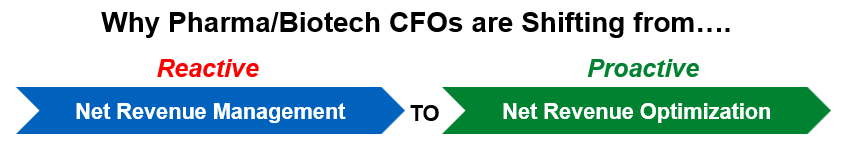

Image 1 – Why Pharma/Biotech CFOs are Shifting from Net Revenue Management to Net Revenue Optimization

Executives across the life sciences industry are navigating the most complex period in recent history. As the commercial and policy landscape grows more complex, net revenue optimization (NRO) has become a critical strategic priority for biotech and pharmaceutical manufacturers. The role of the finance organization is fundamentally shifting. CFOs and finance/accounting teams are moving beyond retrospective revenue management and becoming proactive architects of pricing, contracting, and Gross-to-Net (GTN) strategy. The pharma/biotech CFO is in the middle of the GTN pressure cooker and continuously fielding inquiries and complex questions from key stakeholders looking for directional insights on:

- Inflation Reduction Act (IRA) impacts related to:

- Mandated Part B and Part D Inflation Rebates

- New Medicare Drug Program (MDP), formerly Coverage Gap

- Medicare Negotiations setting a Maximum Fair Price (MFP)

- Physician Fee Schedule (PFS) Final Rule with short-term Compliance

- 340B Rapid Growth & Rebate Model Pilot Program Implications

- Direct to Patient (DTP) Program Popularity

- Most Favored Nations (MFN) Business Operations & Financial Risk

- Medicaid Budget Cuts Impacts on Patient Mix and Programs

- AMP Cap Removal Still Driving Business & Contracting Decisions

- and Tariffs are the final punch to the gut…

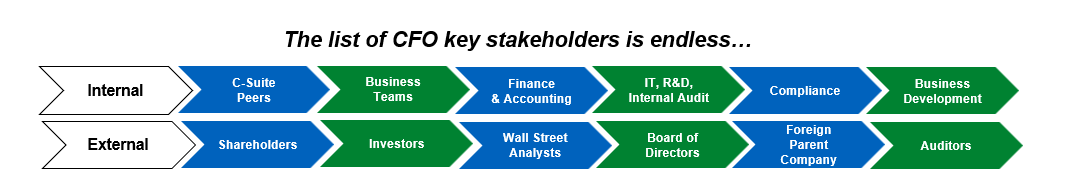

Financial leaders are expected to decipher these transformational changes, while still wrangling classic GTN pressures from Distribution, Payer, and Provider stakeholders. In addition, data expectations are evolving faster than most commercial and finance organizations can manage. As a result, CFOs must rethink how they manage Net Revenue trends and key drivers through net revenue optimization, using more structured modeling and analytics to align internal and external stakeholders across the commercialization journey. Achieving this level of coordination, with the volume of stakeholders below, is nearly impossible for any one individual within an organization.

Net Revenue Optimization in Biotech and Pharma

Net Revenue Optimization in biotech and pharma is the strategic process of maximizing actual cash retained from product sales by proactively managing complex Gross-to-Net (GTN) drivers such as rebates, discounts, chargebacks, government programs, and contractual terms. NRO leverages advanced analytics, AI-driven modeling, and lifecycle-based planning to improve forecast accuracy, cash flow visibility, and long-term profitability. Unlike traditional cost-cutting approaches, net revenue optimization focuses on identifying and preventing revenue leakage at its source while ensuring accurate accruals and stronger, data-informed decision-making.

Image 2 – The list of biotech/pharma CFO key stakeholders

Key Themes Shaping Net Revenue Optimization Strategy

In recent years, I’ve facilitated 1:1 discussions with biotech/pharma industry CFOs and CCOs, giving me the opportunity to listen, compare perspectives, and synthesize recurring insights. Following the CFO Showcase at IntegriChain’s 2025 Access Insights conference, I consolidated the key observations shared by these leaders. While each organization faces its own challenges based on product archetype, patient mix, portfolio maturity, and company dynamics, a few directional themes to drive Net Revenue Optimization emerged:

- Game Theory, Strategic Modeling: CFOs emphasized that finance must be engaged early and well before pricing, contracting, or access decisions are finalized, not simply to approve decisions, but to shape them. Early collaboration with Strategic Net Revenue Optimization focus is quickly becoming a best practice. It is clear now that a cross-functional driven, dynamic, cross-channel, bottoms up scenario development process drives the sensitivity analysis that the CFO’s key stakeholders are craving.

- Unified Data & Analytics: Executives highlighted the need for better data literacy and governance. Finance often takes direct responsibility for data quality, stewardship, and interpretation to ensure accurate accruals, forecasting, and reporting. Many finance leaders are intentionally working very closely with IT partners to develop a holistic data and analytics strategy.

- Policy, Compliance & Reimbursement Expertise: Policy changes, critical compliance requirements, like government pricing and state price transparency, and Payer/Provider reimbursement dynamics carry significant financial implications. Unless a manufacturer has an experienced compliance and policy organization, gaps in expertise may unintentionally create financial and operational risk.

Common Challenges and Pitfalls in Net Revenue Optimization

Net revenue optimization is increasingly difficult as GTN structures grow more complex due to expanding rebates, discounts, chargebacks, and government pricing programs. Many organizations still rely on spreadsheet-based processes that limit visibility into true net price and increase accrual risk. Fragmented data across pricing, contracting, ERP, and CRM systems further complicates forecasting and reconciliation. When finance is engaged late in pricing or access decisions, assumptions may be locked without full GTN visibility, leading to margin erosion, cash flow volatility, and compliance exposure.

Data Integration and Technology Enablement

Effective net revenue optimization requires accurate, integrated data and technology capable of managing GTN complexity at scale. Leading manufacturers are moving beyond siloed systems toward integrated platforms that unify pricing, contracting, claims, and financial data. Advanced analytics, AI, and machine learning improve GTN waterfall forecasting, support early scenario planning, and enable proactive identification of revenue leakage. Automation improves accrual accuracy, accelerates liability settlement, and strengthens audit readiness across the organization.

Core Components of a Net Revenue Optimization Strategy

- Gross-to-Net (GTN) Management: Tracking and optimizing deductions from gross sales, including payer rebates, discounts, administrative fees, and 340B program impacts, to determine true net price.

- Advanced Modeling and Analytics: Using AI and machine learning to forecast GTN waterfalls, pressure-test assumptions, and scenario-plan pricing and access decisions early in development.

- Lifecycle Management: Initiating NRO and GTN modeling pre-launch to anticipate patient mix, channel dynamics, utilization, and policy exposure across the product lifecycle.

- Deduction Management: Auditing, validating, and challenging invalid chargebacks and deductions to prevent revenue leakage.

- Internal Compliance: Ensuring adherence to trade agreements, government pricing rules, and customer contracts to reduce financial and regulatory risk.

Finance Perspective is Critical to Optimize Commercial Decisions

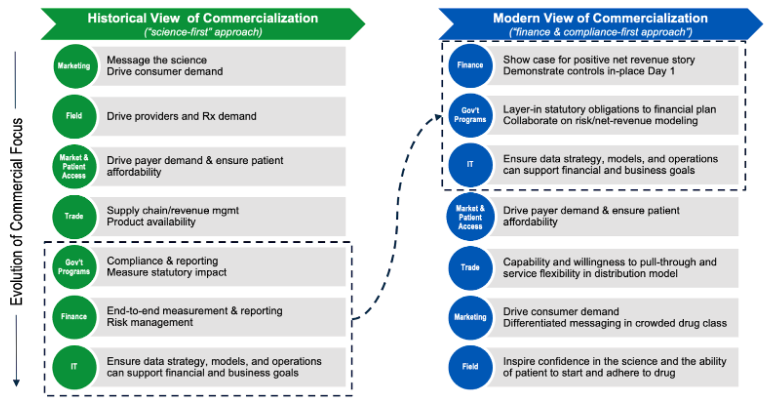

Image 3 – Historical vs. Modern Pharma Commercialization

One of the strongest priorities we see in the current marketplace is the need for finance to be plugged in well before product launch or product price/contracting decisions are finalized. Too often, financial leaders are brought in once assumptions are already cemented, pricing strategies are locked, or payer contracting is underway. Across multiple organizations, finance executives described a similar pattern: commercial teams initiate pivotal decisions quickly and under pressure, relying on finance to validate or operationalize changes after the fact. Yet the potential risks require deeper financial modeling upfront. Why? It’s because each of the following product archetypes and patient scenarios yield a wildly different GTN picture:

Image 4 – General Medicine, Specialty, and ORD/CGT Grouping

Once business and finance leaders lock in and understand product archetype implications, they quickly agree upon and emphasize that this is not about slowing down the business, it’s about reducing the volatility that arises when assumptions are made without full visibility. CFO/Finance Team involvement enables the organization to quickly:

- Pressure Test Assumptions with more rigorous scenario planning

- Identify Business & Financial Risk tied to critical company forecasts

- Ensure Price & Contracting Optimization with a long-term profitability view

- Drive Strategic Business Decisions to capitalize on BD opportunities

CFOs are increasingly advocating for structured touch points earlier in the process, not simply to “approve” decisions, but to shape them. This shift toward early collaboration is becoming a defining best practice among sophisticated manufacturers.As regulatory expectations continue to evolve, leading manufacturers are formalizing cross-functional touch points and decision frameworks that embed finance alongside market access, trade, government pricing, and compliance from the outset. These structured collaborations enable faster, better-informed decisions while maintaining consistency across assumptions, methodologies, and data sources. Ultimately, organizations that treat cross-functional alignment as a core operating discipline, rather than an ad hoc coordination effort, are better positioned to navigate policy change, protect net revenue, and sustain compliance over time. These operating rhythms also create the foundation for scalable net revenue optimization by standardizing GTN assumptions, improving data quality, and accelerating decision-making across teams.

Why Net Revenue Optimization Is Critical for Biotech and Pharma

Net revenue optimization improves predictability for launches and long-range forecasting, strengthens cash flow through more accurate accruals and faster liability resolution, and protects margins in increasingly competitive markets. As GTN complexity outpaces the capabilities of manual tools, manufacturers must overcome data volume, system fragmentation, and ongoing regulatory change, including Medicaid, Medicare, and IRA-driven dynamics. Organizations that adopt structured, technology-enabled NRO strategies gain a competitive advantage by aligning finance, commercial, and compliance teams around shared assumptions and transparent data.

Final Thoughts on Pharma/Biotech Net Revenue Management

Gone are the days of the ‘back of the napkin’ economics in the pharma cafeteria. As pricing, contracting, policy, and reimbursement pressures mount, the industry is shifting toward a mandatory bottoms-up strategic net revenue modeling framework. If you aren’t analyzing each pressure point specifically related to each product archetype and patient scenario, you’re leaving your margins to chance. In today’s hyper-competitive market, precision isn’t just a tactical advantage—it’s a fundamental requirement.The manufacturers that will outperform in the years ahead are those that empower finance to lead with insight, shape decisions, and ensure that every commercial choice is grounded in disciplined assumptions and transparent data. In a world where GTN exposure can change overnight, Proactive Strategic Net Revenue Optimization is becoming the new industry standard. In practice, net revenue optimization combines GTN management, advanced analytics, lifecycle modeling, deduction controls, and compliance discipline to protect margins in an increasingly policy-driven market.

To learn more about how IntegriChain’s Advisory Practice partners with manufacturers to optimize GTN, improve profitability, and drive data-informed access strategies, visit IntegriChain.com or contact our Advisory team jsharpe@integrichain.com