Editor’s Note: This month, we offer commentary on three topics around Pharma Industry Trends in 2024: Industry Updates, Biosimilar Barriers, and the Impact of IRA Medicare Drug Price Negotiations, and pharmacy benefit drugs. As always, if you have questions on any of the content found in this or previous market updates, please reach out to your IntegriChain Consulting Lead or consulting@integrichain.com and we would be happy to talk you through it.

H2: Table of Contents

- Pharma Industry Trends & Updates in 2024

- Challenges to Commercial Success: Biosimilar Barriers

- Why Medicare Patients are Unlikely to See the Benefits of IRA Medicare Drug Price Negotiations

Pharma Industry Trends & Updates In 2024

The healthcare landscape in the US is constantly evolving. The latest report titled “The Use of Medicines in the US 2024: Usage and Spending Trends and Outlook to 2028” provides a comprehensive look at the current trends and future directions in medicine and spending. A few takeaways from the report include:

Slow Spending Growth

In 2023, the overall spending growth on medicines in the U.S. slowed to 2.5%, reaching $435 billion at net price levels. This is primarily attributed to a significant decline in spending on COVID-19 vaccines. However, when excluding these COVID-19-related expenditures, the spending growth rate accelerated to 9.9%. This surge was driven by innovations in several therapeutic areas, including oncology, immunology, diabetes, and obesity treatments. For example, immunology drug use reached 1.2Bn days of therapy in 2023, which is up 60% from 2019. Treatment of Crohn’s and psoriasis accounted for 26% and 15% of growth.

Additionally, projected growth in the US is set to increase 4-7% through 2028 driven by novel drugs and offset by patent expiries. Growth will be fueled by the adoption of newly launched innovative products, with an expected average of 50–55 new medicines entering the market annually over the next five years. These include treatments in oncology, specialty and orphan drugs.

Health Services Utilization

The report highlights a 3% decline in the utilization of health services, encompassing visits, diagnostics, elective procedures, and drugs. A score of 100 or higher indicates equivalent or higher levels of utilization compared to the prior year. Screening and diagnostic tests had a score of 94 while adult, pediatric, and flu vaccinations were at 96. Office, institutional, and telehealth visits and elective visits scored a 95. Despite this overall decline, new prescriptions saw a 3% increase with a score of 104, indicating a shift in how patients are accessing and using healthcare services.

What this could mean for manufacturers

The growth of total healthcare and prescription drug spend continue to rise especially with the growing number of new drug approvals each year across the therapeutic areas. The increasing trend towards new prescription drug usage further supports that these new therapies are also effectively reaching new patients.

Additionally, the government has taken many steps to reduce the costs of healthcare, especially the effects of the Inflation Reduction Act. However, the focus on decreasing patient OOP costs could further drive up new prescription drug utilization and adherence by patients who now face a smaller financial burden.

These factors could contribute to an increased competition in the therapy areas with new launches or upcoming biosimilar events. Public pressure on drug pricing has escalated, which show list price increases have slowed to 4.9% in 2023 and are expected to average 1-4% per year. As manufacturers look to enter the market with new and innovative drugs, they should consider the impacts of pricing changes from regulations and healthcare utilization. By reviewing how these changes could impact the channel and commercial strategy, it can help successfully navigate the ever changing space.

Sources:

Challenges to Commercial Success: Biosimilar Barriers

Biosimilars-often touted as the generics of the biologic drug-have already begun to introduce healthcare savings. However, many market challenges still exist that have the potential to make or break widespread, prospective savings from biosimilars. Some of the key challenges and considerations are summarized below:

Challenge 1: Development of Biosimilars is costly

Although biosimilars are often referred to as “generics” for biologics, the comparison is only beneficial as a high-level reference/comparator.

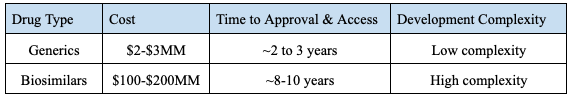

Investment, duration of return and development complexity are a few key differences:

Figure 1. – Example of Cost for Biosimilar Development

More costly and time-consuming development of biosimilars creates greater financial pressure than generics when entering a competitive market, thus, the traditional price “race to the bottom” is less viable and more challenging. Additionally, increased complexity in drug development, education for relevant stakeholders, and distribution contribute to the longer development and input cost.

Challenge 2: Acquiring Biosimilar Interchangeability is Costly with Variable State Regulations

Biosimilar approval does not immediately grant interchangeability for patients with the reference drug. A biosimilar can be approved and marketed without interchangeability.

- Interchangeability refers to an additional FDA regulatory designation where pharmacists can dispense a lower cost biosimilar when a biologic is prescribed.

- Interchangeability requires additional, more costly studies to complete, whereas generics are eligible to be swapped for their reference drug upon FDA approval.

- Variable formulations of the reference product would require interchangeability studies for each unique formula.

- Further, although states have largely similar interchangeability stances, enough variations exist that add further complexity to exercising interchangeability.

- For example, providers can write “dispense as written” to block interchangeability and/or pharmacists may be obligated to notify the provider and/or patient when exercising an interchangeability designation.

Challenge 3: Benefit design economics vary and complicate market access

Medical Benefit Drugs: Compared to pharmacy benefit, Medical benefit covered biosimilars have seen much faster and greater market share following a product launch.

- Key Drivers:

- Physicians, particularly for oncology treatments, are significantly less dependent on payers and PBMs for drug coverage.

The economics of Medical Benefit reimbursement offer competitive reimbursement incentives and dynamics between products. such as aggressive discounting providing steeper financial incentives to a given purchaser that questions product utilization consistency both for the patients and manufacturers.

Pharmacy Benefit Drugs: PBM practices remain the primary determinant for optimal market access for biosimilars as well as other drugs. Per a recent FTC interim report on vertically integrated PBMs, certain market incentives for high priced originator drugs offering steep rebates for formulary exclusivity could be mitigating potential savings from biosimilars. Commonly referred to as the “rebate wall,” the wall blocks biosimilar entry into preferred positions on formularies. Biosimilars offering similar rebates to PBMs are not as appealing, since they have limited market share and subsequent pull through on formularies

Conclusion

Potential savings with biosimilars are a much needed relief to healthcare spending. However, the time and money investment to develop a biosimilar, developing regulations, and variable incentives and subsequent market share challenges in pharmacy vs. medical benefit threaten to disincentivize biosimilar development.

If you are preparing to launch a biosimilar product, IntegriChain is an ideal partner to help you navigate the complex considerations to achieve a profitable and successful launch across therapeutic areas.

Sources:

Why Medicare Patients are Unlikely to See the Benefits of IRA Medicare Drug Price Negotiations

There has been a significant change in the U.S. healthcare system over the past month. You would be forgiven for missing it. This month, for the first time in U.S. history, the government concluded the IRA Medicare price negotiations for 10 drugs that recipients take regularly and that accounted for $50.5B in annual Medicare spending — $3.4B in out-of-pocket costs for Medicare beneficiaries in 2022. The negotiated prices were announced on Thursday, August 15.

If you have a family member or you yourself receive drugs through Medicare, the names of the drugs negotiated will be familiar: they help prevent strokes, control diabetes, and help fight cancer – common conditions faced by the country’s growing over-65 population. In many cases, the costs of these drugs can be as significant a burden as the diseases they are meant to treat. So, if the government steps in and negotiates down the price for you and/ or your family member, that should be a good thing, right?

Not quite. Most of the impact of the negotiation is likely to stay hidden from the Medicare recipients that take these drugs. In a preliminary rule from the Centers for Medicare & Medicaid Services (CMS), discounts that the government just negotiated will be applied only after the prescription is dispensed from the pharmacy – a complex and data-intensive process. The government will have a third-party facilitator eventually refund the hospitals and pharmacies that dispense the negotiated drugs in 2026. The process has been criticized by the American Hospital Association as being unnecessarily arduous and burdensome on the provider institutions.

In addition, the Medicare pharmacies and the pharmacy benefit managers (PBMs) have the obligation to provide coverage for the negotiated drugs. But the negotiated drugs do not need to be the easiest drugs to access. In fact, the PBMs may decide that it is better for their beneficiaries to favor non-negotiated drugs. We will only know how the PBMs will position these drugs on their formularies in the coming weeks.

Just these two factors (and there are many more) mean that the out-of-pocket costs that Medicare recipients see at the pharmacy are unlikely to change. Hospitals, pharmacies, and pharmacy benefit managers now need to expend effort to extract savings from the Medicare program that should be going straight to the Medicare patient. One alternative to the proposed system, would be for the negotiated price savings to be passed to the patient via a rebate at the point-of-sale, when the prescription is dispensed to the patient at the pharmacy window or delivered to their house.

Unfortunately, pricing obscurity is far too common in the pharmacy supply chain. Prices are negotiated regularly between PBMs and drug manufacturers, rarely resulting in changes to the patient’s experience or their financial burden. In most cases the negotiated savings are retained among the many other stakeholders in the system in a process so complicated that even manufacturers have a difficult time “following the dollar.” Point-of-sale rebates are tangible and proven ways that manufacturers and pharmacy benefit managers have implemented to alleviate costs for consumers.

If you have any questions or would like to review your customer contracts, please reach out to Consulting@IntegriChain.com or contact your Advisory lead.