Editor’s Note: This month, we offer updates on two significant regulatory topics and advice to pharmaceutical manufacturers on steps they should consider now and in the coming months. As always, if you have questions on any of the content found in this or previous market updates, please reach out to your IntegriChain Consulting Lead or consulting@integrichain.com and we would be happy to talk you through it.

Table of Contents

I. FDA Set to Continue Applying Orphan-Drug Exclusivity Regulations in the Wake of Catalyst Decision

II. 2022 Employer Health Benefits Survey Results – Kaiser Family Foundation

FDA Set to Continue Applying Orphan-Drug Exclusivity Regulations in the Wake of Catalyst Decision

The Orphan Drug Act of 1983 is a US law that provides financial incentives for pharmaceutical companies to develop and market drugs to treat rare diseases that affect fewer than 200,000 people in the US. These incentives include tax credits, grants for clinical research, and a seven-year period of market exclusivity, during which time no other company can sell a drug for the same indication. This orphan-drug exclusivity period is intended to provide companies with a financial incentive to invest in the development of drugs for rare diseases, which might not be profitable without these incentives. In some cases, the exclusivity period might be extended for an additional six months if the drug is approved for use in pediatric patients.

The Food and Drug Administration (FDA) has announced that it will continue to apply its existing regulations regarding orphan-drug exclusivity – tying the scope of orphan-drug exclusivity specifically to the uses or indications for which a drug is approved. The notification follows a recent decision by the US Court of Appeals for the Eleventh Circuit in Catalyst Pharms. Inc. v. Becerra, which challenged the orphan-drug exclusivity provision of the Federal Food, Drug, and Cosmetic Act.

The announcement came after a court case involving Jacobus Pharmaceuticals and Catalyst Pharmaceuticals in which each had an orphan-drug designation to help treat Lambert-Eaton myasthenic syndrome (LEMS). In November 2018, the FDA approved Catalyst’s drug for LEMS in adults and then in May 2019, the FDA also approved Jacobus’ drug for LEMS in children. In approving Jacobus’ drug, the FDA argued that it followed its longstanding rule, codified in its regulations, that the orphan-drug exclusivity for Catalyst’s drug protected only the approved use or indication within the designated disease. Catalyst filed suit against the FDA, challenging the approval of Jacobus’ application under the Administrative Procedure Act. Jacobus argued that the phrase “same disease or condition” in the Orphan Drug Act unambiguously prohibited the FDA from approving its drug application and that the Orphan Drug Act required orphan-drug exclusivity to extend to all uses or indications within the orphan-designated disease or condition, even uses or indications for which Catalyst had not received approval, such as the treatment of LEMS in children.

The court held that orphan-drug exclusivity for Catalyst’s drug blocked the FDA’s approval of Jacobus’ drug for all uses or indications within the orphan-designated disease, even though Catalyst’s drug was approved only for use in the treatment of LEMS in adults at that time. The court concluded that the FDA’s approval of Jacobus’s drug for the treatment of LEMS in children must be set aside, and the FDA complied. The FDA has recently announced that, outside the scope of the court order, it intends to continue to apply its existing FDA regulations tying orphan-drug exclusivity to the uses or indications for which a drug is approved.

While the FDA has set aside its approval of Jacobus’ drug in response to the Catalyst decision, it will continue to apply its regulations tying the scope of orphan-drug exclusivity to the uses or indications for which a drug is approved in matters beyond the scope of that court order. The FDA believes that this approach is appropriate.

The FDA’s statement is likely to be welcomed by pharmaceutical companies that hold orphan-drug designations as it confirms that the agency will continue to apply its existing regulations in most cases. It also provides clarity on how orphan-drug exclusivity will be handled going forward.

References

- Federal Register: Clarification of Orphan-Drug Exclusivity Following Catalyst Pharms., Inc. v. Becerra

- Justia US Law Opinion Summary

2022 Employer Health Benefits Survey Results – Kaiser Family Foundation

Every year, the Kaiser Family Foundation (KFF) conducts an Employer Health Benefits Survey, which provides a detailed outlook into the trends that shape employer-sponsored health coverage. In its 24th edition, conducted between February and July 2022, KFF surveyed private and non-federal public employers and received a response from more than 2000 randomly selected employers. This blog outlines some of the key highlights from the survey.

Health Insurance Premiums

In 2022, employer-sponsored health insurance averaged $7,911 for single coverage and $22,463 for family coverage, which paints a picture very similar to 2021. As there was only a marginal increase in average premiums in 2022, it is likely to impact the cost of premiums in 2023 owing to rising inflation rates.

Employee Contributions and Plan Enrollment

Employee premium contributions also varied based on the plans and the region. For instance, PPOs remained the most popular plan type, covering 49% of the employees that enrolled. The other common plan type was the high-deductible plan with a savings option (HDHP/SO) in which roughly 29% of the employees are enrolled. From a location perspective, the premiums for single as well as family coverage were higher for employees in the Northeast than those in the South.

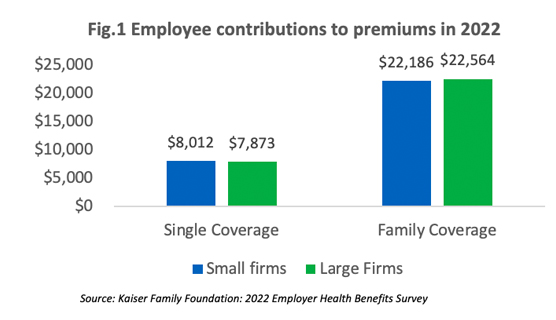

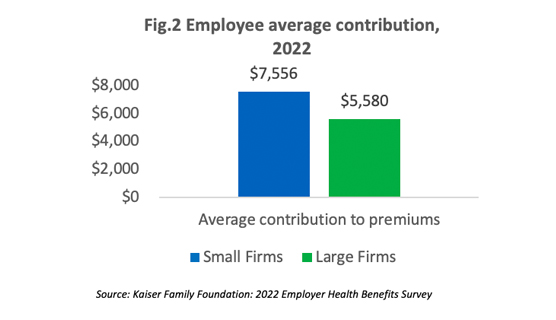

Premiums and Company Size

The survey reveals that employees at small companies and large companies pay relatively similar premiums: $8,012 versus $7,873 for single coverage and $22,186 versus $22,564 for family coverage [Figure 1]. However, if we compare the average numbers, the contribution amount for covered employees in small companies is higher than those in large companies as shown in [Figure 2].

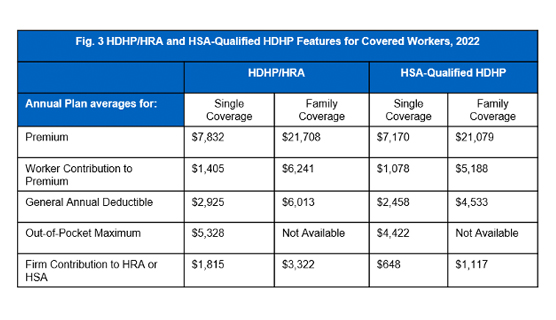

Deductibles in HDHP/SO plans

Employees enrolled in HDHP/SO plans have higher deductibles than employees enrolled in other popular plan types. On average the general annual deductible for employees with single coverage is $2,925 for HDHPs and $2,458 for HSA-qualified HDHPs. In terms of family coverage, the average turns out to be $6,013 for HDHPs and $4,533 for HSA-qualified HDHPs as shown in [Figure 3].

Cost-Sharing

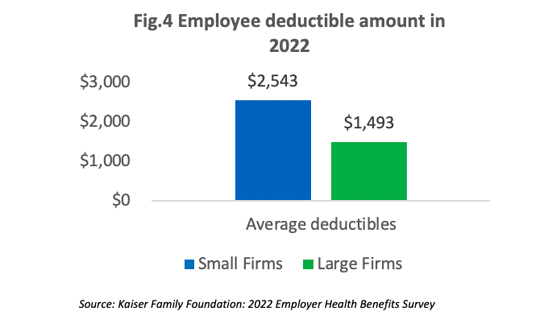

On average, employees in small companies pay a higher deductible than those in higher companies as shown in [Figure 4]. In the past five years, the percentage of employees with an annual deductible of over $2,000 increased from 22% to 32%.

Cost-Sharing Tiers

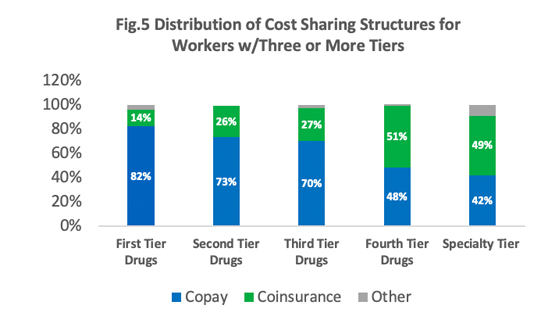

Most employees in the survey (~90%) are in a plan with a tiered cost sharing for prescription drugs. What this means is that these employees are enrolled in health plans that place drugs on a specific formulary that in turn categorizes these drugs based on different cost-sharing ratios. These categories or tiers typically include generic, preferred, and non-preferred drugs. Roughly 84% of the covered employees are in a plan that has three or more cost-sharing tiers [Figure 5]. HDHPs have a cost-sharing pattern that is different from other plans. Employees enrolled in HDHPs are more likely to be in a plan that has no cost-sharing once their deductible is achieved.

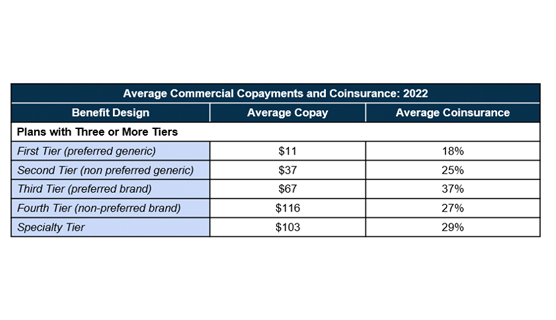

In plans with three or more tiers for prescription drugs where a majority of the employees are enrolled, copayments are the most commonly used cost-sharing and co-insurance comes a close second. As shown in the table, the higher the tier, the higher the copayment or coinsurance. The average copayment rate is $11 for generic drugs (first tier), $37 for non-preferred generics (second tier), $67 for preferred brand (third tier), and $116 for non-preferred brand (fourth tier). Average co-insurance rates also varied based on the tier: 18% for first tier, 25% for second tier, 37% for third tier, and 27% for the fourth tier.

In summary, the annual survey conducted by KFF provides important information regarding changing trends in the employers’ offering of health benefits offered by employers while at the same time pointing out differences between plans provided by small and large firms. This blog highlights employees’ choices of plan enrollment and the impact of cost-sharing based on the size of the companies in which they are employed. While the survey also highlights trends in the areas of telemedicine, health, and wellness programs, the report lays emphasis on health premiums, plan enrollment, and cost-sharing that are critical to a wide variety of stakeholders such as employers, researchers, policy experts, pharmaceutical manufacturers, as well as the general public. It is especially useful for manufacturers to engage their pharmacy benefit managers in discussions related to drug coverage based on copays, coinsurance, and plan deductibles. While not all health plans cover all types of drugs, the drug costs can vary significantly depending on the type of plan in which the employees are enrolled. This becomes a crucial piece of information to note.

References