The 340B program stands out as one of the most dynamic and complex government programs. This initial post in a series will explore how and why we got here, prevailing growth trends, strategic approaches manufacturers have taken, and an overview of legislative and legal matters.

Background and Evolution of the 340B Program

The 340B Program began as a small government program that was primarily discussed within the industry because of the eligibility of the entities it served, the 340B ceiling price it required, and its connection to the Medicaid Drug Rebate Program (MDRP). The dynamics started to change in 2010, when the program began to expand with the Affordable Care Act (ACA) and its expansion of eligible hospital types and then Health Resources Service Administrations (HRSA) expansion of unlimited contract pharmacies. This continued over the last 15 years, leading to the exponential growth we see today where the program’s gross sales are nearly $150 billion; with net sales projected to exceed $60 billion. Despite pharma manufacturers’ attempts to address the growth, it has only accelerated in recent years to where the program has now become the second largest government program. In addition to the growth, manufacturers are faced with duplicate discounts related to abuse across various payers such as Medicaid, Commercial, Medicare, and Tricare. The growth and abuse result in an ever-growing gross-to-net (G2N) spread and inconsistent forecasting. This, along with the lack of transparency, demonstrates the challenges manufacturers are facing with this program and why their senior leadership, C-Suites, and their boards have taken notice.

Why Has This Happened?

Unlike other government programs, the 340B pharma program and its statute are governed by agency guidance, rather than formal rulemaking and regulations. The program also lacks regulatory enforcement by the HRSA, the agency overseeing the program, which, when combined with limited oversight, has created an environment that allows for financial growth and abuse-type incentives for non-manufacturer-related stakeholders. The financial incentives primarily benefit covered entities, especially large hospitals, but include other third-party stakeholders such as contract pharmacies, third-party administrators (TPA), and wholesalers. Pharma manufacturers are actively working to address these issues, but strategies deployed to date have primarily been a point solution against each specific area of 340B growth and abuse. These strategies worked for short periods of time but have not fully deterred program growth and abuse as manufacturers continue to see a bounce back.

340B Growth Drivers

The growth drivers for the 340B program continue to change and evolve as new strategies by covered entities and other stakeholders are evaluated and introduced. However, the primary drivers have recently been:

Move to In-House

- There is a greater mix of in-house 340B covered entities, especially large hospitals.

- Acquisition of independent hospital practices, such as oncology practices, by existing 340B hospitals, which results in the acquiring hospital’s ability to register the oncology practice as an eligible 340B child site.

- Outpatient departments from non-340B hospitals are added to an eligible 340B hospital’s cost report, thus making them eligible.

- In-house and child site shipping address and site eligibility growth as locations continue to be added by covered entities within OPAIS. This includes third parties and addresses that are also registered as contract pharmacies.

Contract Pharmacies Expansion

- The number of contract pharmacy arrangements continues to increase, especially for-profit and publicly traded pharmacy chains (e.g., CVS, Walgreens, Walmart, Express Scripts, and Optum Rx).

- Increase in vertical business relationships.

- New and emerging strategies and workarounds to manufacture contract pharmacy policies (e.g., Alternative Distribution Models, Banked Accumulations, Virtual Credit Replenishment, etc.).

- Lobbying by covered entities and trade organizations at state level to pass laws allowing for unlimited contract pharmacies and limit claim requirements in those states.

Increase in 340B Capture Rate

- The 340B capture rate is increasing due to covered entities and their supporting TPAs reacting to loosened regulatory environment around patient definition, especially considering the Genesis decision a little over a year ago. For example, covered entities may change its policy to expand the period of time in which that individual last had an encounter at the covered entity from one year to two years to be an eligible patient.

- Covered entities capturing a large share of prescriptions written by affiliated prescribers, including the use of telehealth and referral capture services.

- Covered entities seeking manufacturers with products that do not limit 340B utilization, via manufacturer contract pharmacy policies.

An additional element to the growth is the mechanism that dominates how the 340B program operates today. The replenishment model is an inventory mechanism that allows the covered entity or their TPA to make 340B eligibility determinations. When a patient comes into a pharmacy, whether they are a 340B patient or not, they get the product on the shelf at the pharmacy, which may or may not be dispensed at the 340B price. If the covered entity or their TPA determines that the product dispensed to the patient was 340B, then replenishes the dispensed product whether that drug was purchased at the 340B price or not with a new drug purchased at the 340B price. This mechanism, which is primarily electronic and based on algorithms, contributes and even escalates the growth, especially at contract pharmacies.

340B Strategies for Pharma

Pharmaceutical manufacturers have been evaluating and implementing various strategies. Manufacturers are not only looking to address and/or mitigate the program’s growth and abuse but also gain additional insights into the program and further transparency. Pharma 340B strategies vary significantly based on the manufacturer product type, distribution, administration, rebating, and specific exposure, however, manufacturers’ efforts can typically be categorized as follows:

Advocacy

Advocacy efforts aim to expose program harm and abuse, urging federal and state lawmakers for reform. This includes opposing state contract pharmacy laws, identifying bad actors, stressing data transparency, highlighting the lack of patient-specific benefits, and advocating for state-level transparency laws.

Legal

Develop federal and state legal strategies to preserve 340B reform opportunities or advance initiatives through litigation, including federal cases on contract pharmacy, preemption against state contract pharmacy laws, rebate/credit models, site eligibility, and access to contract pharmacy arrangements.

Self Help/Operational

This includes developing operational-related strategies to mitigate the growth and abuse of the program. Operational strategies deployed or considered include:

- Scrubbing for 340B duplicate discounts (Medicaid, Commercial, Medicare (IRA/MFP), TRICARE, Part B and Part D Inflation Rebates, etc.)

- Contract Pharmacy type policies including geofencing, claims collection, and entity and state level exemptions

- In-house pharmacy type policies including claims collection

- Rebate/Credit type models

- Patient Definition evaluation

- Enhanced site eligibility validation

- Evaluation and monitoring of stakeholder workarounds (e.g., Alternative Distribution Models, Banked Accumulations, Virtual Credit Replenishment Models, etc.)

- Limited and/or direct related distribution type models

- Acquisition of additional data assets and implementation of more robust monitoring and analytics capabilities for better insights and proactive monitoring of 340B issues

- Enhancing operational and technical capabilities including single integrated 340B solutions

To evaluate and implement these types of strategies, manufacturers have also been enhancing their governance and operating models to manage the program and keep up with the ever-changing environment. This includes implementing 340B dashboards into their day-to-day activities, hiring dedicated 340B resources, and/or establishing 340B Center of Excellence.

Overview of Federal and State Legislation or Activity

Federal Level

Congress Legislative Actions

Numerous federal bills have aimed to alter the 340B program, focusing on contract pharmacies, data access, patient definition, and site eligibility. This includes the most well-known bill, which is the bipartisan Sustain 340B Act, introduced by six senators, stalled in 2024 but a new version is expected in 2025.

Senator Cassidy’s Report

In May 2025, Senator Cassidy, a vocal critic of 340B hospital and contract pharmacy expansion, released a report following a year-long review. Based on sampled data from hospitals, Federally Qualified Health Centers (FQHCs), contract pharmacies, and drug manufacturers, the report highlighted covered entities’ use of 340B revenue and financial benefits for contract pharmacies and TPAs, stressing the need for 340B reform.

HRSA Moving to Center of Medicaid and Medicare Services (CMS)

The Trump administration’s 2026 budget proposes moving HRSA, which oversees the 340B program, to CMS. This move, while maintaining HRSA’s funding, would place the program under an agency with a more rigorous rule making process and greater resources.

HHS and HRSA to Release Rebate Guidance

Department of Health and Human Services (HHS) announced it would issue rebate guidance on May 2, 2025. The guidance was submitted to the Office of Management and Budget (OMB) on June 1, 2025, and while they have 90 days, it is expected to be released sometime in July 2025 or early August 2025, given the upcoming manufacturers deadline of September 1, 2025, regarding MFP effectuation plans. There have been several manufacturers, trade groups, and other organizations that have met with HHS to discuss and voice their opinions on the rebate model leading up to the release of the guidance.

State Level

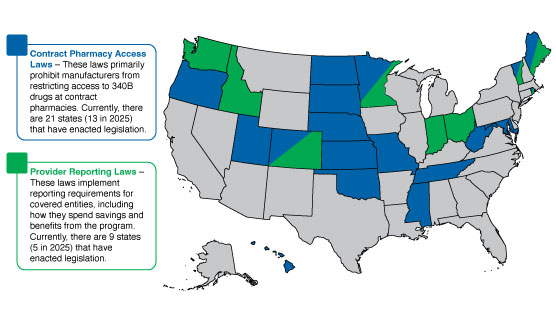

Over the past couple of years, and primarily in response to manufacturer contract pharmacy policies and other advocacy efforts mentioned, there has been a serious uptick in 340B state legislation. Below is an overview of the contract pharmacy access and provider reporting related laws:

Figure 1 – State laws that have passed as of 7/1/2025

Overview of Litigation

Due to the strategies from both the covered entities and manufacturers, along with the significant financial dollars at stake, there has been increased litigation. The volume and scope of the litigation today is significant but a few highlights from the larger topic areas include:

Contract Pharmacy

Since 2020, manufacturer contract pharmacy policies have led to litigation, continuing into 2025. Two federal appellate court decisions (3rd Circuit and DC District) have largely favored manufacturers, allowing reasonable conditions and restrictions to contract pharmacies. This led to an increase in such policies from 2023 onwards, which remain active.

Rebate/Credit Model

Due to 340B program growth, five pharma manufacturers publicly sought alternatives to the chargeback and replenishment model, proposing various types of rebate/credit type models. HRSA rejected those models and threatened sanctions, leading manufacturers to each file lawsuits. Since then, both cases across the five manufacturers have issued rulings and statements. Both Judges (Judge Dabney Fredrich and Judge Rudolph Contreras) from the District Court of DC ruled HRSA can approve/deny rebate models but acknowledged the statute contemplates rebates or 340B pricing. Importantly, both Judges mentioned that requiring claims data from covered entities was permissible, which could open claims collection by manufacturers beyond just contract pharmacy.

What’s Next for the Pharma 340B Program?

For manufacturers who may not have robust capabilities for insights into the current state of the pharma 340B Program, are grappling with the growth and abuse type areas, or would like to understand and evaluate evolving strategies, now is the time to review what you are doing today and ensure you have the leading processes and 340B strategies in place.

IntegriChain offers a full suite of 340B solutions and services designed to help pharma manufacturers understand the complexities of the ever-changing 340B Program, while assessing and integrating market access or commercial strategies, operations, and financial-related dimensions that are needed to effectively manage 340B Program risks and opportunities.

Stay tuned for additional information on the 340B Program, but feel free to reach out to our pharma 340B experts to discuss how we can help.

Join us at our upcoming Access Insights Conference this October and contact our team for more information.