Editor’s Note: This month, we offer updates on four significant regulatory topics and advice to pharmaceutical manufacturers on steps they should consider now and in the coming months. As always, if you have questions on any of the content found in this or previous market updates, please reach out to your IntegriChain Consulting Lead or consulting@integrichain.com and we would be happy to talk you through it.

Table of Contents

I. The Inflation Reduction Act and the Impact on Research and Development

II. OIG Studies on Average Sales Price

The Inflation Reduction Act and the Impact on Research and Development

As the pharmaceutical industry has had time to assess the regulations and impact of the recently passed Inflation Reduction Act (IRA), many companies and investors have expressed grave concerns about the potentially large impact the statute has on R&D. There is no secret that lawmakers are attempting to lower drug prices to facilitate access and affordability for patients, but will this increased financial pressure on manufacturers have an effect of also decreasing the investment in and availability of new drugs for both common and rare disease indications? Below we take a look to uncover some of the main Inflation Reduction Act questions and concerns about the tax credit and R&D, coming from the industry leaders and investors.

First, many pressing questions and concerns around the introduction of Maximum Fair Price (MFP) stand out across the pharmaceutical industry. MFP is a price point that is set by the Secretary of the Health and Human Services (HHS) during Medicare drug price negotiations with the manufacturer for the highest cost drugs under Medicare Parts B and D. Manufacturers have looked to understand the impacts of government involvement with drug price setting across various countries and the research highlights delays in innovation and market access to be the most concerning downstream impact. For example, a study suggests that drugs are available in Europe on average 403 days after the US (range 17-1187 days). Another study suggested that in countries with price setting measures, just half of the medicines launched since 2012 are available compared with 85% in the US. Certainly there are other factors that can influence these observations, but considering the much lower price points offered in Europe, we can see how innovation and market access can be directly affected by the reduced revenue potential.

In addition, two eligibility criteria for the MFP are also drawing large amounts of criticism and concern

- Small molecule drugs are eligible for MFP after only nine years of patent exclusivity

- A drug can only receive one orphan designation.

Regarding small molecules, healthcare investors sent a letter to Congress emphasizing the potentially detrimental act of placing small molecules under nine years of patent exclusivity prior to MFP negotiations vs. biologics, which are provided 13 years of exclusivity. Investors claim that reducing cost recovery to only nine years contradicts the intentions of the Hatch-Waxman act and leave investors having to shift investment away from small molecules. The Hatch-Waxman act allowed manufacturers to extend patent life after lengthy clinical trials, as patents are filed in early development, well before clinical trials begin. Among many implications cited in the letter, a reduction of four years of exclusivity compared with 13 for biologics makes drug investment for small molecules much less attractive over an already long-term, high risk investment.

Related to orphan designation, the drug status was created for drugs with low patient populations and a high unmet need with associated economic incentives for manufacturers. Assuming effectiveness in other diseases, these incentives can be maintained by additional orphan drug designations and allow for the cross pollination from one orphan disease to another. However, the IRA only excludes orphan drugs with a single indication for MFP negotiations, so investors argue that the regulation offers the wrong incentives for manufacturers to limit the number of potential indications, which is more likely to harm prospective rare disease patients.

To summarize, investors and manufacturers are already forecasting large cuts to R&D programs after the release of the healthcare reforms in the Inflation Reduction Act. R&D/innovation and market access are the resulting impacts to the establishment of a MFP with implications for small molecule and orphan drug investment. Investors and CEOs have weighed in and discussed the need to cut R&D spending as a result of the IRA. Looking forward, close attention should be paid to how these critiques are addressed in Congress.

References

- National Library of Medicine

- PhRMA analysis of IQVIA MIDAS and U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), Japan Pharmaceuticals and Medical Devices Agency (PMDA), Australia Therapeutic Goods Administration (TGA) and Health Canada data. July 2022. Note: New active substances approved by FDA, EMA and/or PMDA and first launched in any country between January 1, 2012 and December 31, 2021.

- PhRMA Letter to Congress

- Life Science Leader: Big Pharma CEOs discuss Collaboration, Talent, and IRA Implications and Galien Forum

OIG Studies on Average Sales Price

On January 3, 2023, the Office of Inspector General (OIG) released the results of two studies of Average Sales Price (ASP) calculations in pharma. A summary of the studies, as well as key takeaways, are noted below:

Manufacturers may need additional guidance to ensure consistent Average Sales Price calculations. In the Consolidated Appropriations Act of 2021, Congress included a provision for the OIG to review the accuracy of manufacturer-reported ASP data. Ensuring the accuracy of ASP drug pricing is vital because CMS uses ASP to calculate the payment amounts under Medicare Part B directly.

Key Areas Addressed

- The OIG identified a number of inconsistencies in manufacturer ASP pharma calculations, among which include the treatment of TRICARE-related drug sales and whether certain fees paid to third parties meet the criteria for being considered Bona Fide Service Fees, which are excluded from the ASP calculation

- Some manufacturers requested additional CMS guidance on the treatment of sales and rebates offered through value-based purchasing agreements

- Manufacturers expressed concerns that CMS has not published robust regulations and guidance on the calculation of ASP, as compared to AMP or Best Price. They must, therefore, rely upon reasonable assumptions to a much greater degree than when calculating AMP or Best Price.

Recommendation

The OIG recommended that CMS actively review guidance related to the calculation of ASP. CMS agreed with this recommendation and has stated that it will begin reviewing the current guidance and determine whether additional guidance is necessary.

Reference

CMS Should Bolster Its Oversight of Manufacturer-Submitted ASP Data to Ensure Accurate Part B Drug Payments

Gaps and limitations in CMS’s oversight of ASP may continue to limit its ability to ensure the accuracy of data, leading to inaccurate Part B payment amounts.

Key Areas Addressed

- CMS has some oversight procedures to review ASP data, such as system edits in the ASP data collection system and CMS’s internal reviews of manufacturer data. However, gaps exist in the oversight process and CMS is not able to fully provide oversight into manufacturer-reported ASP. Therefore, potential inaccurate manufacturer-reported calculations may be impacting Medicare Part B payment amounts.

- CMS’s procedures also do not include checks to ensure the accuracy of the manual processes it uses to analyze data used to calculate Part B payment amounts. CMS also does not use its ASP data collection system to produce analytical reports that would monitor ASP data quality.

There are several reasons CMS could not calculate ASP-based payment amounts including:

- The manufacturer reported a negative sales or ASP value

- The manufacturer had no sales to report for that quarter

In total, it was found that 24% of drug codes were missing ASP data for one or more specific drugs between 2016-2020.

Recommendation

The OIG recommends CMS build a better strategy by implementing new additions to their oversight procedures to reduce the likelihood of errors in collecting ASP data. This will help ensure the accuracy of Part B drug payments. CMS agreed with the OIG’s recommendation and will work on enhancements to the current ASP calculation system and its internal processes.

Reference

Military Family Members and Retirees’ Medical Services Will Be Moved from DoD Service System in 2023

As reported by Military News, Congress has reportedly approved a Pentagon decision to move as many as 200,000 non active-duty military beneficiaries from treatment in Military Treatment Facilities (MTFs) to civilian health providers. Most of these beneficiaries are military retirees and their families.

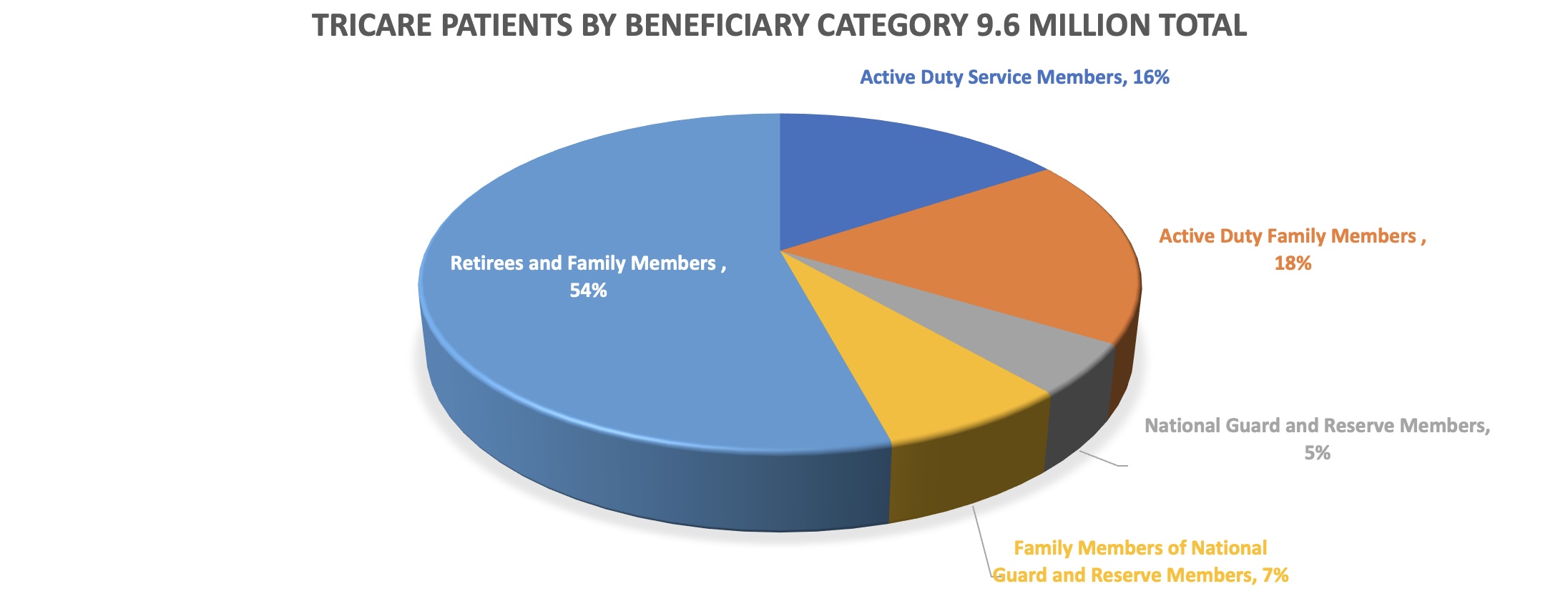

In an effort to continue cost savings, DoD is limiting medical care to only active-duty patients (which comprise approx. 16% of military medical beneficiaries) in on-base, outpatient clinics in areas where there are sufficient civilian health care services to absorb the additional patients. Additionally, approximately 30 military treatment facilities across the country are being closed to non-active-duty patients or closed entirely. Of course, many military retirees already receive their medical care through civilian TRICARE channels and/or use the Express Scripts Tricare mail-order pharmacy program.

Manufacturer Considerations

As a result, pharmaceutical manufacturers that sell military pharmaceuticals to MTFs may start to see a reduction in MTF sales for outpatient drugs and possibly a commensurate increase in Tricare Retail Refund Program (TRRx) rebates.This is because prescriptions previously filled in MTFs would then be filled in community pharmacies that would be captured in TRRx rebate invoices.

References

- Military.com – Here’s the List of Military Clinics That Will No Longer Serve Retirees, Families

- Military.com – 155,000 Military Health System Patients to Be Pushed to Civilian Care Starting This Year