Regulatory Market Update

Updates for Pharma Manufacturers

As always, if you have questions on any of the content found in this or previous market updates, please reach out to your IntegriChain Consulting Lead or advisory@integrichain.com and we would be happy to talk you through it.

ICYMI

Earlier this week, IntegriChain hosted a webinar on the legislative and regulatory landscape changes of state price transparency in 2022 and the implications for manufacturers.

Have you signed up for ICyte Self-Service Profiles?

These profiles will feature all your information in one centralized location and be able to provide you with up-to-date answers to common questions between your company and IntegriChain such as current account executives, contact roles and information, and the status of open issues. To opt-in, email support@integrichain.com.

Branded Pharma Fee: Manufacturer Considerations

The Branded Prescription Drug Fee (“BPDF”) was enacted with the Patient Protection and Affordable Care Act (the “Act”) and was assessed against entities engaged in the business of manufacturing or importing prescription drugs. Each company subject to the BPDF was assessed an amount based upon its relevant sales of branded prescription drugs when compared to the total relevant sales within the industry. The Internal Revenue Services (IRS) is responsible for imposing an annual flat fee on revenues starting at $2.8B (2019) on the branded pharmaceutical manufacturing sector.

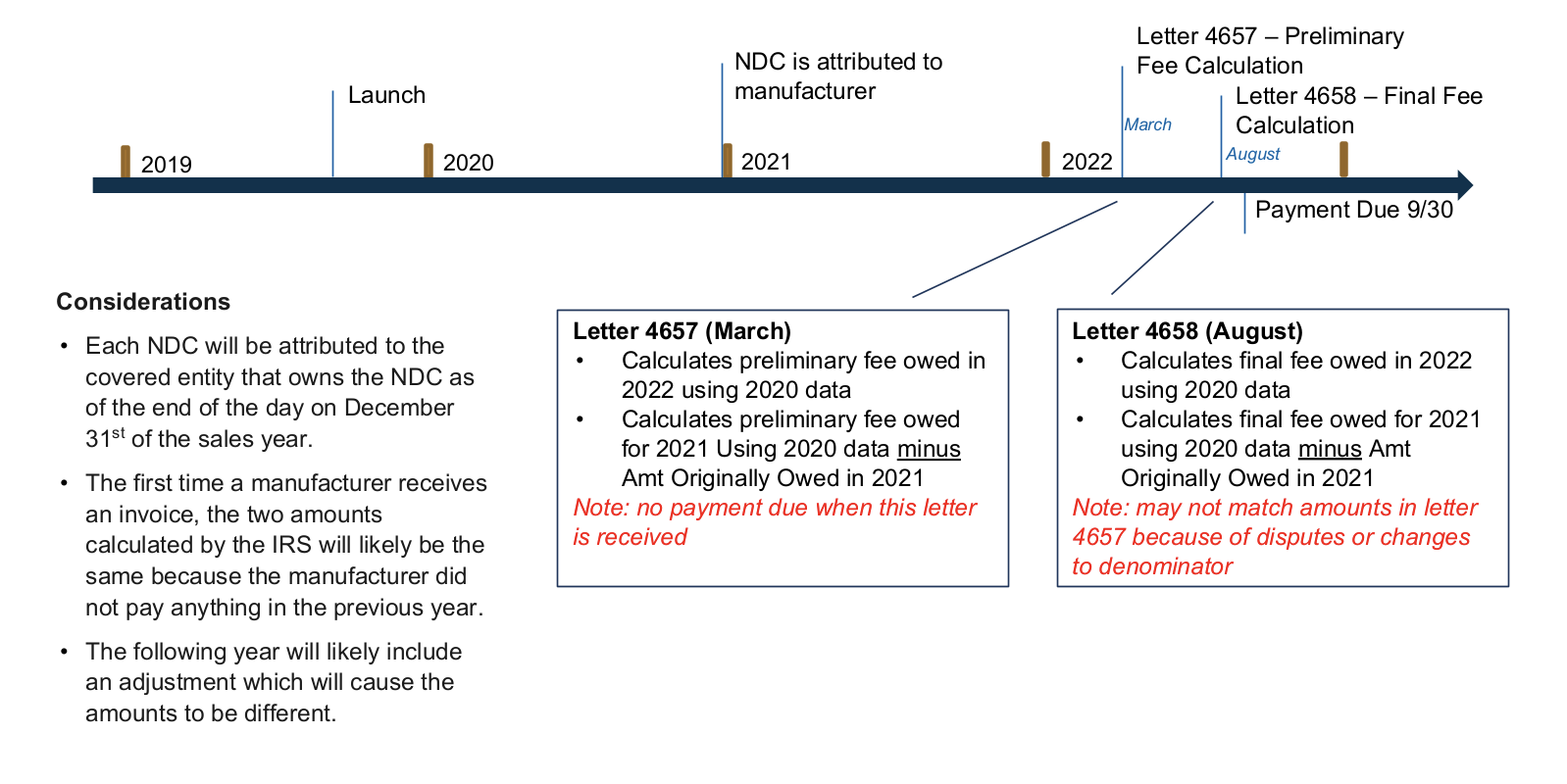

- Eligible manufacturers should expect to receive the preliminary fee calculation letter (“Letter 4657”) from IRS by March 1, 2022

- Eligible manufacturers should take action between March 1, 2022 and August 2022 to review the fee calculation and if applicable, prepare to dispute the preliminary fee before the payment due date (September 30).

Fee calculation: This non‐deductible fee would be allocated across the industry according to market share of the sale of branded prescription drugs by a covered entity during the previous calendar year for specified government programs (e.g., Medicare, Medicaid, and TRICARE) and would not apply to companies with sales of branded pharmaceuticals of $5 million or less or certain orphan drugs. Each year’s fee calculation is based on the previous year’s sales data.

Each taxpayer subject to this fee may submit a Form 8947 to provide information necessary to determine its share of the fee. The IRS will then issue a preliminary fee calculation subject to the acceptance or disagreement of the taxpayer. If the taxpayer disagrees with the preliminary calculation, it must do so in writing before approximately mid-May of the year of receipt of the preliminary calculation. The IRS will review such disputes and issue a final fee calculation by approximately August 31st of the same year.

It is important to note the fee can be waived for manufacturers of orphan drugs as long as they had previously requested and filed an “Orphan Tax Credit” via tax form 8820 (indicating the expenses incurred related to rare disease/orphan drug designation). If this was not filed at the time the expenses were incurred, manufacturers should work with their tax accountant to ensure they file an amendment to the return to submit the Orphan Drug Credit in order to get the waiver for the Branded Pharma Fee.

Eligible manufacturers can anticipate receiving the final fee letter from IRS (“Letter 4658”) that will include the 2022 owed fee amount. IRS payments are due by September 30, 2022.

Below is an illustrative timeline for an eligible drug that was launched prior to 2020:

Source: Annual Fee on Branded Prescription Drug Manufacturers and Importers

Line Extension Guidance Update

As part of their 2020 Final Rule, CMS provided further clarity around the term “new formulation” and what constitutes a Line Extension (LE). This narrowing of the definition will now include more drugs into the category of Line Extension than before and will require manufacturers to consider the alternative Line Extension URA Formula to accurately determine their Medicaid rebate liabilities.

The updated definition of “new formulation” includes “any change to the drug, provided that the new formulation contains at least one active ingredient in common with the initial brand name listed drug.” CMS even went as far as to list a few examples of what now qualified as an LE which included the following:

- Extended release

- Change in dosage

- Change in strength

- Changes routes of administration

- Change in indication

- Change in ingredients

CMS also specifically called out that formulations for abuse-deterrents did not qualify as an LE drug.

These new considerations went into effect January 1, 2022, and are applicable to all branded products currently on the market as well as all future launches. If you think a more detailed conversation around Line Extensions is warranted for your manufacturer, reach out to your IntegriChain GP lead or account representative today

Source: Establishing Minimum Standards in Medicaid State Drug Utilization Review

Federal Government to Transition from DUNS Number to Unique Entity Identifier on April 4, 2022

The government is transitioning from using the DUNS number (Data Universal Numbering System) currently managed and owned by Dun & Bradstreet to its own Unique Entity Identifier, (UEI), in order to simplify the process of registration and make it easier for organizations to do business with the federal government. The UEI is a 12-character alphanumeric value assigned and managed by the government that would serve as the authoritative identifier for all entities. This Unique Entity ID would be integrated across all Integrated Award Environment (IAE) APIs and systems, including the System for Award Management (SAM) database, FPDS, eSRS, FSRS, CPARS, and FAPIIS. Sub-award recipients would also be able to request a UEI on SAM.gov with no required entity registration.

Companies with new and existing (or inactive) registrations in the System for Award Management (SAM) database will automatically be assigned a UEI and no further action is required. Currently, both the DUNS and UEI are viewable in the SAM database for registered companies. Registrations and reporting will continue using the DUNS number until this transition is complete and afterward, entities will no longer need to use a third-party website to obtain an identifier or receive any assistance. All federal agencies and systems have been directed to implement and complete this transition from DUNS to UEI no later than April 4, 2022, when the government will cease to use the DUNS number in any IAE interface/screen and will only use the Unique Entity Identifier (SAM). More information on this transition can be found on the GSA’s Unique Entity Identifier Update web page.

Source: VA FSS Newsletter, December 2021

Guidance for 340B Providers During Emergency Disaster Relief Efforts

HRSA has ruled that during a declared public health emergency, disaster relief efforts warrant additional flexibility for affected 340B entities. Recipients of 340B drugs are required to be patients of 340B covered entities, however, in these situations, there are other conditions that may determine whether the individuals qualify:

- Services must be provided consistent with the scope of the grant and other eligibility

- Covered entities must retain health records of care provided to patients

- Individuals must receive services from health care professionals employed by covered entities

In a declared health emergency, abbreviated health records are sufficient for the 340B program provided they include a record of the patient’s identification, medical evaluation or diagnosis, and their prescribed treatment. Under these emergency circumstances, patients and providers may not have access to insurance records or medical history so self-reporting of identity, condition, and history would be sufficient for 340B record requirements. If volunteer health professionals are providing care during declared emergencies, emergency documentation should be used to clearly establish the relationship between the provider and the covered entity. This documentation would recognize the emergency situation, the name, address, and relationship of the volunteer to the entity and be maintained by the covered entity. In addition, during a declared public health emergency HRSA will allow entities in disaster-affected areas to enroll immediately, rather than wait for the normal quarterly update to allow entities to better meet the needs of affected residents.