of the “Best Price” for single-source and innovator multiple-source drugs. Historically, for more than three decades, the Medicaid statute and the corresponding regulation, §477.505(a), define Best Price as “the lowest price available from the manufacturer during the rebate period to any” Best Price eligible entity for the same product unit. As elucidated in the Sheldon v. Allergan case by the Fourth Circuit, when multiple concessions are extended on the same unit to distinct entities, they aren’t aggregated.

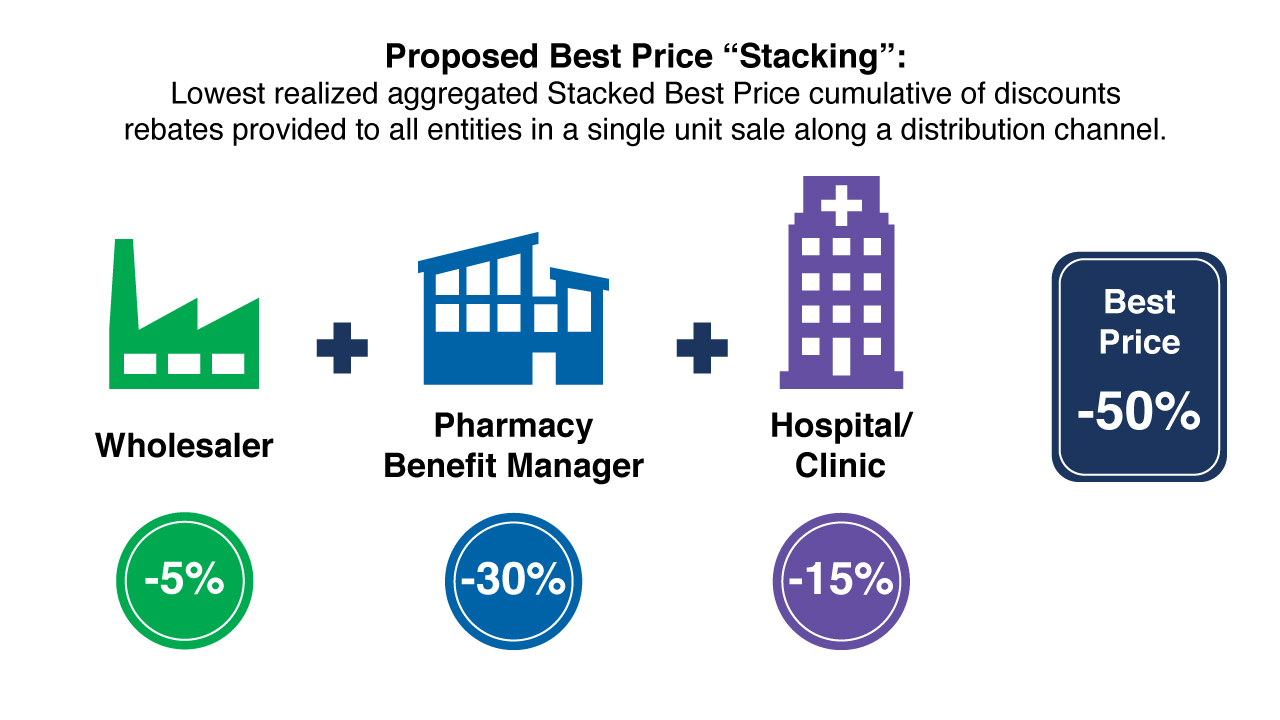

The new proposal, however, seeks a dramatic reorientation. It mandates manufacturers to “follow the pill,” “stacking” all rebates, discounts, or other price concessions imparted to any Best Price-eligible entity throughout the supply chain into one unified Best Price, irrespective of whether the concessions recipients are completely independent. The proposed revision of §477.505(d)(3) paints a picture of the newly perceived Best Price by emphasizing the lowest price “realized by the manufacturer.”

Not only would the financial repercussions to pharma manufacturers be significant, but they would also face a logistical challenge as current systems are designed to track discounts and rebates by single customer sales transactions, not by “following the pill.” Aligning with the new rule will demand considerable operational changes.

Pharma Manufacturer Considerations

Document Assumptions: Manufacturers should meticulously record assumptions related to their capacity to monitor discounts throughout the supply chain, given the new stacking requirements.

Statutory Inconsistencies: There exists a substantive claim that the altered regulatory definition diverges from the clear interpretation of the statutory definition, considering the historical practices.

CMS contends that the proposal serves as both a clarification of its existing policy and a response to the Sheldon case, which spotlighted ambiguities in CMS’s stacking requirement. However, should CMS cement this proposal into regulation, manufacturers might be primed for legal contention as the clarity and alignment of the new rule clashes with established historical norms.

References:

- https://www.govinfo.gov/content/pkg/FR-2023-05-26/pdf/2023-10934.pdf

- https://public-inspection.federalregister.gov/2023-10934.pdf

- https://www.ca4.uscourts.gov/opinions/202330.P.pdf

PBM Market Dynamics Update

Since our last update in July from IntegriChain Manager Michael Gorokhovsky, pharmacy benefit managers (PBMs) continue to garner focus from legislators, while the changing healthcare landscape is resulting in shifting market dynamics. Legislators have been looking to increase financial transparency, improve drug access, and limit practices that are suspected to drive up payer costs. Meanwhile, PBMs are capitalizing on the rapidly growing specialty market. Some of these quick highlights are described below.

PBMs and Legislators

July 20, 2023: The Federal Trade Commission (FTC) voted to withdraw prior advocacy for limited PBM transparency (FTC Statement: July 20th). The withdrawal for prior advocacy aims to begin unraveling the rapidly changing middleman industry and to get ahead of the eagerly anticipated results of the ongoing inquiry into the Prescription Drug Middlemen Industry, which started on June 7, 2022.

Prior advocacy dating from 2004 to 2017 for limited commercial practice transparency was founded on facilitating healthier market competition. However, this has since been withdrawn based on determinations that the current market dynamics are no longer equivocal to those conditions for the existing stance. The changing dynamics reference the large scale at which PBMs have become vertically integrated with the healthcare market, such as upstream integration with payers and downstream integration with different varieties of pharmacies.

The Commission aims to counteract the habitual reliance on prior work when PBM advocates are engaged in opposition with lawmakers, enforcers, and regulators. These engagements are an ongoing battle within the pharmaceutical market as Congress attempts to address healthcare spending. (Read more at Pharma Drug Costs – House Hearing.)

For more detailed information, see the statements below, which pose examples of how the current FTC investigation is reviewing and considering the behind the scenes effects middlemen have on drug prices and government payers.

PBMs and Market Dynamics

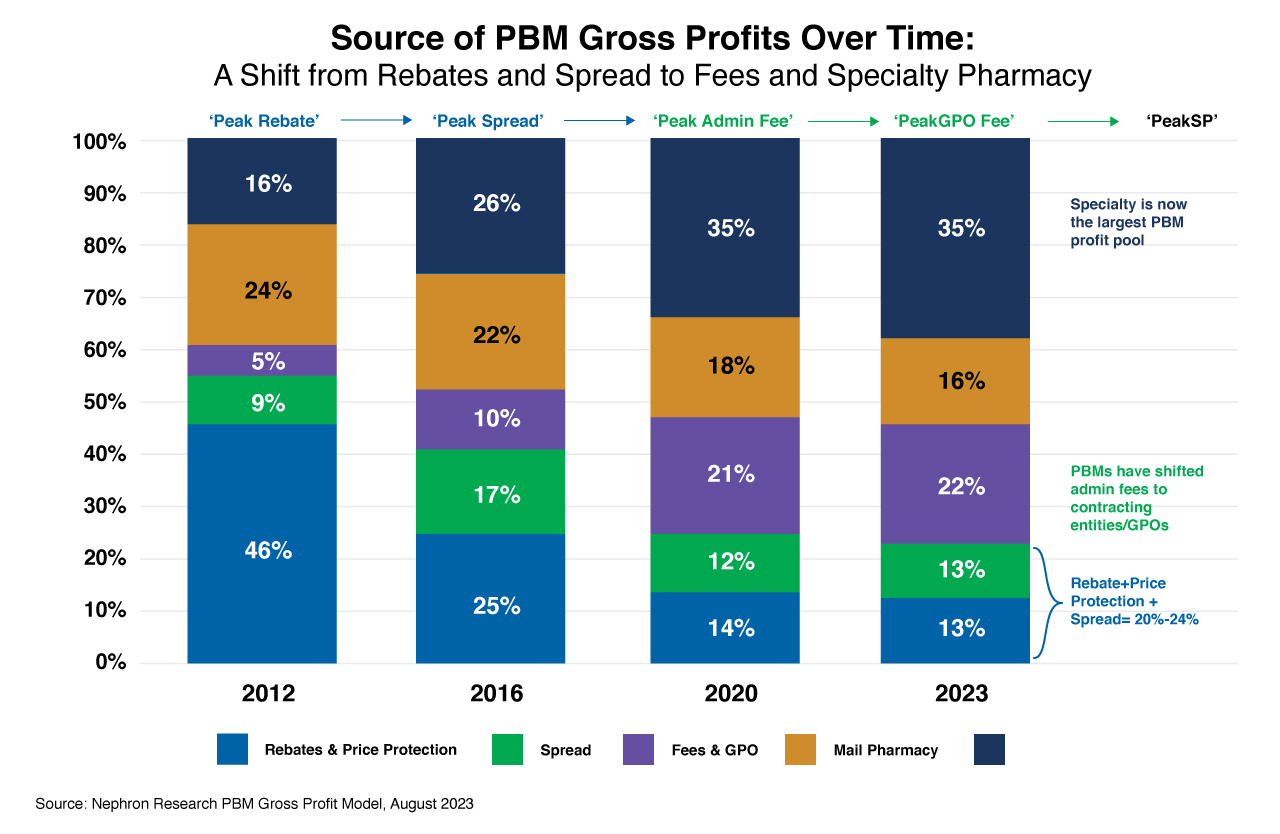

In line with the FTC’s redaction of prior PBM guidance – on the grounds that market dynamics have evolved in the past decade – Nephron Research published an analysis in September that highlights and describes some of these changes. A figure is extracted below that summarizes the changing revenue streams for PBMs over time.

Key Takeaways

As rebates and price protection declined, specialty pharmacies (SPs) now make up the majority of PBM revenue. The following fees make up the revenue:

- SP dispensing fees, manufacturer invoice discounts

- SP clinical program fees

- SP data fees

- Copay maximizer retention and admin fees and 340B contract pharmacies

- Novel compensation methods are also resulting from data and data portal fees

In summary, the FTC is calling for greater transparency and investigating the impact middlemen have on the price of drugs and their aggregate costs to payers and patients. The call for transparency stems from rapidly evolving PBM commercial practices. Practices have shifted from heavy reliance on rebates and price protection to specialty pharmacy revenue and growing novel revenue sources through data management and contracted entities. With healthcare spending continuing to rise amidst an always-changing commercial landscape, IntegriChain can help you stay informed on the results of the FTC investigation to be prepared for any potential future legislation and subsequent impacts.

[1] The full list of documents and stances the FTC withdrawals support can be found below.

References:

New Stakeholders Create Both Opportunity and Complexity

Those of us who have been working in the pharma and biotech space for a number of years are very used to thinking about the Big 3 wholesalers, the major PBMs, and the big retail chains. Vertical integration and consolidation across channels have been leading us down a path for years where fewer stakeholders have a bigger influence over the access and distribution of drugs. Over the past few years, however, many small and upstart organizations have been popping up left and right. It feels a little like the big bang… our channels have contracted so much that they are now exploding with small, nimble organizations eager to take advantage of opportunities on which the much bigger legacy organizations have been slower to capitalize.

In the distribution space, we have new specialty distributors that are eager to serve as alternatives to increasingly expensive traditional wholesalers, sometimes focusing on niche disease categories (e.g., anovo, BioCare SD, Optum Frontier Therapies,). In the GPO space, we have organizations that are focusing on a more narrow set of organizations, such as hospice or community care providers (e.g., AllyGPO, Specialty Networks, Asembia). The pharmacy space has been changing in a huge way, with waves of new pharmacy models emerging to fill major gaps presented by retail pharmacies increasing preference for generics and traditional specialty pharmacies struggling to maintain margins. A variety of technology-enabled hubs, digital pharmacies, and cash pharmacies are creating a web of new players in the space that can be overwhelming to navigate (e.g., ASPN Pharmacies, GoodRx, BlinkRx). Even on the health plan and PBM front, we are seeing new market entrants with specific value propositions, such as offering a fee-for-service model that is a stark difference from the traditional PBMs fee structure that is directly tied to WAC (Oscar, Bright Health Group, RxPreferred, Clover Health).

It’s imperative for pharma professionals to be aware of the multitude of new organizations as they present new options for commercialization and patient access. At the same time, these organizations and the associated contracting approaches create new operational and compliance complexity, as manufacturers must evaluate how these organizations, contracts, price concessions, and service fees impact government price reporting, gross-to-net, and contract operations. As always, IntegriChain is standing by to help you navigate the ever-evolving pharma landscape.

As always, IntegriChain continues to support pharma manufacturers in breaking down and staying ahead of new regulations. If you have any questions or concerns, please reach out to us at consulting@integrichain.com.