Regulatory Market Updates on High Pharmaceutical Product Prices

As always, if you have questions on any of the content found in this or previous market updates, please reach out to your IntegriChain Consulting Lead or advisory@integrichain.com and we would be happy to talk you through it.

Comprehensive Plan for Addressing High Pharmaceutical Prices

Last month the Biden Administration released their plan to combat “high drug prices.” What exactly does the plan cover, and what could be in store for manufacturers and other players within the industry? Let’s break down more information about the proposed plan:

Medicare Part B and D Pharmaceutical Product Pricing Extension

One of the biggest possible impacts to the current workings of the entire pharmaceutical industry is a proposal that would allow the Secretary of Health and Human Services (HHS) to negotiate Medicare Part B and D drug prices directly with manufacturers and extend that same pricing to commercial plans. This would effectively create a nationwide price ceiling for many drugs that currently attain their pricing through statutorily defined calculations based on higher commercial drug prices. The impact here could obviously be quite large, but we are currently in the dark when it comes to the details of the proposal; so full impact is hard to gauge presently. The plan specifically would allow for negotiations in pursuit of a “fair” price for “high priced drugs for which there are no competitors.” How this would be accomplished is not clear, as the plan only lays out the use of unspecified “tools.”

Biden’s plan to combat high drug prices in the Part B and D space includes the possible introduction of an inflationary penalty for drugs that raise pricing faster than inflation. Again, no specifics were mentioned but we can probably expect to see the use of an inflationary index akin to those used in Unit Rebate Amount (URA) calculations within the MDRP. Absent from the plan, however, was any mention of the launch price of higher-cost drugs. Which could mean that launching at a higher price, rather than taking more regular price increases, could allow manufacturers to step around this new penalty.

Most Favored Nations (MFN) Model

International price benchmarks have been introduced as part of H.R.3, back in 2019, but were absent from Biden’s plan. This aligns with the CMS proposed rule that would officially rescind the Most Favored Nations (MFN) Model that the previous outgoing administration hastily added on their way out of office in 2020, and was enjoined in the courts shortly afterward. Combined with the lack of mention in the proposed plan, we can safely assume that this model is not very favorable to moving forward.

Value-Based Payment (VBP) Models

Value-Based Payment (VBP) models have also been a hot topic in the industry lately and did not escape mention in Biden’s plan. While no specifics were mentioned again on the ‘how,’ Biden’s plan does call for “models using value-based payments in Medicare Part B, in which payment for drugs is directly linked to the clinical value they provide patients.” VBP models have been slow to adopt as they require complex data gathering and analysis to achieve. The plan made no specific mention of how these federal models may work, but we could expect to require some additional level of clinical data in the coming years to comply.

Pharmacy Benefit Manager (PBM) Changes

The White House’s plan also took aim at the safe harbor treatment PBM’s currently enjoy. This removal of status would open them up to federal anti-kickback law prosecution and could mean the passing on of several rebates, currently solely enjoyed by PBM’s, to the Medicare beneficiary at their local pharmacy.

Handling Pharmaceutical Pricing Strategies and Laws

All in all, Biden’s plan is shaping up to enact some rather large changes to the current landscape. Luckily, IntegriChain is well equipped to handle all of this changing legislation in real-time. If you have any questions or concerns about the current Administration’s plans and what it could mean for your company, please feel free to reach out to our Consulting Team at advisory@integrichain.com.

If you’d like to see what Integrichain can do to help you with your pharmaceutical pricing strategy, visit our Government Pricing page.

Source: Report to the White House Competition Council

Public Law Reporting Cycle

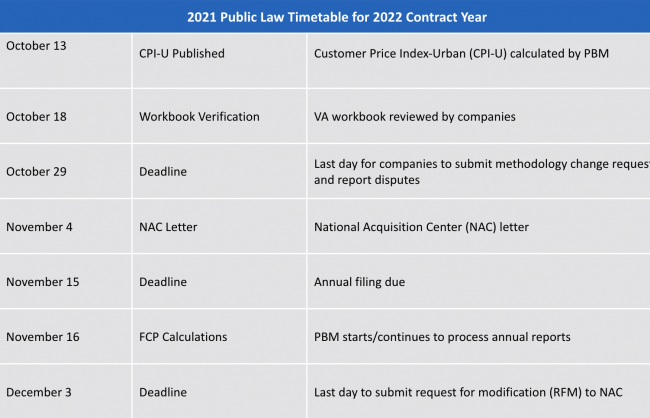

The Office of Pharmacy Benefits Management Services (PBM) is responsible for maintaining calculated federal ceiling prices (FCPs) for covered drugs through the Public Law annual reporting process. All companies of covered drugs are obligated to comply with the reporting requirements under Public Law 102-585, also referred to as the Veterans Healthcare Act of 1992. This Act requires companies to report annual non-Federal Average Manufacturer’s Price (non-FAMP) calculations for covered drugs. The timeline for Public Law reporting is shown in the table below:

CPI-U

The Bureau of Labor Statistics (BLS) publishes a wide variety of measures of consumer price change, each with different market baskets that are used to calculate average price change across items and cities. A Consumer Price Index (CPI) is a weighted average of price change for a market basket of consumer goods and services. One measure of price change is the CPI All Urban Consumers (CPI-U). This measure is what most media outlets refer to as consumer inflation. The CPI-U that was recently published shows a 5.4% increase between September 2020 and September 2021. This means companies will be able to take modest price increases without triggering any inflation penalties that would have otherwise been in place without this increase.

Sources:

Measuring consumer price change during economic downturns

Consumer Price Index for All Urban Consumers

P.L. 102-585 Regulations & Guidance

MA and Part D Contracting for the 2022 Plan Year

Between January 14 and 15, 2021 the CMS finalized the CY 2022 MA and Part D rule and the CY 2022 Request for Applications (RFAs) for the Part D Senior Savings Model as well as the Part D Modernization Model. Since many customers have asked about these new guidelines, we’ve created some bullet points for areas that are most likely to impact manufacturers.

Specialty Tier Changes:

- The specialty tier threshold for 2022 rose from $670 to $830

- January 15, 2021, CMS finalized CY 2022 MA and Part D rule, which allows Part D plans to implement a second specialty tier with lower cost

- The current maximum cost ranges from 25%-33%

- This change may impact out-of-pocket costs for enrollees in plans with two specialty tiers

CY 2022 Center for Medicare and Medicaid Innovation (CMMI) Demonstrations

New changes and new formulary flexibility for the CY 2022 Part D Modernization Model include:

- The ability to waive two significant Part D program requirements:

- Mandatory coverage of all or substantially all drugs in the six protected classes

- Inclusion of at least two drugs per class

- CMMI postponed waiving mandatory coverage of antiretrovirals until 2023

These new changes will directly impact beneficiaries taking drugs in the six protected classes.