Editor’s Note: The following post is adapted from IntegriChain’s 2021 Access Insights Conference panel session: Best Practices for Launch featuring DBV Technologies, Karyopharm Therapeutics, and Sesen Bio. Responses have been edited for clarity. Click here to view the full webinar recording.

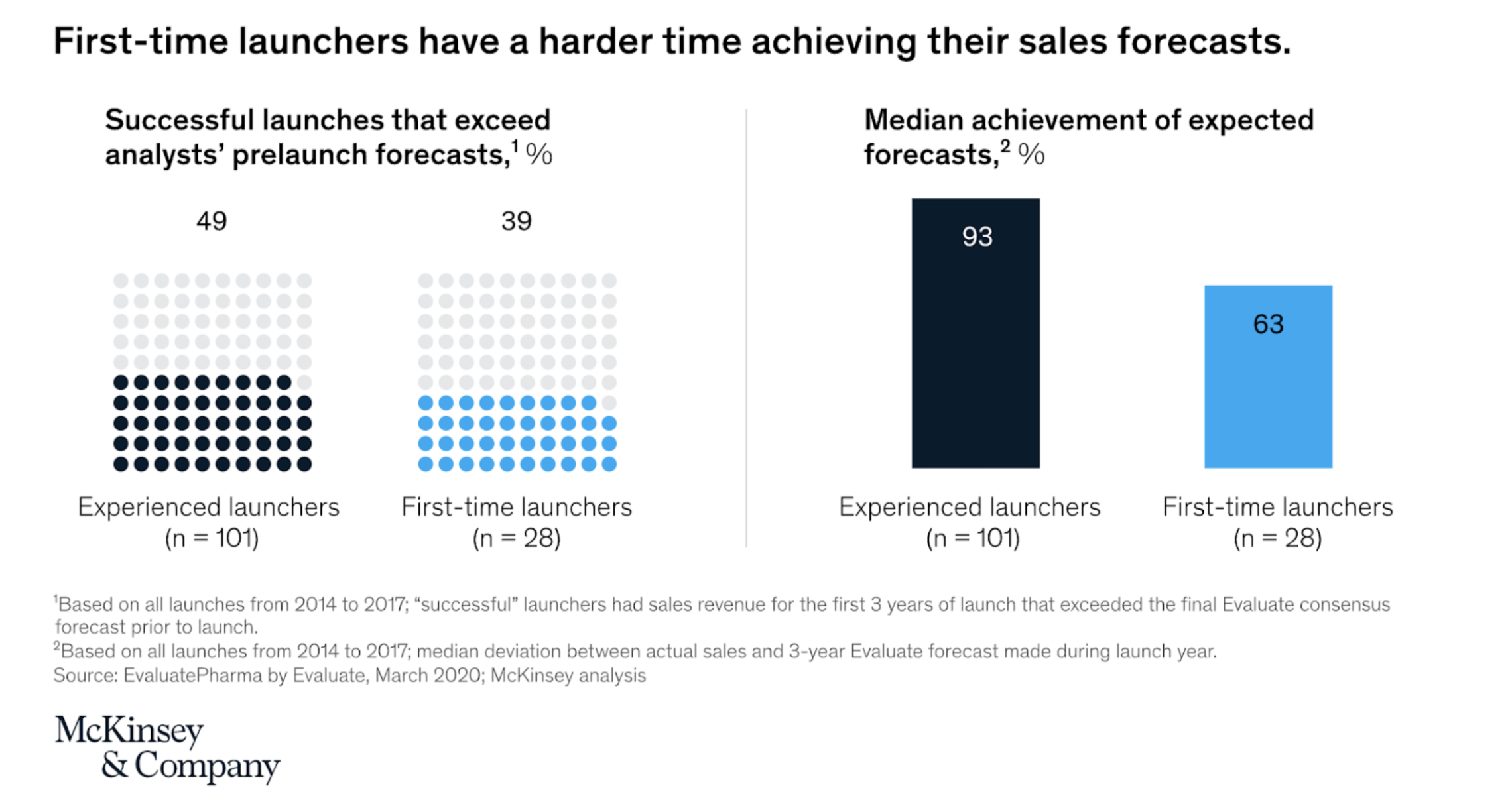

In 2021, McKinsey released a fascinating study of first-time drug launches. One key takeaway from this study was that it’s obviously a challenge to achieve your pre-launch forecast to begin with, and experienced organizations achieved their goals more than first-time launchers. That isn’t surprising, but what was surprising is that the median for the experienced launches achieving forecast was about 93%, while first-time launchers were only about 63%.

In our last best practices for launch blog, our panelists discussed their experiences gearing up for a commercial launch and what they would have done differently if they had the ability to go back to square one in their launch planning process. In this blog, we’ll be hearing more perspectives from our panel on key factors from their experiences that led to better results in terms of achieving the forecast for a launch company.

Our Panel:

Moderator

Dave Weiss

Vice President, Industry Solutions at IntegriChain

Mike McCarthy

VP, Market Access at DBV Technologies

Steve Barbera

VP, Market Access at Sesen Bio

Dan Ryan

Senior Director, Commercial Finance at Karyopharm Therapeutics

What are the critical factors in a successful launch and what goes into really earning that prelaunch forecast?

Mike McCarthy: I think what happens is it’s a combination of things, but what I’ll stick to is the market access component and what you can control within it. It all starts with the forecast. So often forecasts from the very beginning are started years in advance and evolve over time. There are elements of it that change, like if patient share goes up or down, but what I often find is that the market access components of those forecasts, like how much access you’re going to get, and what the gross-to-net is going to be doesn’t often change that much.

So for me, that’s one area where I think that having credibility within your organization and making sure you have a really solid understanding of what the access environment is going to look like so you can ensure that it’s being built into the forecast appropriately. For example, if you have 80% patient share by the end of year one, that isn’t realistic unless you’re willing to give up significant gross-to-net to achieve the access necessary to make that happen…and even then, that is still a stretch. That’s just one area where I’ve seen things go off the rails very quickly and many years in advance.

Steve Barbera: That’s a great point. Whether we take it on ourselves to gain better credibility with senior leadership to be more impactful, or how we articulate what we think the market forces will be in the buy-and-bill world, I’ll answer for myself and say discounting is obviously quite the challenge. So it’s really about how quickly you can create that reimbursement confidence and make it forward-looking so you can get the organization to understand how you will get there in that forecast.

Whether you’re dealing with risk-averse physicians or something else, there are market forces that may delay that uptake. So I think the more you can articulate that with senior leadership to try to zero in on that predictability.

Mike McCarthy: It always sort of felt like an internal negotiation and really at the end of the day what it comes down to is “how do you want to make money?” Do you want to make the product fast and be competitive very quickly? This would obviously increase your gross-to-net exposure. Or do you want to do this over time and have a more sustainable gross-to-net model so that becomes a negotiation between market access, the brand team, and ultimately sales?

Steve Barbera: That’s a good point because what we face in the buy-and-bill area is that until things change, you have to really balance that because you’re managing average sale prices (ASP). For example, we’re getting ready to launch a first-in-class product, and we’re already talking about how we are going to discount and whether or not we should think about doing that yet because it creates another component to account for. So I think it’s important to try and slow things down a bit, whether it’s for the preservation of ASP or gross-to-net. Buy-and-bill is a difficult model because you’ve got to get it right first or you’re going to be living with it for a long time.

Dan Ryan: I’d like to add that when you want to protect against gross-to-net erosion, you have the offset of limiting paying for access with Commercial or Part D payers. But from a finance perspective, I think hearing “did you hit your forecast?” makes you think of net revenue goals. Ultimately we all know how many different assumptions are going to go into the Net revenue calculation. Things like price increase strategy, contracting strategy, inventory levels/fluctuation, wholesaler fees, payer mix, copay programs, etc.

So you can estimate a lot of those fairly accurately. But if something happens where you have to increase a payer contract, for example, that could affect government pricing and your best price, which could increase your 340B discount and Medicaid Rebates and disrupt that forecast. Or if your best price goes up from 35 to 40%, that affects all of your federal and government forecasts as well.

So there are a lot of moving parts, and again I’ll stress that the market access, finance, and government pricing teams really need to be on the same page and realize how the contracting can affect GTN and GTN erosion. Ultimately when it comes to hitting your bottom-line forecast, everyone thinks of net revenue, but if you don’t hit your demand or GTN, then you’re not going to hit your forecast.

As Steve mentioned, getting alignment is really critical up and down the management team, cross-functionally, and to the C-suite. I remember years ago, there was a grudging discussion of market access issues at the C-suite, but now I think we’ve all aligned on its value.

Dave Weiss: From your responses, there’s obviously a lot to be concerned with at launch and only so much budget to go around. Are there some critical data needs that you wish you had some more budget for or spent more time on in some of these launches? Is there something else that would have been extremely helpful for you?

Dan Ryan: Payer mix is a big one, and I think that’s the first place I would start. You want to get the analog data to set up your GTN accruals and your assumptions, but when you do, a lot of that data is already three to six months old. Then by the time you’ve launched, you’re using these assumptions and your auditors will want refreshed data. So it’s an aspect of timing to get the analog data for 340B for your payer mix. If you can refresh that data right before launch at a reasonable price, I would recommend doing that.

Steve Barbera: I think if we would have been able to grab 340B analytics early on, we could have conversations with finance with to say our initial assessments were a bit off and it would have made it far less painful to try to recapture some of that revenue. That said, we had to do a very unique model with our channel in the way our product was mixed and needed to be drop-shipped. That information would have helped us tremendously.

Dave Weiss: Right, and that’s a good point because IntegriChain has a lot of 340B analog data but it’s really like finding out what’s the particular analog that’s close and a lot of your brands now are so innovative or new. If you think about a peanut allergy or a food allergy, there’s only one other on the market and it’s a completely different channel design. Even for us as a vendor that collects a lot of this data, it gets to be really complicated. And so much of it is related to your distribution model too.

Mike McCarthy: When it comes to distribution because it’s so connected to data, the most important word that you will have is “no.” Everybody wants access to your product. No matter how big, no matter how small, everyone is competing for access to this product, whether it’s a PBM-owned specialty pharmacy, an independent specialty pharmacy, a chain, or an integrated delivery network that tells you they won’t use a product unless they have access to it through their specialty pharmacy. So you’ve got to know that upfront because once you start opening up this Pandora’s box and everybody has access, you’ve lost complete control of your data and potentially the patient experience. It becomes a push and pull on what should be a pretty easy decision. It’s not as simple as splitting the data you have to distribute and the data you need, because they’re so interdependent.

Check back for part three in the series, where our panelists discuss barriers to patient and market access they’ve faced in their careers and strategies to overcome them.

Learn more:

Best Practices for Launch: Redesigning the Perfect Launch

Watch the webinar “Industry Panel: Best Practices for Launch”